The Indian government replaced 29 previous laws with four unified labour codes on November 21, 2025. This is arguably the largest overhaul of workforce-governance in decades for CHROs, compensation heads, and HR leaders, making it more than just a compliance update.

The ripple effects are significant. Current salary structures will need redesigning to meet the mandatory 50% wage definition. PF and gratuity bases must be recalculated. Fixed-term employees are now entitled to benefits after one year of service instead of five and i.e., fundamentally reshaping benefit eligibility timelines.

This is not a procedural update, it’s a structural overhaul of how compensation is defined, administered, and governed in India. Organizations that respond only at a compliance level risk financial liabilities, employee trust issues, and long-term cost unpredictability.

This guide is designed to equip HR and compensation leaders with clarity and direction - explaining each change, its implications, and how to rebuild compensation frameworks that are compliant, cost-balanced, and future-ready.

At a glance: The wage codes push organizations toward higher transparency, higher statutory costs, and stronger governance. Employers who act early—by redesigning pay, auditing equity, and digitizing compliance - will reduce risk and avoid last-minute disruption.

Implication: For organisations that previously kept “basic pay” low (say 30–40% of CTC) and had large allowance components, there is a need to restructure salary components. This will affect statutory benefits, take-home pay, and payroll accounting.

Because of the redefinition:

What this means: Many employees may see a drop in take-home (in-hand) pay compared to older packages - because a larger portion is statutory deductions — but their retirement savings, benefits, and long-term security improve.

For example: industry analyses (for some sample CTC levels) show monthly in-hand salary may drop by a few thousand rupees, but PF and gratuity accumulation increases.

Implications for Compensation Teams:

For payroll / HR teams: This demands robust payroll systems, digital record-keeping, timely salary-run, utility of appointment letters, and better compliance processes — especially for a mix of permanent + contract + gig workers.

One of the more transformative aspects: the new codes aim to bring vast swathes of the workforce that were previously unregulated — into the formal labour / benefits ambit.

What this means for HR/Comp professionals: As organisations — especially in services, gig economy, platform-based — expand or formalise, they need to incorporate these benefits and compliance requirements. Payroll, social-security account-management, hiring contracts, benefit slabs, etc., all need rethinking.

While the new codes bring clarity and fairness, there are real challenges for organisations — especially in Compensation & Benefits and payroll functions:

Cost Pressure on Gig / Platform-based Businesses: For aggregator/platform businesses, extending social security benefits to gig workers means higher costs and possibly rethinking business models.

Given the scale of changes, here’s what HR / Comp & Ben / Payroll leaders should prioritize over the next 3–6 months:

India’s labour codes are not difficult because of interpretation alone. They are difficult because they introduce interconnected calculations at scale.

Every wage decision now touches multiple downstream outcomes: statutory costs, long-term liabilities, employee communication, and audit exposure. When these connections are managed manually, organizations lose control faster than they realize.

Most organizations believe they will “catch issues during review.” In reality, labour code transitions expose a different risk pattern:

The danger is not one incorrect salary. It is hundreds of correct-looking salaries built on the wrong logic.

Once letters are issued and payroll is run, corrections become expensive—financially and reputationally.

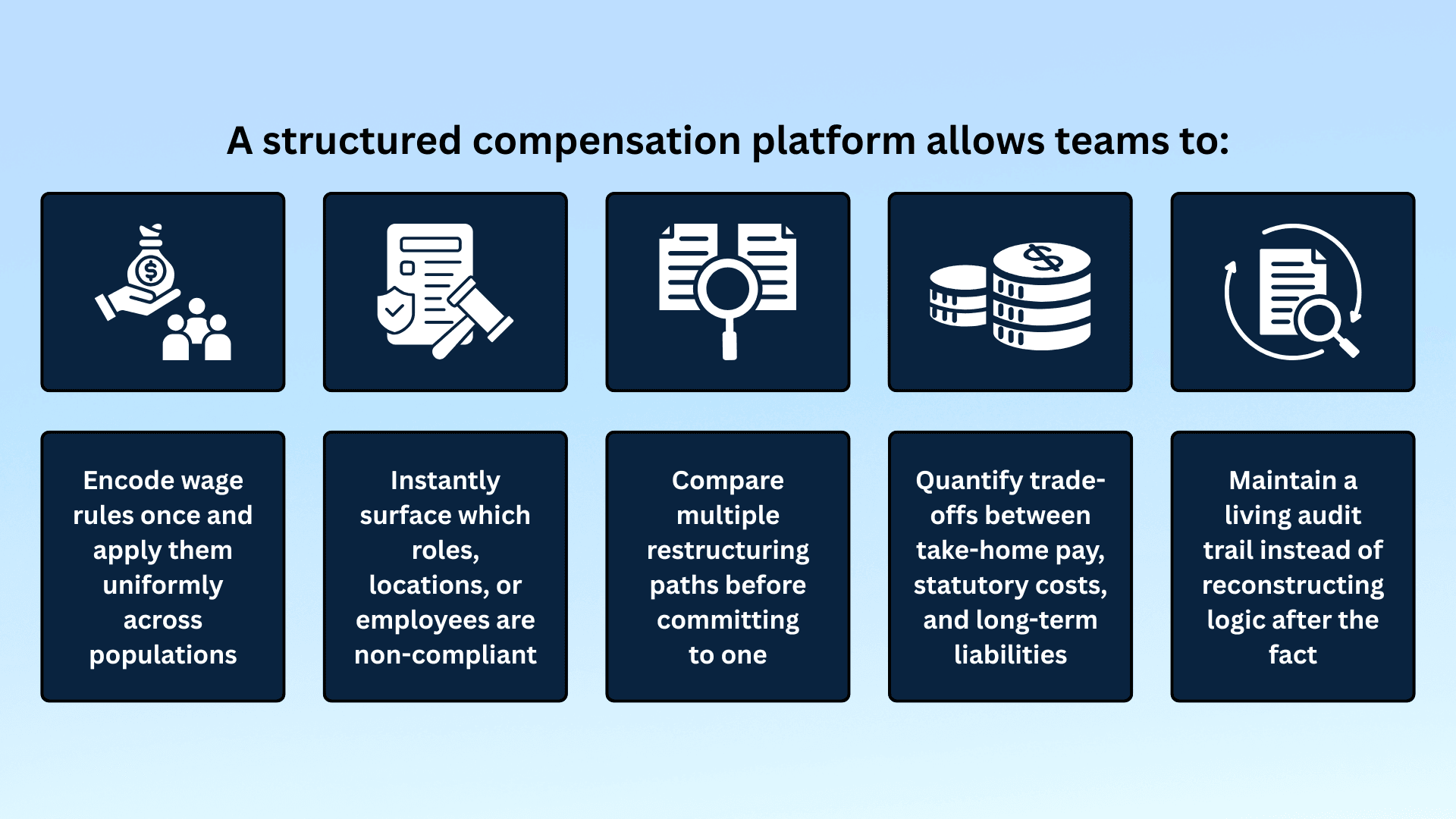

Technology does not just “speed up” labour code compliance. It changes the quality of decision-making.

A structured compensation platform allows teams to:

For professionals, this means decisions move from intuition to evidence.

Forward-looking HR leaders are using labour codes as a forcing function to fix what already wasn’t working:

That shift only happens when organizations can explain compensation clearly and consistently—at scale.

This transition is not about whether you comply. Everyone will.

The real question is how much control you retain while doing so.

Organizations that rely on spreadsheets will spend months validating numbers and responding to questions. Those that invest in compensation technology will finish earlier, communicate better, and make structurally stronger decisions.

Labour codes are rewriting the rules of compensation governance in India.

The winners will not be those who react fastest—but those who build systems that last.

Purpose-built compensation platforms like CompUp replace fragmented manual effort with structured, rule-driven execution.

Instead of recalculating packages individually, teams can define wage rules centrally. Once the 50% threshold is set, any non-compliant structure is automatically identified, along with the exact adjustment required to bring it within limits.

State-level minimum wages can be maintained centrally and applied consistently across employee populations, eliminating manual tracking and reducing the risk of oversight.

What truly changes how teams work, however, is scenario modelling.

With CompUp, comp&ben and rewards teams can model multiple restructuring scenarios in parallel and understand their implications before implementation:

This allows leaders to move beyond “what is compliant” to “what is optimal” — balancing cost, take-home pay, and long-term benefits.

CompUp also enables more transparent employee communication. Instead of generic explanations, teams can generate personalised compensation letters that clearly show what has changed, why it has changed, and how long-term benefits have increased — supported by real numbers.

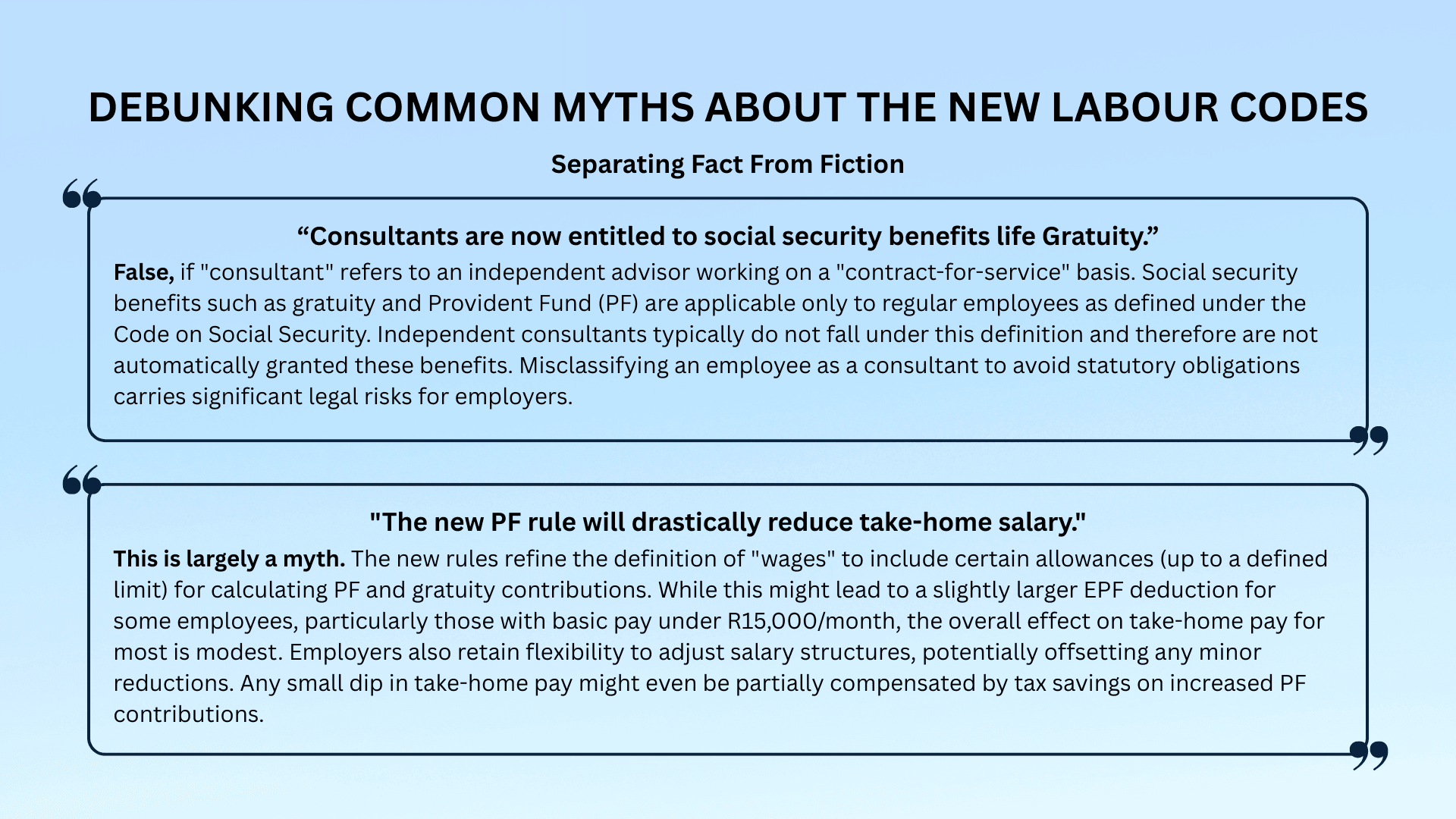

Are the labour codes only a payroll issue?

No. They directly impact compensation design, workforce costs, benefits strategy, employee communication, and audit governance.

Will take-home pay reduce for all employees?

Not necessarily. Impact varies by structure, location, and employer strategy. The key is modelling scenarios before implementation.

Is technology mandatory for compliance?

Legally, no. Practically, for medium-to-large organizations managing scale and risk, it is increasingly unavoidable.

What are the four Labour Codes?

1- Code on Wages (2019)

2- Code on Social Security (2020)

3- Occupational Safety, Health and Working Conditions Code (2020)

4- Industrial Relations Code (2020)

Will salaries increase under the new labour codes?

Not necessarily. CTC may remain unchanged, but take-home pay could reduce due to higher PF contributions on a larger wage base. Whether organisations increase CTC to offset this impact depends on internal policy decisions.

Community Manager (Marketing)

As a Community Manager, I’m passionate about fostering collaboration and knowledge sharing among professionals in compensation management and total rewards. I develop engaging content that simplifies complex topics, empowering others to excel and aim to drive collective growth through insight and connection.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking