When hiring a new employee or managing the old ones, stating the compensation clearly is an absolute necessity. Whether you’re a small business owner or an HR professional, stating the annual compensation, salary, and benefits has to be on your priority list. While "salary" and "annual compensation" are terms we often use interchangeably, they’re not the same thing.

So, what do you do to ensure that there’s a clear understanding of what annual compensation and annual salary are for both the employee and the employer? In this blog, let’s clarify each term to help you understand its implications for your business and team.

Salary refers to the fixed amount of money an employee is paid annually, typically before taxes, and is usually divided into regular payments (e.g., monthly or bi-weekly). This amount doesn’t change unless there are adjustments, like raises or deductions. For instance, if an employee’s salary is $60,000 a year, that’s the guaranteed base pay they will receive, regardless of performance or other factors.

On the other hand, annual compensation is the total financial package an employee receives in a year, encompassing more than just salary. It includes the base salary as well as bonuses, benefits, stock options, and other perks. For example, an employee with a $60,000 salary might also receive a $5,000 bonus, $3,000 in health benefits, and retirement plan contributions. All of this adds up to a total annual compensation of $74,000.

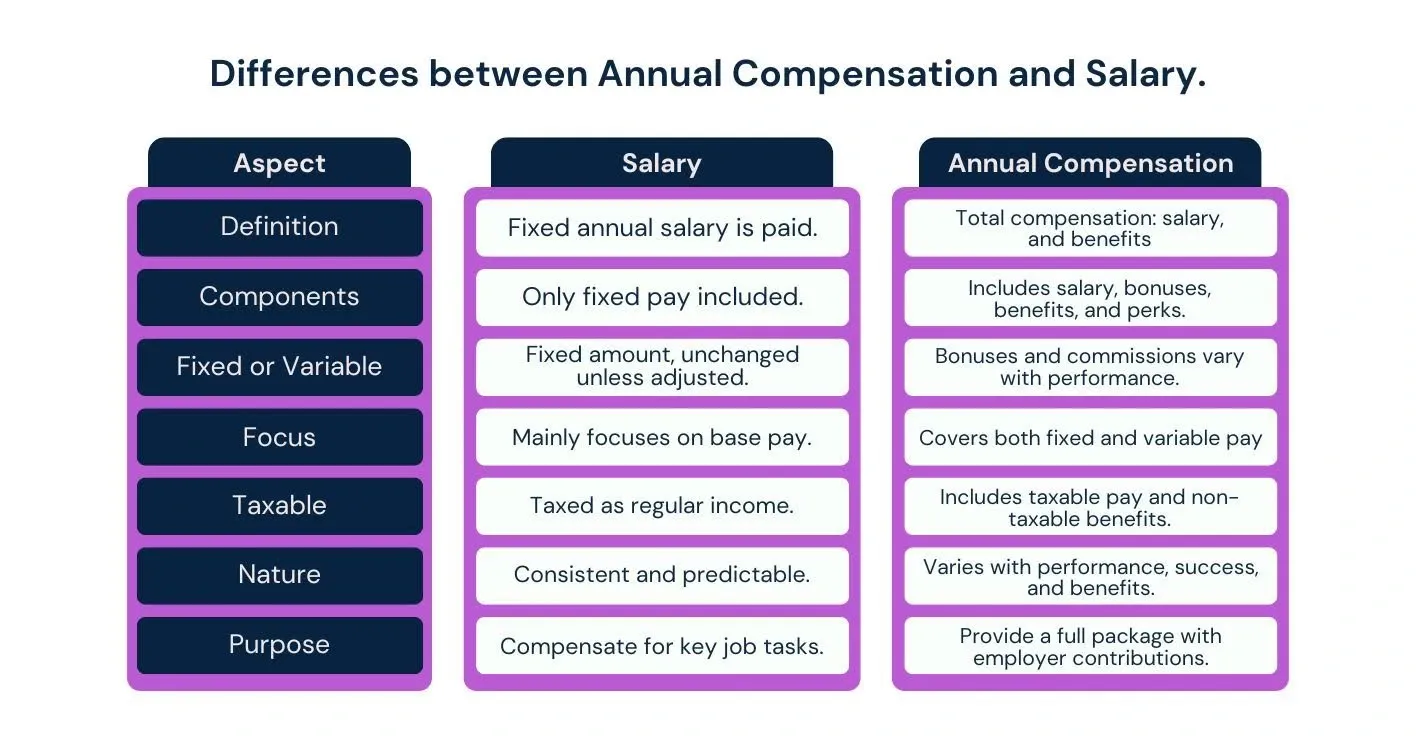

So, while salary is the fixed amount paid for an employee’s work, annual compensation includes salary plus bonuses, benefits, and any other financial perks. Understanding the difference is essential for both employers and employees in setting expectations and negotiating compensation.

Here are the key differences between annual compensation and the salary of an employee.

Now that we have a clear picture of what differentiates salary from annual components, let’s take a closer look at the key components of the latter.

Suggested Read: Pay Transparency: Understanding Salaries in the Workplace

To understand annual compensation, it's helpful to break it down into three key components: Base Salary, Variable Pay, and Additional Benefits.

Base salary is the fixed amount an employee earns for their role, typically paid on a regular schedule (e.g., monthly or bi-weekly). This pay doesn’t change unless there are raises or other adjustments. For example, if an employee’s salary is $50,000 a year, that’s the guaranteed amount they will receive, regardless of performance.

Variable pay depends on performance or results and is designed to reward employees for meeting specific goals. It includes:

Variable pay motivates employees to perform well, aligning their goals with the company's success.

In addition to salary and variable pay, additional benefits contribute to an employee’s total compensation package. These benefits may include:

These benefits enhance job satisfaction and long-term financial security, adding value beyond just the paycheck.

Meanwhile, this is not it. When considering annual compensation, more types of compensation plans need to be understood.

Suggested Read: Creating a Compensation Job Offer Letter: A Template Guide for Every Situation

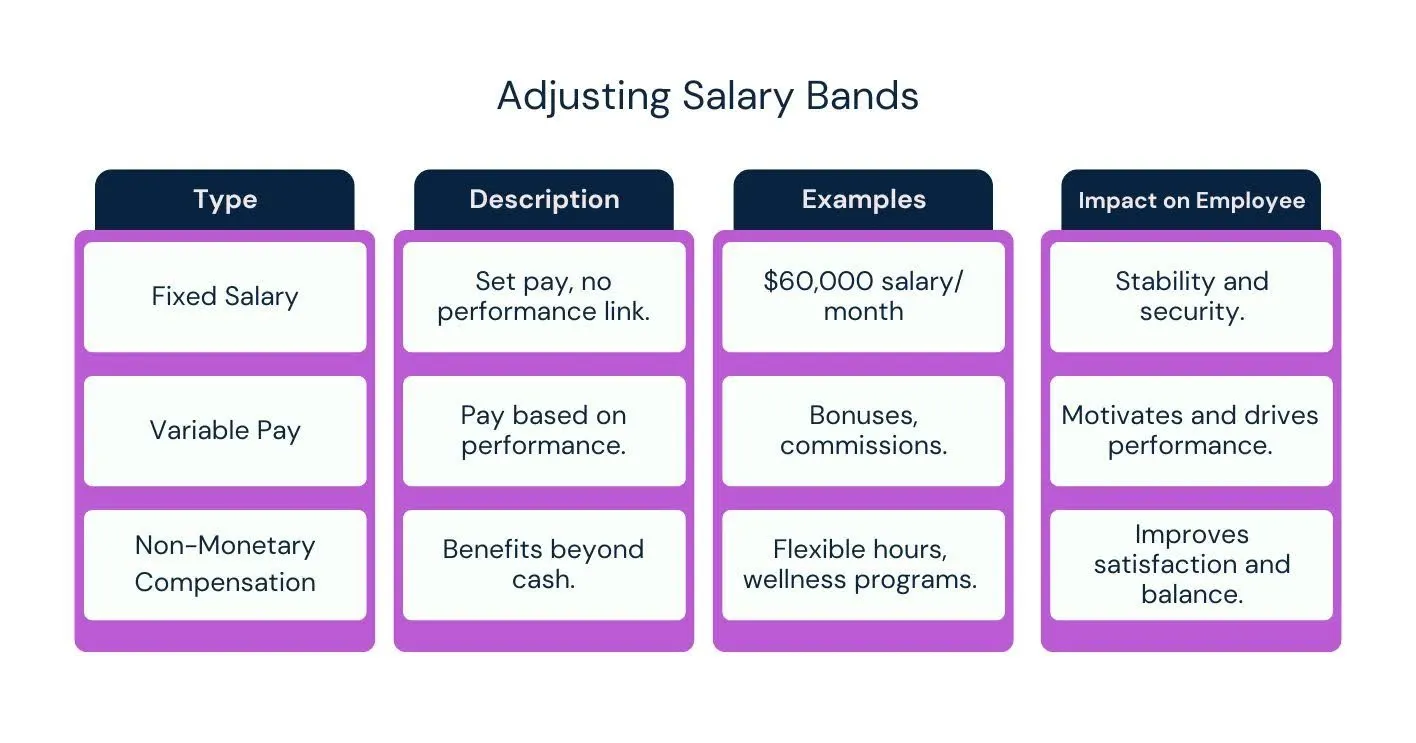

To fully understand annual compensation, it's important to distinguish between different types of pay and benefits. These can be broadly categorized into Fixed Salary vs. Variable Pay and Non-Monetary Compensation. Here is a comparison of each type.

Whatever way you choose to compensate your employees, you need to understand the taxation of each type. Let’s examine the legal considerations.

When discussing annual compensation, it’s crucial to understand the legal and tax aspects that affect both employees and employers. Compensation isn’t just about the salary employees earn; it also involves how different components are taxed and regulated. Here’s a more in-depth look at the important legal and tax considerations:

Understanding which parts of an employee’s compensation are taxable versus non-taxable is essential for both employees and employers, as it directly affects the take-home pay and overall compensation value.

Taxable Components

Non-Taxable Components

These distinctions are important for employees because they can significantly affect what they take home versus the value of their total compensation. While salary and bonuses increase taxable income, benefits like health insurance and retirement contributions enhance the overall value of compensation without increasing tax liability.

The exempt vs. non-exempt classification is key when determining whether employees are entitled to overtime pay. These distinctions are regulated by the Fair Labor Standards Act (FLSA), and knowing the difference can help businesses stay compliant with labor laws.

Exempt employees are typically salaried employees in managerial, professional, or administrative roles. They are not entitled to overtime pay, no matter how many hours they work beyond the standard 40-hour workweek.

Example: A senior manager or an executive working 45 hours a week would still receive the same salary as someone working 40 hours, without additional pay for the extra hours.

Non-exempt employees are usually hourly workers or those whose job roles do not qualify for exemption. They are entitled to overtime pay (usually 1.5 times their regular hourly rate) for any hours worked beyond 40 hours in a week.

Example: A retail worker or factory employee working 45 hours a week would be eligible for overtime pay for the additional 5 hours worked.

Understanding the distinction between exempt and non-exempt employees is critical for employers to comply with overtime regulations and ensure proper compensation for extra work hours.

Now that you have a better understanding of taxable and non-taxable components of the annual compensation, let’s take a look at the factors that affect it.

Suggested Read: Understanding Enterprise Compensation Management

Annual compensation is influenced by several factors that determine how much employees are paid. These factors can vary greatly depending on industry, company performance, location, and individual contributions. Here’s a breakdown of the key influences:

One of the most significant factors influencing annual compensation is the industry in which a business operates. Different industries have different financial structures, demands, and profit margins, which can result in significant variations in pay.

Understanding industry standards helps employers remain competitive and employees set realistic expectations.

A company's overall performance plays a huge role in determining annual compensation. If a business is doing well financially, it may be more willing and able to offer higher salaries, bonuses, or even raise wages. Conversely, when business performance declines, employers may need to reconsider or reduce compensation packages.

Employers need to adjust compensation based on business success to retain top talent, while employees should align their expectations with company performance.

Geographic location is another important factor that directly impacts annual compensation. The cost of living, local labor market conditions, and even the city or region in which the company is based play a major role in determining how much employees are paid.

Understanding geographic differences helps employers offer competitive pay based on location and helps employees understand how far their salary will go in different areas.

One of the most personalized factors in annual compensation is the employee’s individual contributions to the company’s success. Employees who bring measurable value to the company, whether through new business, revenue growth, or key innovations, may see higher compensation as a result.

Employers use performance-based incentives to align employee goals with company objectives, while employees who bring significant value can negotiate higher pay.

Now comes the question of negotiating the annual compensation. As an HR professional, it falls on you to offer reasonable compensation to hire or retain an employee while aligning with the company budget.

Suggested Read: How to Build Pay Structures: Pros and Cons of Salary Bands and Pay Ranges

Negotiating compensation is a critical skill for HR professionals and small business owners alike. It’s about aligning expectations, offering competitive packages, and ensuring fairness for both the company and the employee. Here’s how HR professionals can approach compensation negotiations effectively.

Before any negotiation, HR should come prepared with data on industry standards, regional salary benchmarks, and role-specific expectations. Tools like Glassdoor, PayScale, and industry reports help you stay competitive while aligning offers with your company’s budget.

Salary is only part of the equation. Review the full package, including health benefits, retirement plans, bonuses, equity, and flexible work options. Highlighting these perks can make your offer more appealing, even if the base pay is fixed.

Clear, honest dialogue is key. Set expectations upfront about what’s negotiable and listen closely to the candidate’s priorities. Transparency builds trust and leads to smoother, more successful negotiations.

If you find yourself struggling while planning a compensation strategy for your business, CompUp is here to help. Here’s how we can help you build and manage a competitive annual compensation policy.

As an HR professional or small business owner, building a well-rounded compensation strategy requires more than just setting salaries; it demands data, clarity, and the right tools. CompUp simplifies this process by helping you benchmark pay, plan effectively, ensure equity, and clearly communicate total rewards. With built-in analytics and customizable planning features, you can design compensation packages that align with industry standards, support internal fairness, and keep your workforce engaged and informed.

Whether you're adjusting pay bands, running appraisals, or rolling out bonuses, CompUp gives you a structured, transparent, and data-backed way to manage annual compensation.

Key Features at a Glance:

With CompUp, you’re not just managing pay but building a smarter, more transparent compensation framework that grows with your team. Contact us today for a consultation!

1. What’s the difference between salary and annual compensation?

Salary is the fixed base pay an employee earns annually, typically before taxes. Annual compensation includes salary plus bonuses, benefits, retirement contributions, stock options, and other perks, offering a complete picture of what the employee receives.

2. Why is it important to communicate total compensation clearly during hiring?

Clear communication prevents misunderstandings, sets realistic expectations, and helps candidates see the full value of their offer, not just the base salary. This can be a key factor in talent acquisition and retention.

3. Which components of annual compensation are taxable?

Salary, bonuses, and commissions are generally taxable. Employer-paid health insurance premiums, retirement plan contributions, and some dependent care benefits are typically non-taxable, reducing the employee's taxable income.

4. How does geography affect compensation?

Compensation often reflects the local cost of living. Employees in high-cost cities may receive higher pay compared to similar roles in smaller towns or rural areas.

5. Can tools like CompUp help in designing compensation packages?

Yes, CompUp helps HR teams benchmark salaries, plan equitable compensation, analyze pay gaps, and clearly communicate total rewards, making it easier to build fair, data-driven strategies that attract and retain top talent.

Community Manager (Marketing)

As a Community Manager, I’m passionate about fostering collaboration and knowledge sharing among professionals in compensation management and total rewards. I develop engaging content that simplifies complex topics, empowering others to excel and aim to drive collective growth through insight and connection.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking