"I have nearly $300,000 of post-high school education. It would be surprising if I weren’t articulate and sharp,” said Adams, who is based in Durham, USA.

She claimed that her peers at the company — one of whom did not have an MBA — were promoted while she was held back two years in a row.

Numerous researches exhibit how the gender pay gap in many states in The United States remains a persistent issue despite the progress made in education and workforce participation. This persistent inequality highlights the need for pay transparency laws, which can address disparities by providing greater clarity on salary practices. This article explores the nuances of pay transparency laws in Illinois, the risks of non-compliance, and how you can prepare for its implementation.

Pay transparency can be defined as the practice of openly sharing new information regarding employee compensation. This could include salaries, detailed benefits descriptions, and sometimes the criteria or processes behind these decisions. These laws include detailed breakdowns of the compensation plan for employees and the general salary bands offered for their job roles.

On August 11, 2023, Illinois Governor J.B. Pritzker signed a new law that is going to change the Illinois Equal Pay Act (IEPA) and requires pay transparency in job postings for most employers in Illinois. This is a new law that, on January 1, 2025, shall come into effect with a greater pay transparency requirement besides the several recent amendments made to the IEPA, which will drastically change the way employers operate in Illinois. From 1 January 2025, employers with 15 employees or more will be mandatorily required to make pay ranges in job postings in Illinois. The amendment will apply only when creating job postings.

Some key provisions for the amendment are as follows:

Probably, the most significant provision in the new amendment is a complete disclosure of pay ranges and other benefits. For instance, employers have been compelled to ensure that the wage range or salary range for the position is provided or indicated on the job posting. Also, employers are required to provide information regarding other forms of compensation, which may include bonuses, and stock options, among other incentives.

The pay scale being offered must be in good faith and fall in a reasonable range. The pay scale and benefits must be what the employer reasonably expects to offer. This expectation could be based on the already existing relevant pay scales for jobs in similar positions. An unreal salary range like $1 to $100,000 is likely to fail to meet these requirements or be considered as an actual range.

These transparency requirements directly apply to any/all positions that will be performed in Illinois. For remote positions taking place from outside Illinois, the employee would report to a supervisor or work site inside which would be based in Illinois.

These transparency requirements also extend to job postings by third-party recruiters, provided the employer supplies the necessary information. The Illinois Department of Labor will enforce the law and handle violations reported by aggrieved individuals.

When employers use third parties like recruiters to post jobs, they must provide pay ranges and benefits details, which the third party must include in the job posting.

Employers are required to announce, post, or otherwise make known all opportunities for promotion to current employees no later than 14 calendar days after making an external job posting for the same position.

Not abiding by the compliance requirements can lead to serious consequences for employers, including penalties for retaliation against employees:

IDOL can fine or take other remedial actions after investigating a complaint. It is contingent on the nature and severity of the violation in specific penalties.

Non-compliance or retaliation might lead to lawsuits, reputational harm, and intensified scrutiny by regulatory agencies.

IDOL gives an employer a reasonable amount of time to correct all identified violations before further sanctions apply.

Define Clear Pay Ranges: Establish consistent and well-documented pay ranges based on market research, budget constraints, and internal benchmarks.

Document Additional Compensation: Include descriptions of benefits, bonuses, and incentives in job postings.

Create a Written Policy: Draft a formal pay transparency policy that aligns with the Illinois Pay Transparency Act and distribute it to employees.

Maintain Accessibility: Ensure that pay transparency information is available on public-facing platforms, such as the company website, and is easy to understand for applicants and employees.

Evaluate Current Pay Structures: Assess pay equity across all roles to identify and address disparities or any other equity issues.

Benchmark Against Industry Standards: Compare pay ranges with competitors and industry averages to ensure competitiveness.

Regular Updates: Schedule annual or semi-annual pay audits to keep compensation practices in compliance and reflective of the labor market.

Train HR teams on the Illinois Pay Transparency Act, covering legal requirements, job posting compliance, and strategies for pay-related discussions with employees and applicants. Equip managers to handle pay inquiries without bias, using role-playing scenarios to prepare for real-world situations while ensuring legal and ethical compliance.

The Equal Pay Act does not allow an employer with four or more employees to pay different amounts of wages for equal work by both men and women unless such payment is based upon either a system of seniority, a merit system, a pay scale measuring quantities or quality of products or services, or any factor other than otherwise.

IHRA prohibits private employers from making an employment decision on an individual basis about considerations to practices that are discriminatory involving considerations toward and discrimination on account of factors involving Sex, Pregnancy, Childbirth or connected medical condition, and Age over Forty.

The Illinois Workplace Transparency Act, commonly referred to as WTA, is a legislative measure that protects employees, consultants, and contractors from alleged unlawful discrimination, harassment, or criminal conduct in the workplace. This is achieved by preventing nonnegotiable confidentiality obligations, waivers, and the mandatory arbitration of claims related to discrimination, harassment, or retaliation.

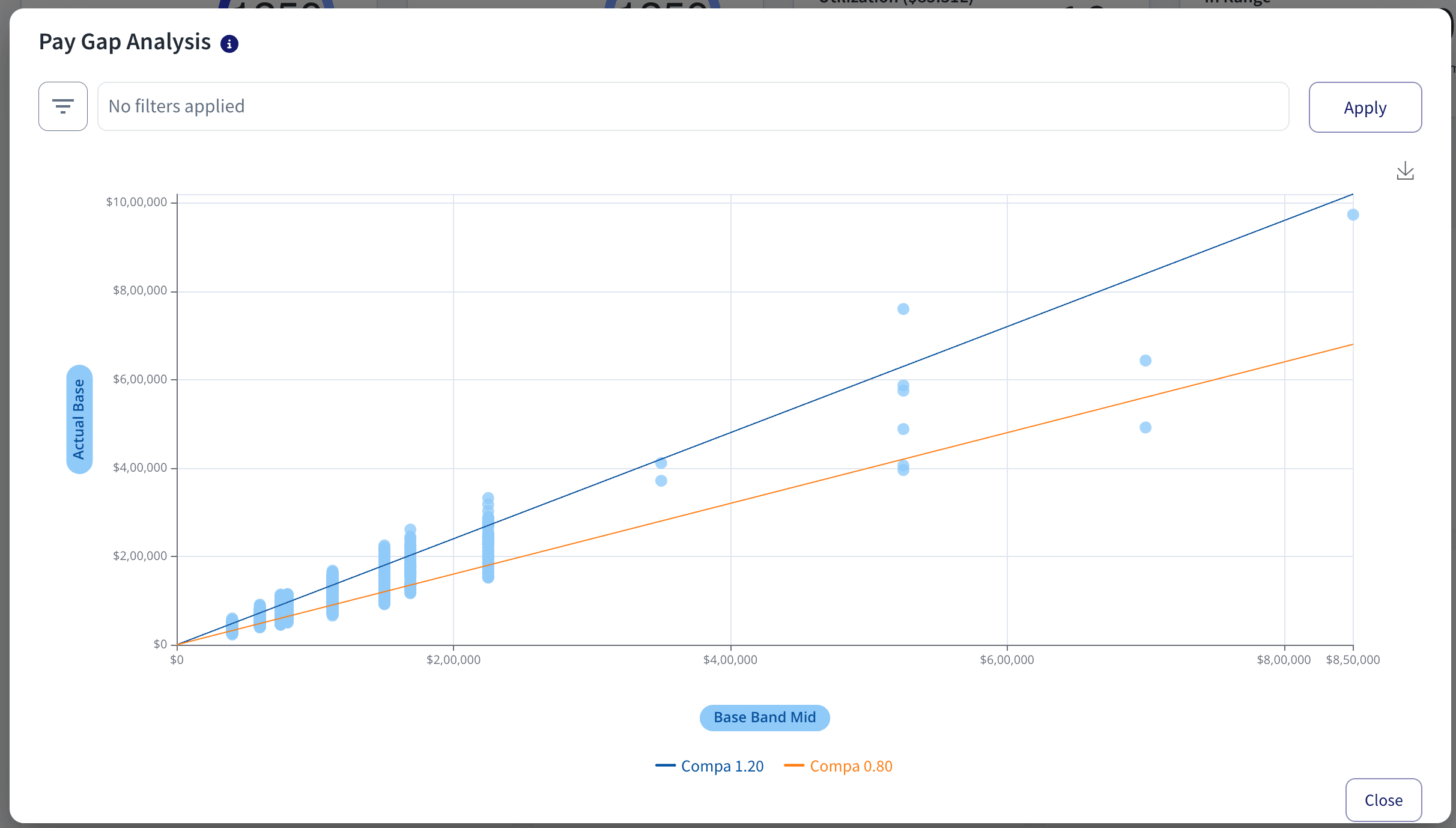

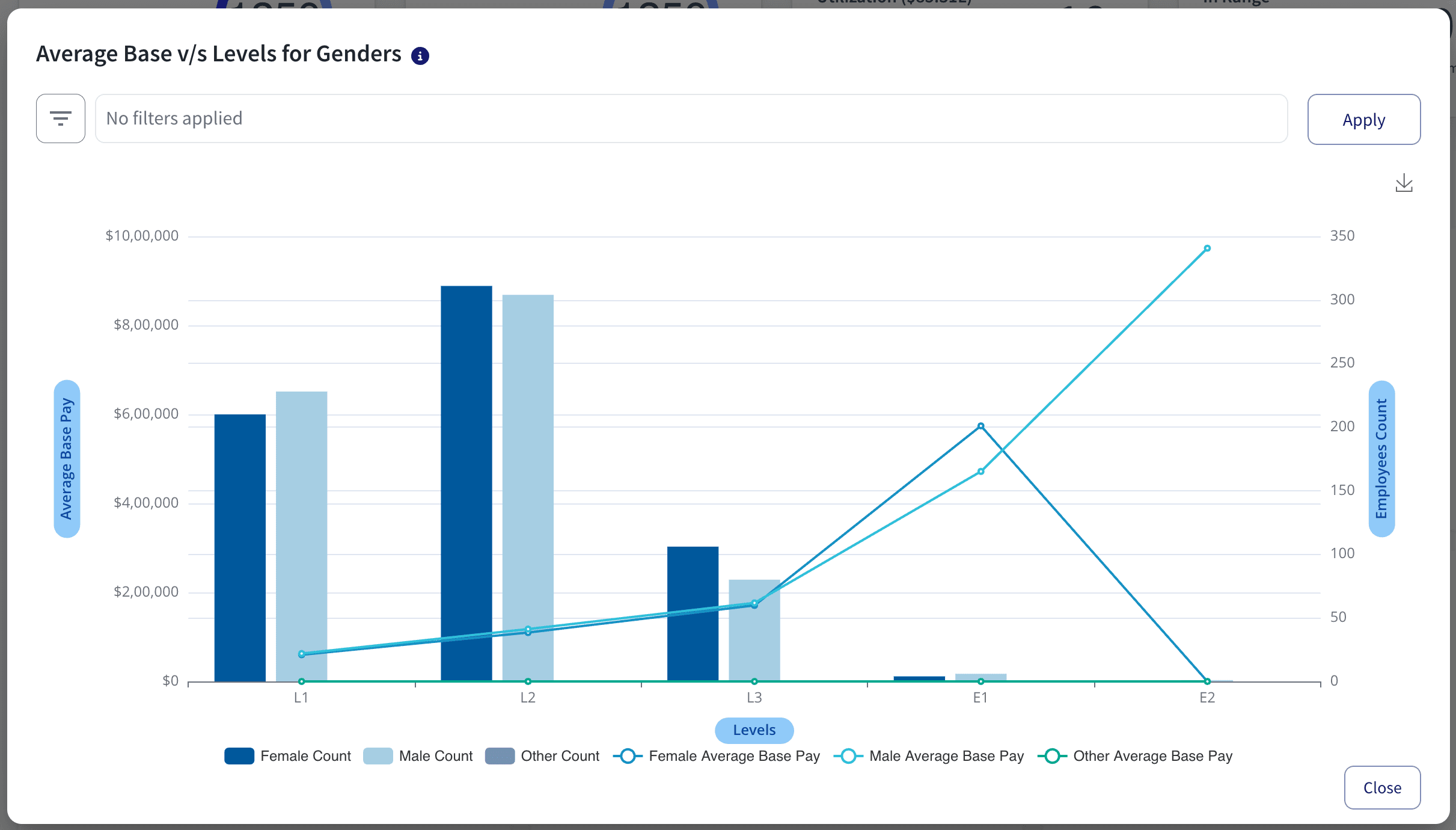

Pay Gap Analysis

CompUp helps organizations identify and address wage gaps, ensuring compliance with pay transparency laws. By analyzing compensation data across roles, you can eliminate disparities, promote pay equity, and align with legal requirements effortlessly.

Many other features like budget planning, peer comparison, and total rewards statements make CompUp the perfect solution for modern compensation management—and more.

Equip your workforce with tools and knowledge for smooth implementation.

Stay compliant, build trust, and attract top talent. Contact CompUp for a demo today!

The Illinois Pay Transparency Act is a requirement for regulation compliance and a giant leap toward equal workplaces. Preparing for such changes will make you comply and strengthen your organization's position as a fair and transparent employer.

Solutions like CompUp enable businesses to address compliance efficiently, maintain equity, and enhance employee trust. Be proactive—reach out to CompUp and future-proof your compensation practices today.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking