Warren Buffett once rightly said that - “the stock market, with its unpredictable ebbs and flows, serves as a compelling teacher, imparting invaluable lessons in patience and resilience.”

So, understanding the hidden aspects of your stock program with its unpredictable flows is simply transformative in the financial success of the company.

Making sure to invest in a stock program, especially in the world of finance, is a statement to one’s own spirit of long-term vision and wealth creation and limitless capacity to create wealth.

So, a compelling lesson to the attention of employees is the Employee Stock Program.

The initiative aimed to match workers interests with the overall productivity entailed and financial abundance of the company.

A company that primarily sponsors benefits programs like the Employee Stock Program (ESP) enables the staff members to acquire company stock at a discounted price or stock options, as stock options are a part of the program in its entirety.

Participating in an ESP includes certain terms and conditions, such as a certain period of vesting enabling them to be encouraged to stay with the company to be able to realize the entire benefits of the stock options that are made available to them.

And since their interests lie in the overall company’s stock performance, they will attempt to seek, inspire, and strengthen the overall commitment of the employees.

These are given to the employees so that they are able to have a certain level of ownership over the stocks of the company, which helps the employees feel like they are an actual part of the organization and its overall processing. This also manifests more loyalty from their side towards the company.

The main features of an employee stock plan include:

Employees are given the offer to buy shares of the company that they are working for a certain vesting time period at fixed company stock price, it's also called a call option. This allows the employees to have a sense of loyalty and ownership to the company, which will help increase the overall efficiency.

This is a means of setting a certain condition in return of which the employee can receive the offer of buying shares in the company; the conditions can be of having the employee stay in the company for a certain time duration, which also improves employee retention.

This allows an effective discount rate on the sale price for the purchase of shares in the company the employee works for with tax payroll deductions in it. These plans are done on precise offering periods. Such a discount price attracts employees to buy shares.

The income tax benefits assigned to this can be for the employees, who turn their ordinary income taxes into deferred tax on their stock purchases until they own those shares themselves in the company.

ESPs can also offer benefits of tax to companies in the regular tax rate, but it is very much dependent on the country’s laws or local state laws.

Selling stock by the employees, especially in the case of private companies, needs a wait for a liquidity event like an initial public offering before it. It differs in the case of public companies, for they can sell the shares on the open market, so the wait time can probably be avoided.

Employees who have bought shares in the company are given dividends, which the company pays them.

An employee stock program (ESP) is a powerful asset for organizations, impacting the bottom line in various strategic ways:

ESPs offer the biggest advantage as an employee benefit plan without substantial immediate financial impact make them a cost-effective alternative to traditional bonuses or raises.

Employee ownership motivates efficient work and increased productivity. ESP participants tend to stay loyal, reducing costs associated with turnover.

Such a broad-based stock plan attracts and retains top talent by offering financial growth opportunities and ownership incentives, minimizing disruptions from high turnover rates.

ESPs align employee and company interests, encouraging decisions that enhance long-term success and fostering a collective focus on shared financial goals.

Successful ESPs enhance a company's reputation, instilling confidence in investors, partners, and customers. This positive perception can attract investments and foster loyalty.

Some jurisdictions provide tax benefits, optimizing cost structures and enhancing the organization's financial health.

Implementing an Employee Stock Program (ESP) can make a significant difference in your people strategy, transforming the way you attract, retain, and motivate your employees. Here's how an ESP can impact your people strategy:

An employee stock program in its entirety tends to create an elevated sense of belongingness among the employees for the company. Most certainly when employees feel that they have ownership because they paid the share price and bought stakes in the company’s performance.

This definitely creates an elevated sense of commitment in them, making a more consistent and dedicated team of employees.

Being able to own shares by paying the purchase price of the shares to a company they work for, is simply a powerful motivation for employees to aim for better results and the overall success of the organization.

ESP as an offer is a valuable tool that simply enhances the overall appeal of the company. Prospective employees are drawn to such companies that provide them with opportunities for personal and financial growth while having a stake in the company’s success.

So, this can be a definite way to attract top talent to the company contributing to the overall company benefit.

Employees who are offered with the stock option plan have a direct means of benefiting from the company’s overall success since they are a part of the company contributions. This makes them more engaged and satisfied in their jobs, for they feel a sense of belongingness and value.

ESPs can be a powerful tool in succession planning. By encouraging employees to invest in the company's future, you create a pool of potential future leaders who are deeply committed to the organization's values and goals.

The interests of employees are aligned with them participating in ESP in a position of leadership and ownership. Their interests align because when employees turn into shareholders, they share the same vision and goals as that of the company.

This enables creating an environment with maximum contributions and commitment to the company’s objectives and overall performance.

So, in a gist, sale of shares through the employee stock program into your people strategy will help create a workforce that is simply more committed and engaged.

If your organization has been following a standard compensation plan and ESOP benchmarks without considering broader market standards, it's essential to understand the Employee Stock Program.

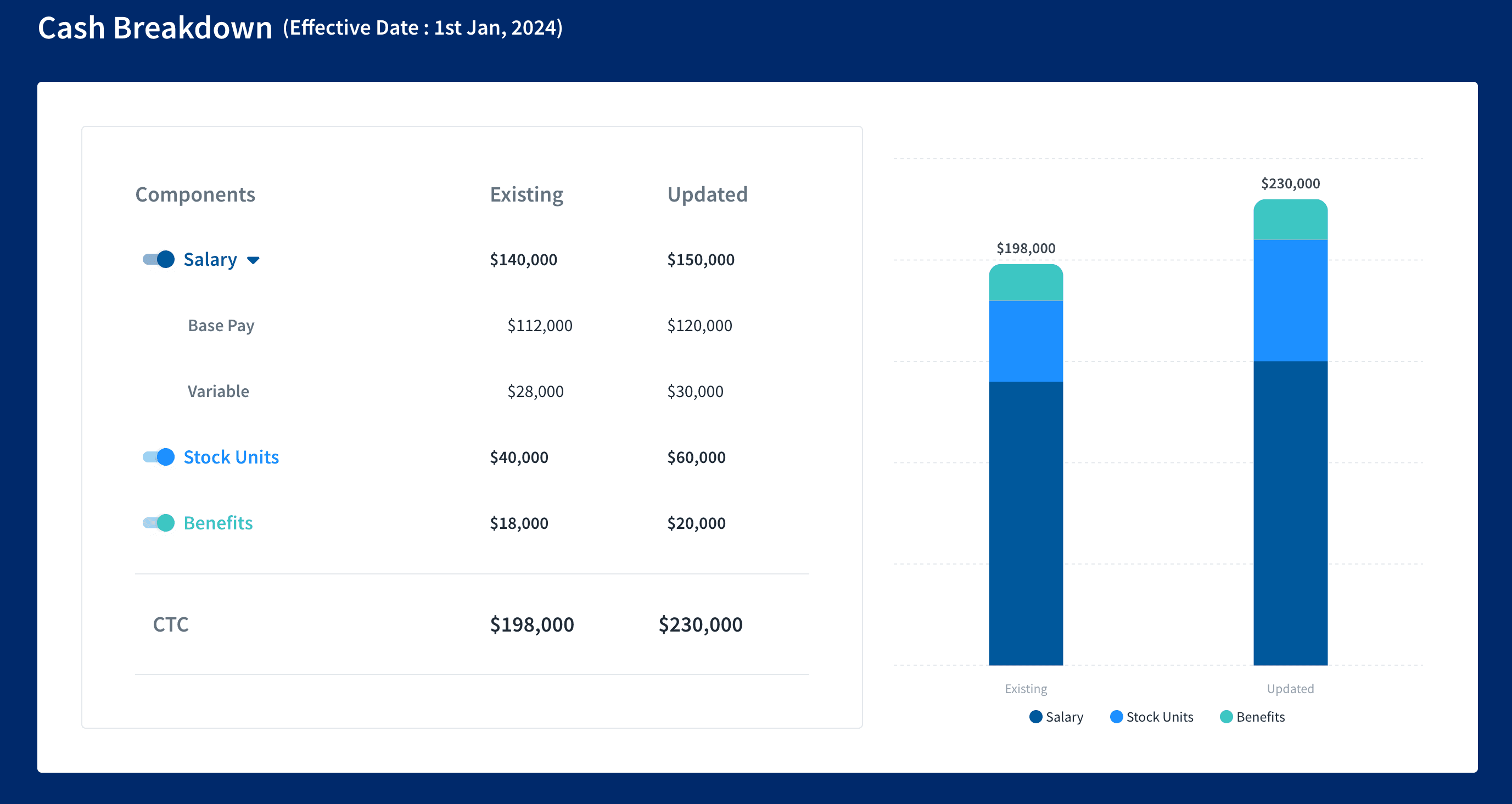

With CompUp, employees can track their total compensation, including their stock options, through a Total Rewards Statement with a holistic dashboard.

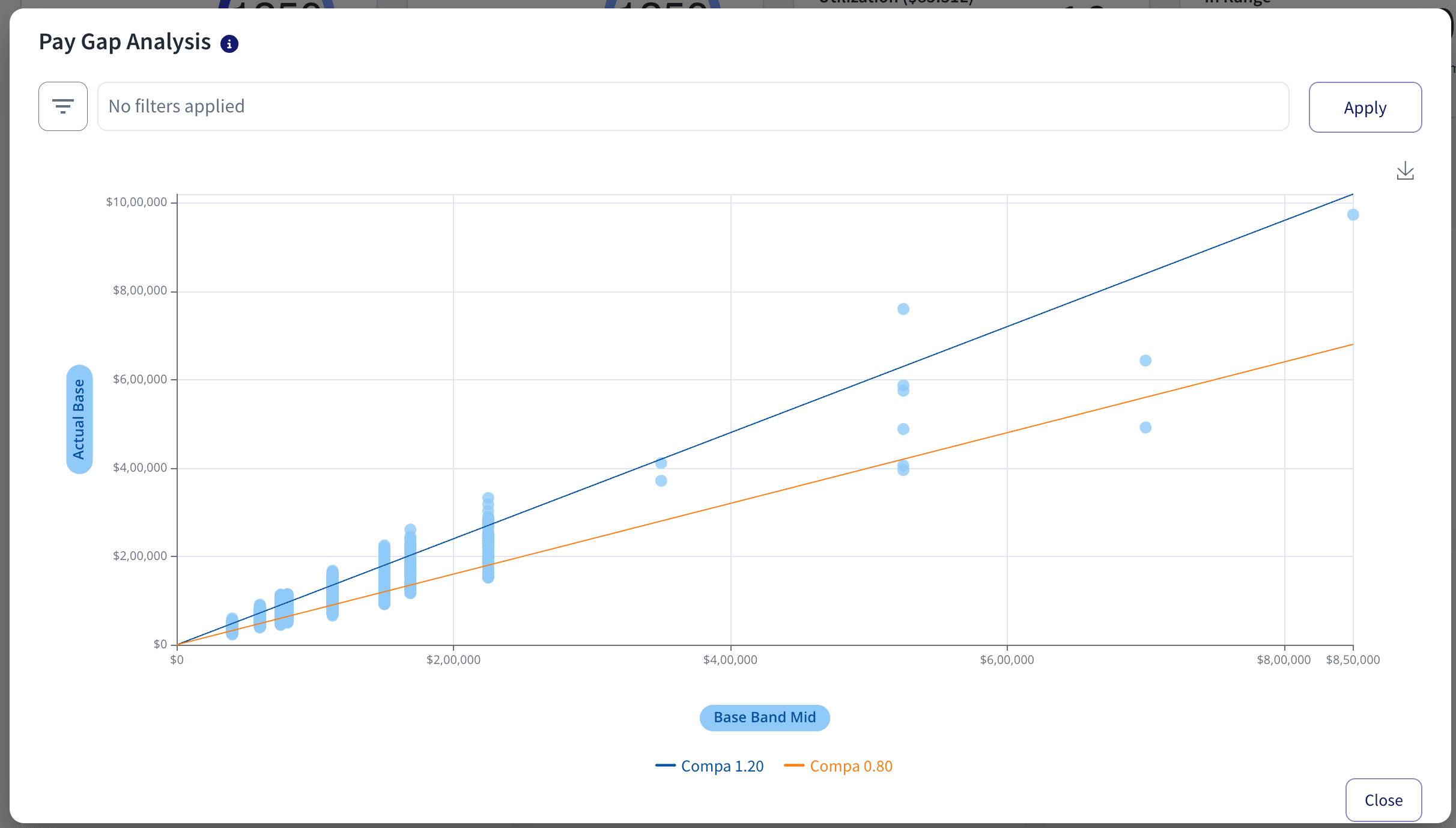

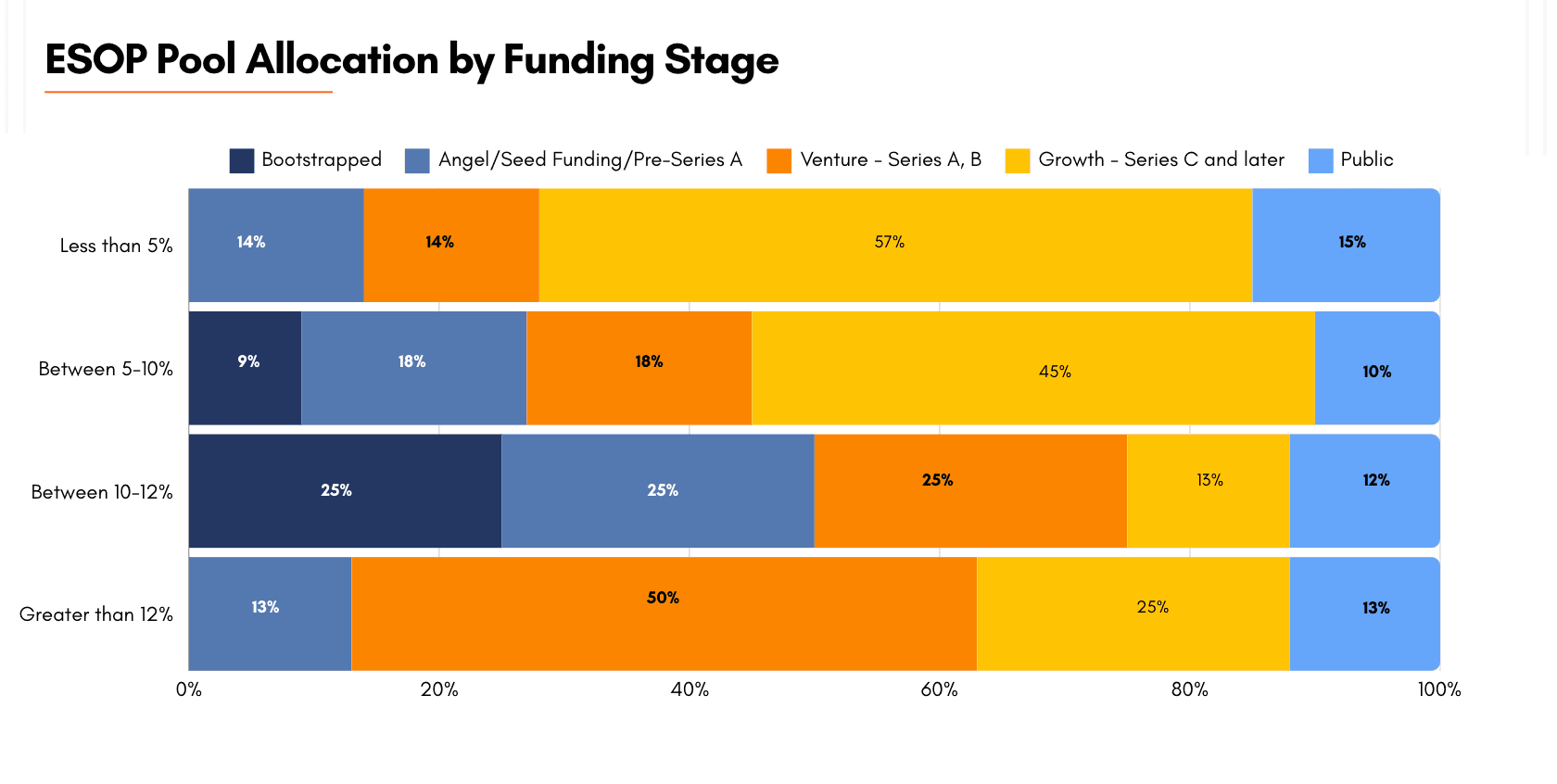

CompUp does an annual ESOP benchmarking survey to summarize the valuable insights that are related to the Employee Stock Option Plan.

CompUp specializes in guiding you toward a cutting-edge, real-time compensation planning platform, revolutionizing your employees' satisfaction.

Understanding the Employee Stock Program (ESP) reveals how modern employee benefits go beyond basic packages.

ESPs strategically transform a company's strategy, attracting talent and fostering loyalty. They reduce turnover, align interests, and boost productivity.

Click here to learn more about what makes CompUp an all-in-one compensation management platform.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking