According to a survey, 47% of the modern workforce would like to have custom-made total rewards.

Compensation and benefits professionals are on the lookout for creating the perfect balance of total compensation (base salary, cash, and non-cash incentives) taking in both company and employee performance.

There are 2 components - equity compensation and variable pay plan that are strong influencers in attracting skilled talent to your organization. They hugely contribute to determining the short-term and long-term financial gains of an employee, impacting employee retention and turnover rates in the process.

Let’s start by understanding equity compensation and variable compensation plans in depth to create a more balanced total rewards strategy.

What is equity compensation?

Equity compensation is a form of pay that represents an employee’s ownership of the company. This compensation strategy is majorly employed by start-ups and rapidly growing industries to align their employee’s performance with that of the organizational goals. There are several forms of employee equity compensation:

- Stock options - Employees can buy company stock at a discounted exercise price once the vesting period is over.

- Restricted Stock Units - These equity grants are linked with performance targets, and once the employee achieves the business objectives or the goal as the criteria, they receive the performance shares.

- Stock Appreciation Rights - In this approach, the employees do not have to buy any shares of the company. They usually benefit from any increase in the company stock price over a predetermined time and receive them as financial rewards.

What is variable pay?

Variable payment is a performance-linked incentive (it might be employee performance, organizational performance, or both) that is given to employees to make their compensation plan more attractive especially in sales roles.

This approach is very effective in keeping employees engaged and motivated in the short term. There are several variable components in a compensation strategy:

- Bonuses - These are one of the most common forms of variable pay and may be tied to individual performance, team productivity, or overall organizational performance. The type of bonus can be annual, quarterly, or follow any other format depending on the compensation philosophy of a company like referral bonus, retention bonus, and more.

- Commissions - This is common for sales representatives, where individual performance is attached to the revenue targets or sales targets to motivate your employees with sales commissions.

- Incentives and rewards - Employees can get these incentives in the form of cash or non-cash compensation. This is again performance-based pay or time-based compensation to keep the workforce engaged and motivated to achieve desired business goals.

Key differences between equity compensation and variable pay

There are some key differences between equity compensation and variable pay that need to be considered when creating total compensation for your workforce:

Purpose and key objective

- Equity compensation serves as a long-term incentive for the employees. It induces belongingness and a sense of ownership and positively impacts employee retention.

- Variable pay is known to provide short-term motivation to employees and keeps them consistent when working towards achieving organizational objectives. It is a great way of tying individual goals to company performance.

Time Horizon

- Equity compensation is majorly tied to vesting schedules so employees have to wait for the vesting schedule to end to receive equity pay.

- Variable pay often has short-term payouts to reward immediate performance goals.

Risk factors

- Equity-based compensation is significantly influenced by market conditions and the company’s performance. If the organization performs exceptionally well, the profits are huge, and vice versa if there is a case of underperformance.

- Variable compensation program is usually ruled by individual or team performance so it’s a more stable and predictable rewards structure.

Financial impact

- Equity compensation is a non-cash offering that helps early-stage companies control the financial resources invested for employee compensation while creating an attractive compensation package aligned with the financial goals of the company.

- Variable pay involves cash flow and enhanced labor costs and hence is used by companies to skyrocket employee performance to achieve immediate goals.

Choosing the right incentive structure for your organization

There are some key points that you can keep in mind while choosing the right form of compensation for your workforce:

- Different functions in your organization might require different approaches. For example, your tech division would prefer equity-based incentive programs to help them assume more ownership, while the sales team would thrive on having additional compensation in the form of commission plans.

- The demographics of your company should also play a huge role in determining financial incentives. For example, the younger generation would be attracted to short-term incentives while the seasoned employees would prefer long-term incentive plans in their compensation plan.

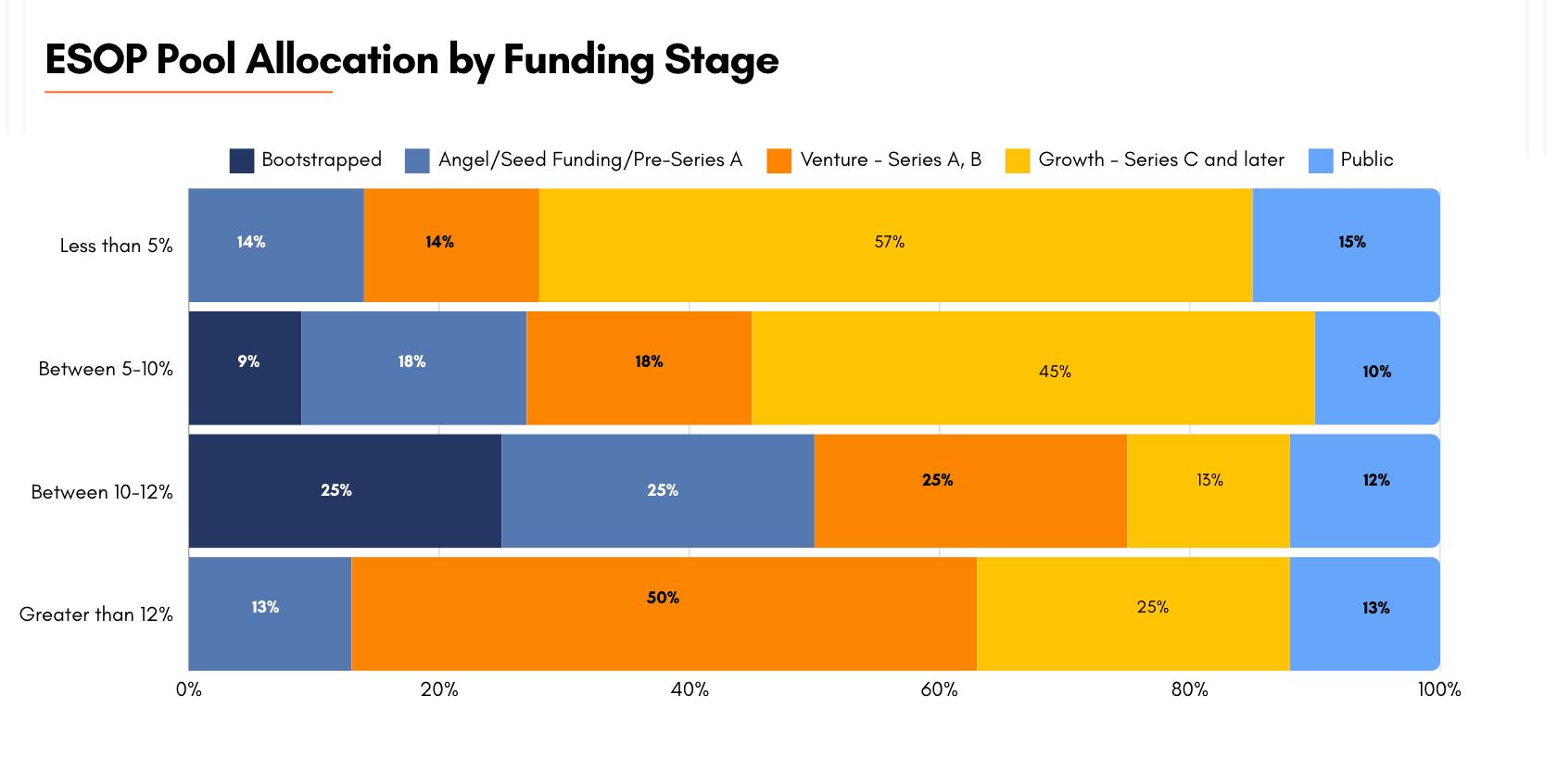

- The compensation maturity of an organization is an important factor to consider. Early start-ups should include more equity compensation in their compensation package to save on financial resources while having the flexibility to create an appealing total compensation structure. On the other hand, rapidly growing companies can use short-term incentives to propel their company success.

- Regularly review your reward structure to make sure they are aligned with the market standards and your company culture. This approach helps you understand the current requirements of your workforce and empowers you to create a compensation package aligned with the welfare of your employees.

Role of CompUp in streamlining your compensation structure

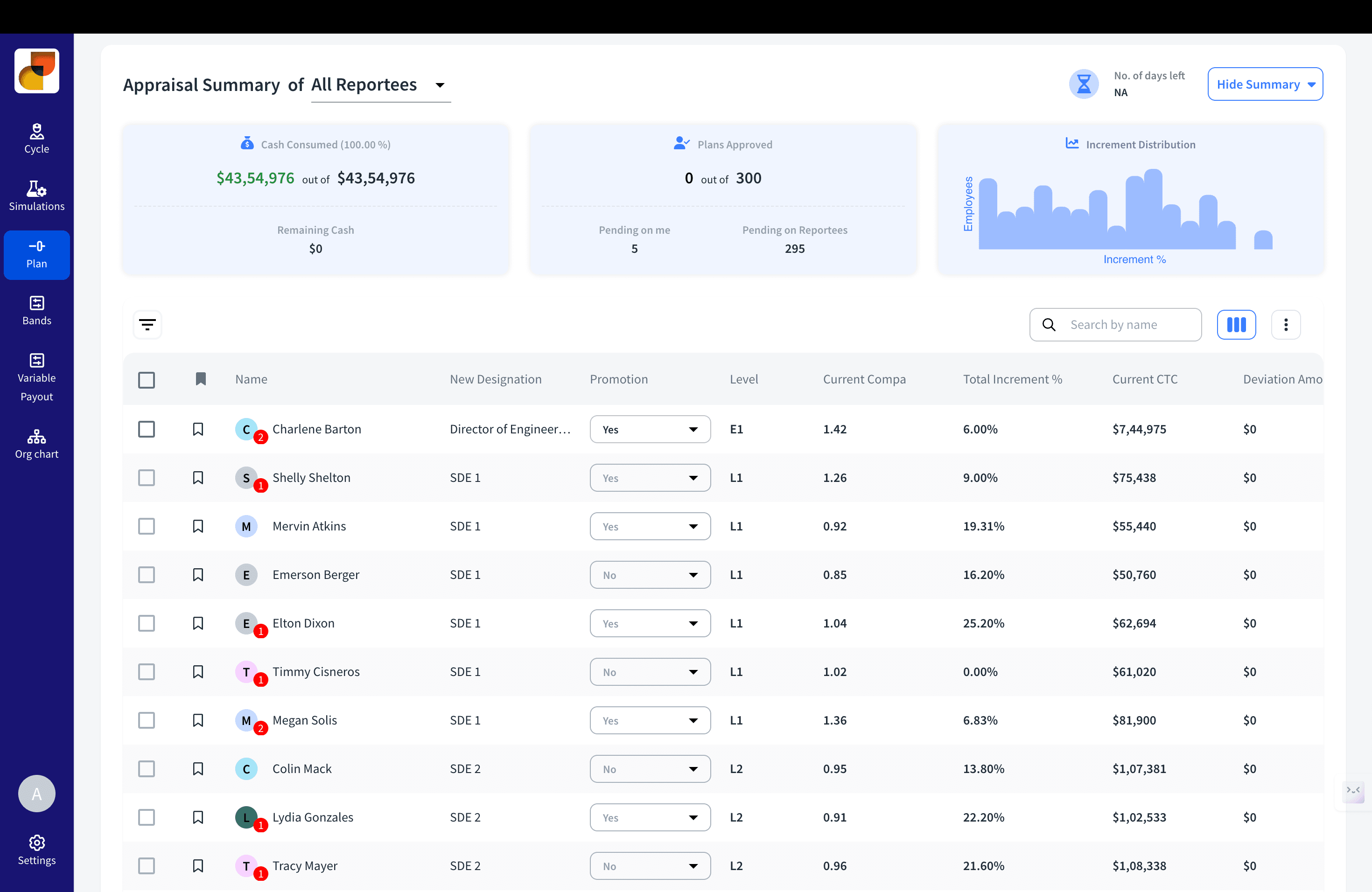

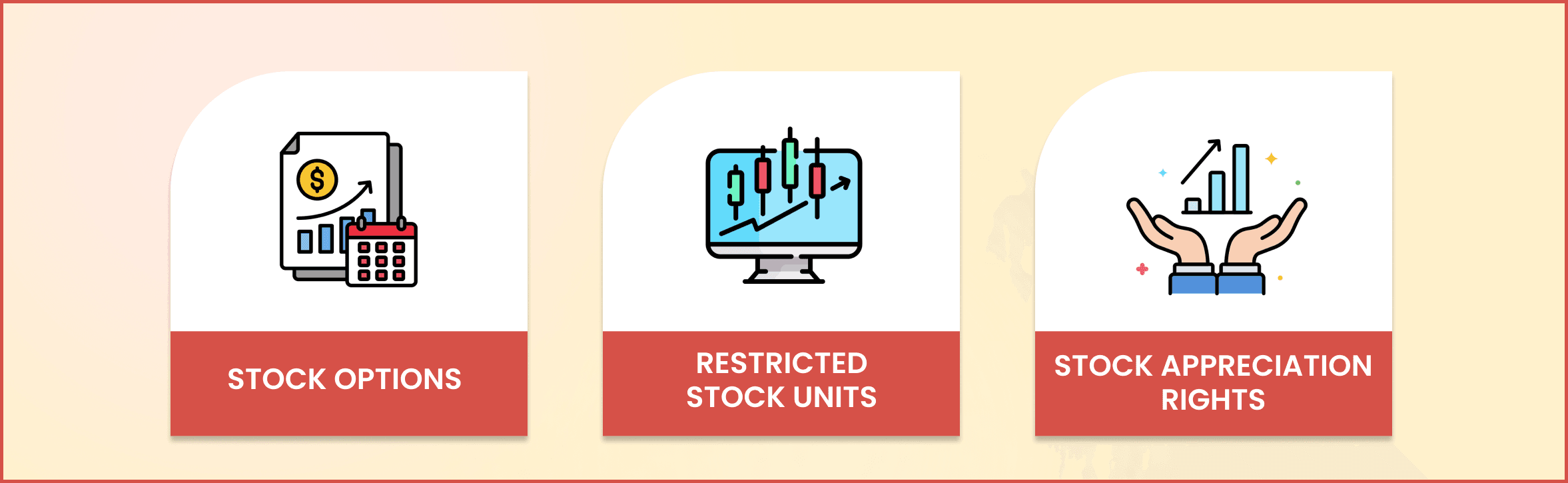

CompUp is a compensation management platform that helps you create a total rewards strategy with an AI-driven dashboard that allows you to attract and retain top talent.

- CompUp has a community of total rewards professionals that helps you be up-to-date with the latest trends in the total rewards industry.

- The annual benefits benchmarking report provides you with the best practices through which you can optimize your employee benefits strategy.

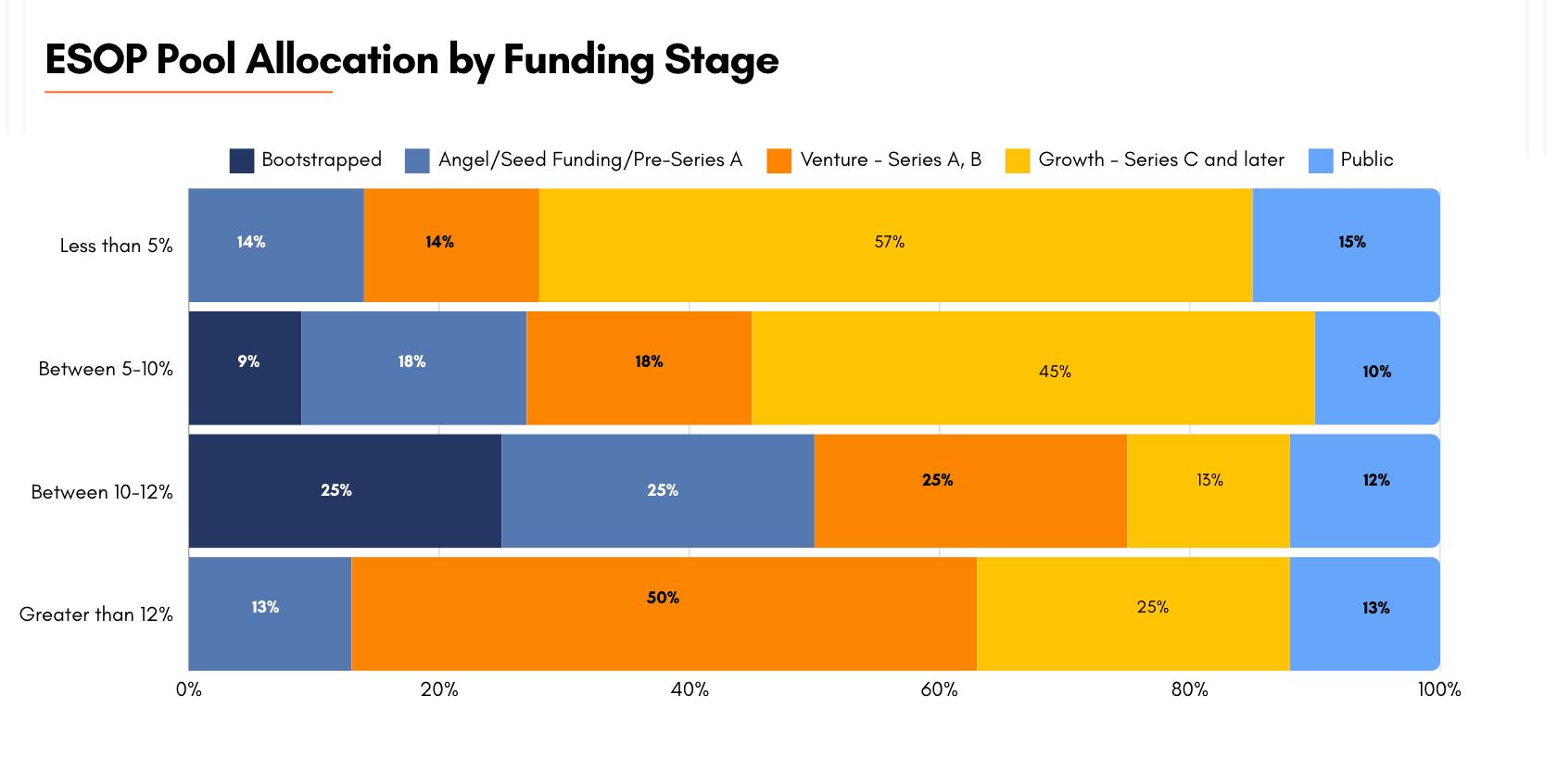

- The platform also has an annual ESOP benchmarking report that curated insights from the latest industry trends to streamline your equity compensation planning.

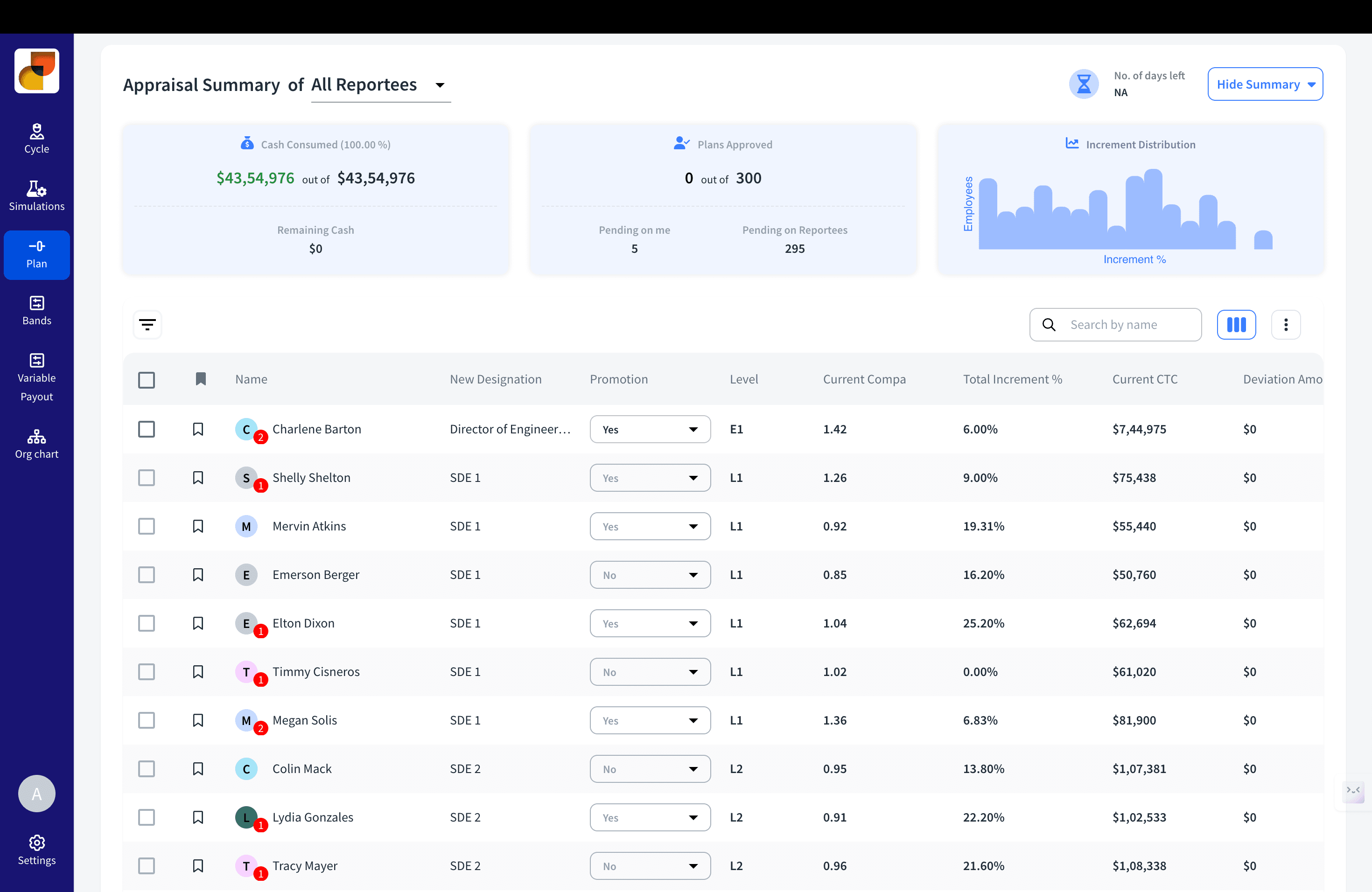

- CompUp has a central dashboard that helps you run budget simulations to visualize the impact of your rewards strategy on your employees.

Try the platform now to learn how CompUp can help you adopt fair and transparent pay practices.