According to research, employee compensation makes up approximately 70% of the total company expenses. A major chunk of financial resources is thus allotted to compensation packages for employees.

As a result, compensation and benefits professionals are constantly on the lookout for structuring compensation planning with best practices.

The currency workforce, however, has a mix of different populations including GenX, Millennials, GenZ, and more. To streamline their compensation planning, it is very important to grasp the basics of compensation management for improving employee benefits.

Let’s start by understanding what is compensation management in detail.

Compensation management refers to the comprehensive alignment of employee compensation philosophy with organizational goals to enhance employee engagement and reduce employee turnover.

Another thing that we need to take into consideration is the concept of total rewards in compensation strategies. Currently, employee compensation is deemed effective only if it has the right balance of monetary compensation and other rewards and benefits.

Since elements like stock options, insurance, parental leave, company bonuses, incentive plans, and others have evolved to adapt to the dynamic needs of the modern workforce, it is important to understand the various types of compensation trending in the HR industry.

There are 4 major types of compensation when creating employee total rewards:

Base pay is the fixed monetary compensation employees receive in exchange for performing their tasks. As a fixed component (like monthly, daily, or hourly wages), it does not change and is decided with the help of market data for specific roles and functions.

Several factors might influence the base pay of an employee:

Variable pay is subject to change according to the performance and achievements of an employee. The motive of having variable pay in the compensation plan is to push employees to perform better and be rewarded as a result.

The primary forms of variable pay are:

Long-term incentives (LTIs) are majorly introduced to improve employee retention rates in an organization. These incentives also develop a sense of belongingness within your employees as they become a part of sharing company’s growth.

The various types of Long-term incentives are:

According to market trends, these incentives are usually given to the senior leadership or employees who are known to add great value to the company through their work.

Non-cash benefits are what makes you an employer of choice for the modern workforce. They are usually given as benefits packages that make the additional compensation more appealing to the candidates.

When 74% of employees have complained about mental health issues at work according to a report by Forbes, compensation and benefits professionals are now focusing on non-cash benefits to increase employee morale and engagement for better results.

The major elements of non-cash benefits are:

Compensation planning involves key metrics or factors that hugely influence employee compensation to create plans that are equitable and competitive. Multiple factors need to be considered when determining salary ranges:

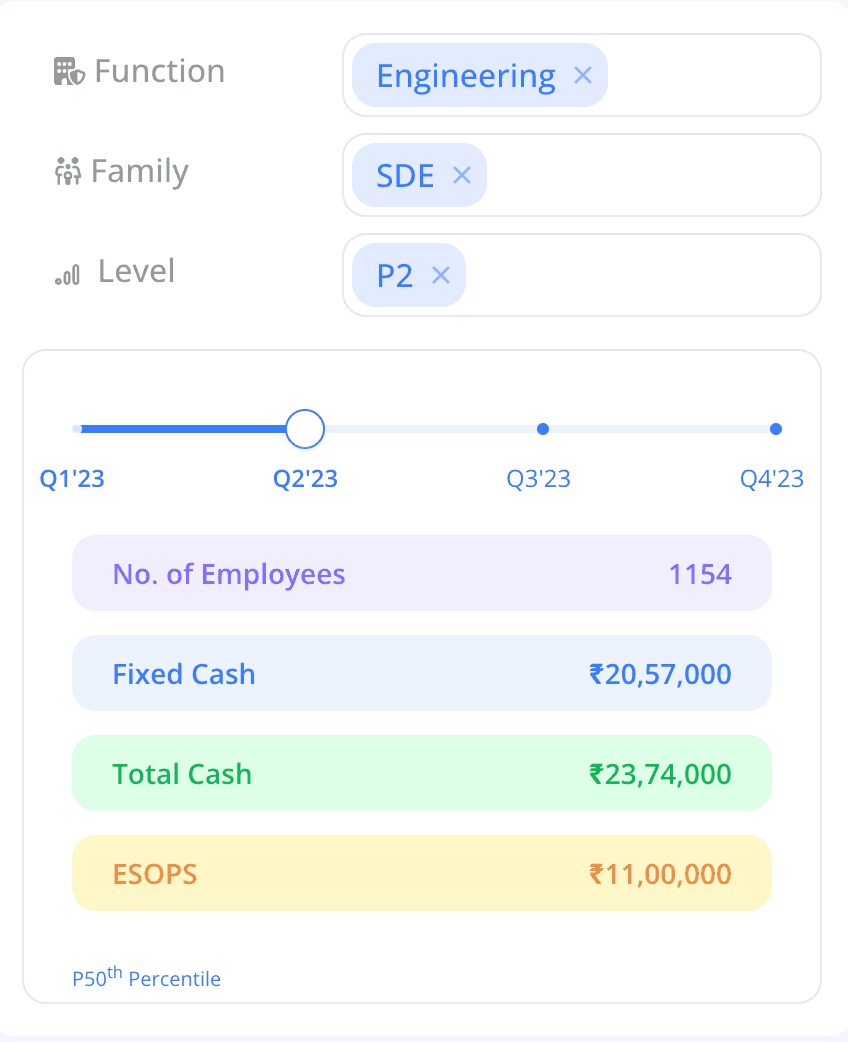

Market data benchmarking is done to analyze multiple pay data create salary bands for your workforce and give you a competitive edge in the latent game.

This can be done in numerous ways including taking part in different compensation surveys that provide salary data, studying real-time compensation benchmarks from platforms such as CompUp to make informed decisions, analyzing industry salary benchmark reports, and more.

In this process, compensation managers identify the unique responsibilities of a specific job role and make distinct categories or levels to determine competitive compensation packages for these roles.

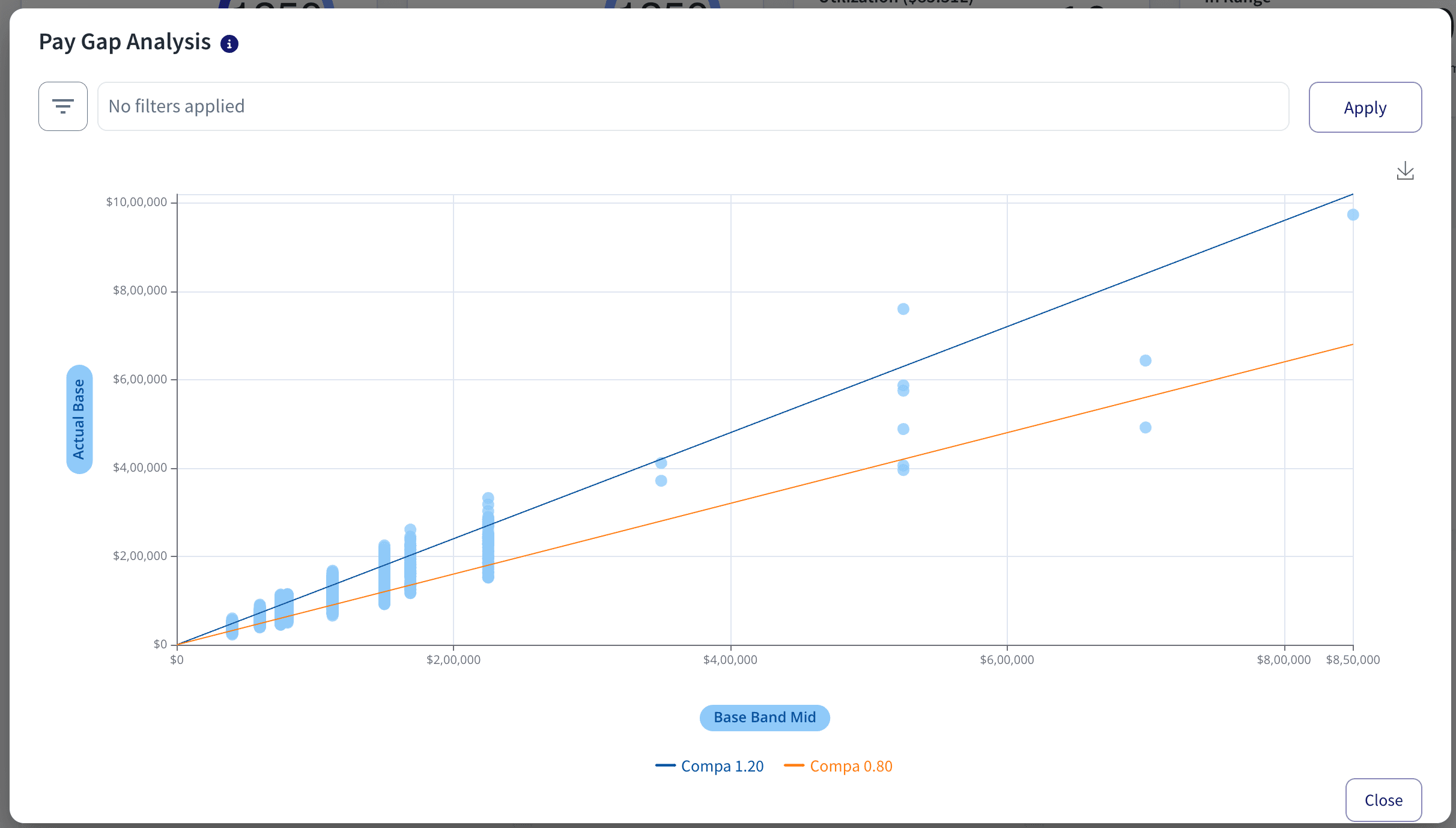

Factors like experience level, education, certifications, and impact of the role are taken into consideration during this structural analysis. This step is important to ensure the internal equity of pay within the organization for both direct compensation and indirect compensation.

Creating compensation plans based on location and cost of living is very important to ensure that employees in different locations are moderately able to maintain similar living standards.

For example, high-cost cities need employees to earn more as compared to smaller cities as dictated by human capital management practices.

Compensation planning has to be sustainable for the company’s financial growth. This means that the pay bands designed for compensation management should be financially stable for the business in the long run.

In this case, companies at different levels of compensation maturity adopt different approaches. For example, an early start-up in their compensation philosophy might keep the base pay in the 50th percentile and compensate for the lack with attractive long-term incentives or non-cash benefits.

Compliance with labor laws is important for businesses to eliminate legal consequences in the long run. It also gives a healthy reputation to the organization.

For smoother compensation planning, several labor laws need to be considered:

The are numerous benefits of compensation management:

Here are some strategies HR folks can use to ensure effective compensation management:

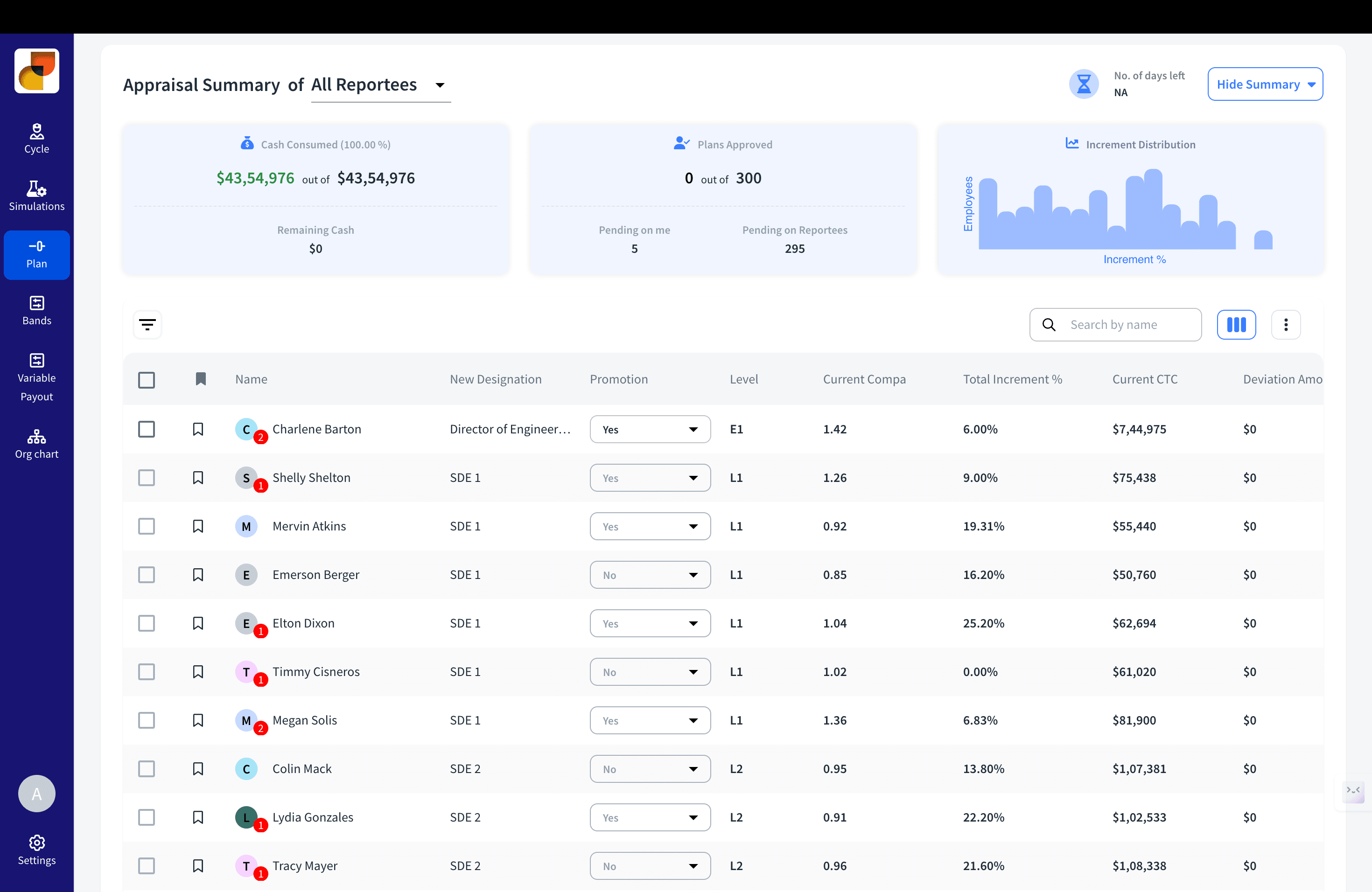

Compensation management software is an AI-driven platform that automates compensation planning to break down intricate calculations associated with pay decisions. A study mentions that using compensation management software reduces employee turnover by up to 15%.

Using compensation management software has major benefits that include:

CompUp is a compensation management software equipped with futuristic capabilities when it comes to compensation planning. It is an end-to-end solution that streamlines the whole process of creating holistic pay offerings for your workforce.

Click here to discover how the platform integrates AI capabilities in compensation management strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking