"A well-compensated employee becomes your best advocate, while an undercompensated one can quickly turn into your biggest challenge.”

When making offers or reviewing pay, it's vital to get the details right to avoid dissatisfaction, lost talent, and potential legal risks.

Outdated or misaligned compensation packages hinder your ability to attract and retain top talent, giving competitors an edge. With 52% of recruiters struggling to secure their top choices before competitors, the need for competitive, well-structured pay is clear.

You can streamline processes, manage pay equity and make data-driven decisions with the help of a compensation management software.

In this guide, you will get an in-depth understanding about salary, total compensation, and total rewards and also crack how to calculate compensation and understand how exactly a compensation management software can manage it efficiently.

Let’s get started.

The term- total compensation describes the total value or their annual salary received by the employees by their organisation. It includes monetary and non-monetary benefits employees receive, such as-bonuses, benefits packages having health insurance, dental insurance, allowances for vacation days, life insurances, commissions and other forms of compensation. This compensation philosophy ensures employee retention as they feel valued and motivated leading to benefit the company on the whole.

Total Compensation = Annual Base Salary + Incentive Compensation

Now that we understood what it means, let us cover the aspects that comes under it-

The base salary, also known as base pay, is the core of an employee’s earnings. is the initial amount that is fixed irrespective of the additions or reductions of the overall compensation package offered by the organisations to the employees in exchange to their service.

Over time, as employees take on more responsibilities or move up in the company, this amount can increase as they level up. The base salary is the foundation of what an employee takes home and it doesn’t include extras like bonuses or benefits.

Factors that influence base salary are as follows:

Bonus pay is additional compensation that employees receive with respect to their performance or period of service. Cash, stock options, or paid time off are just a few of the ways that bonuses can be offered.

Programs for bonus pay differ from firm to corporation. While some businesses offer yearly incentives to every employee, others may have performance-based incentive plans that are dependent on predetermined standards.

Employers can express their gratitude for their employees' hard work by rewarding bonuses for reaching goals or recognising significant company milestones. Bonuses are a popular method of rewarding staff and raising spirits, although they are not always guaranteed.

Non-cash perks that enhance the work experience are known as employee benefits. Health insurance, retirement programs, paid time off, and financial aid for college are examples of common benefits.

These advantages, which differ depending on the business, can greatly raise the total compensation package for an employee. While certain benefits—like Social Security and Medicare—are provided in accordance with corporate policy, others are mandated by law.

Offering stock options to employees allows them to buy firm shares at a fixed price in the hopes that the value will rise during time.

Employees and the business are in sync with this type of compensation since everyone gains from the company's success.

Therefore, it is a long-term compensation strategy designed to attract and retain top talent, stock options are often included.

Commission is employee performance-based pay, typically used in sales roles. It’s a way to reward employees directly for achieving their targets and bringing in profit to the company.

Let’s take an example to understand better- if an employee earns a 10% commission on a $45,000 sale, they get an extra $4,500, in addition to their base pay. This system motivates employees to exceed their targets.

There are two forms of payment in commission-

Ramped commission, wherein the percentage increases when the employee generates more sales or reaches higher targets.

In certain industries, like hospitality, tips are a big part of an employee’s income. These are extra payments made by customers directly to the workers for their good service. Tips can significantly boost earnings, making them an essential part of total compensation in these fields.

Think of the base salary as the bread, but total compensation? That’s the whole sandwich with all the fixings that truly satisfies.

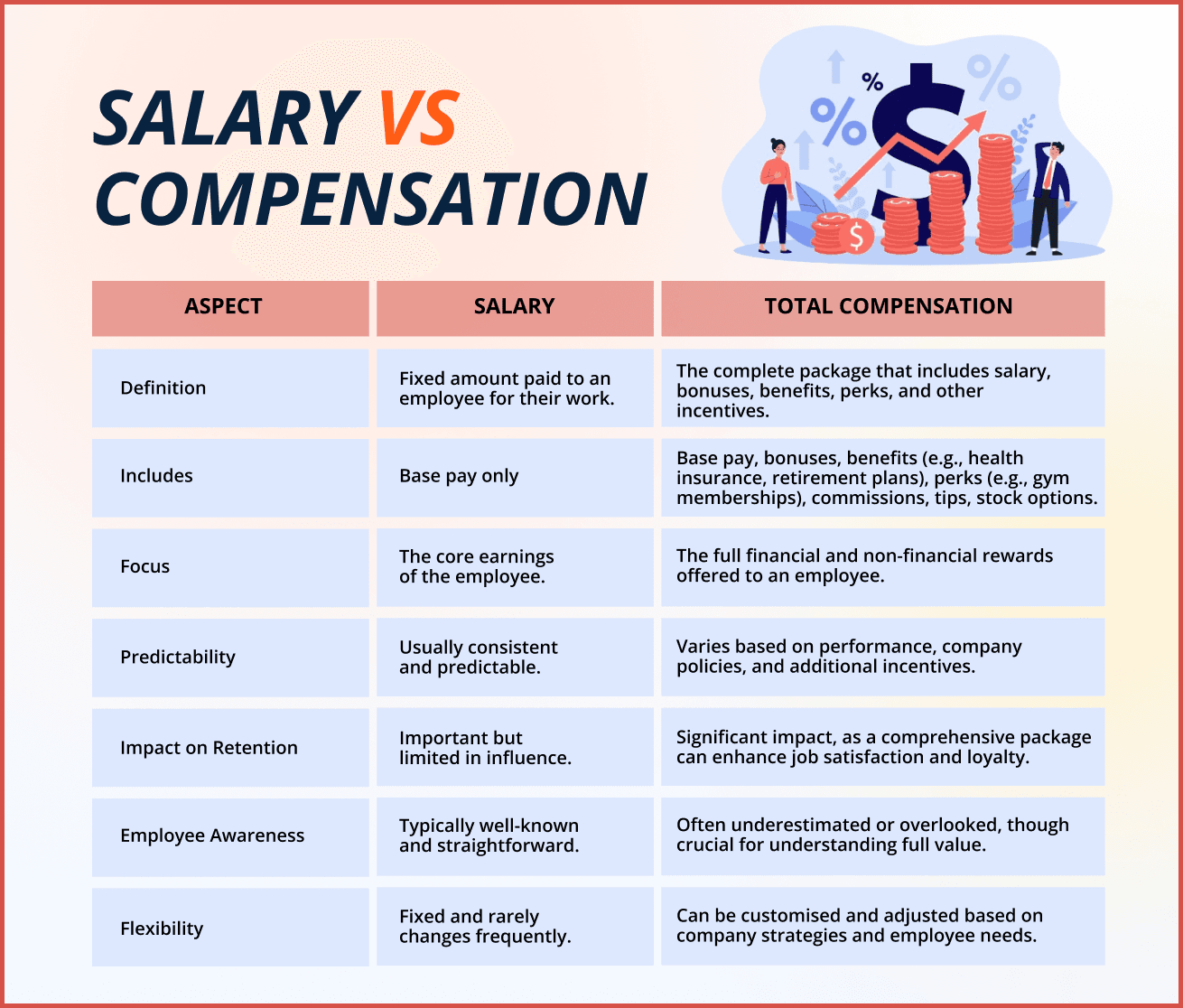

Salary is the core of an employee’s earnings, that is fixed while total compensation is the complete package that can vary. Many employees focus on their salary, but understanding total compensation is key to seeing the full value of their work.

Let’s understand in detail-

Now that we are clear with the significant difference between Salary and Total compensation, let’s check out how it differs from Total Rewards.

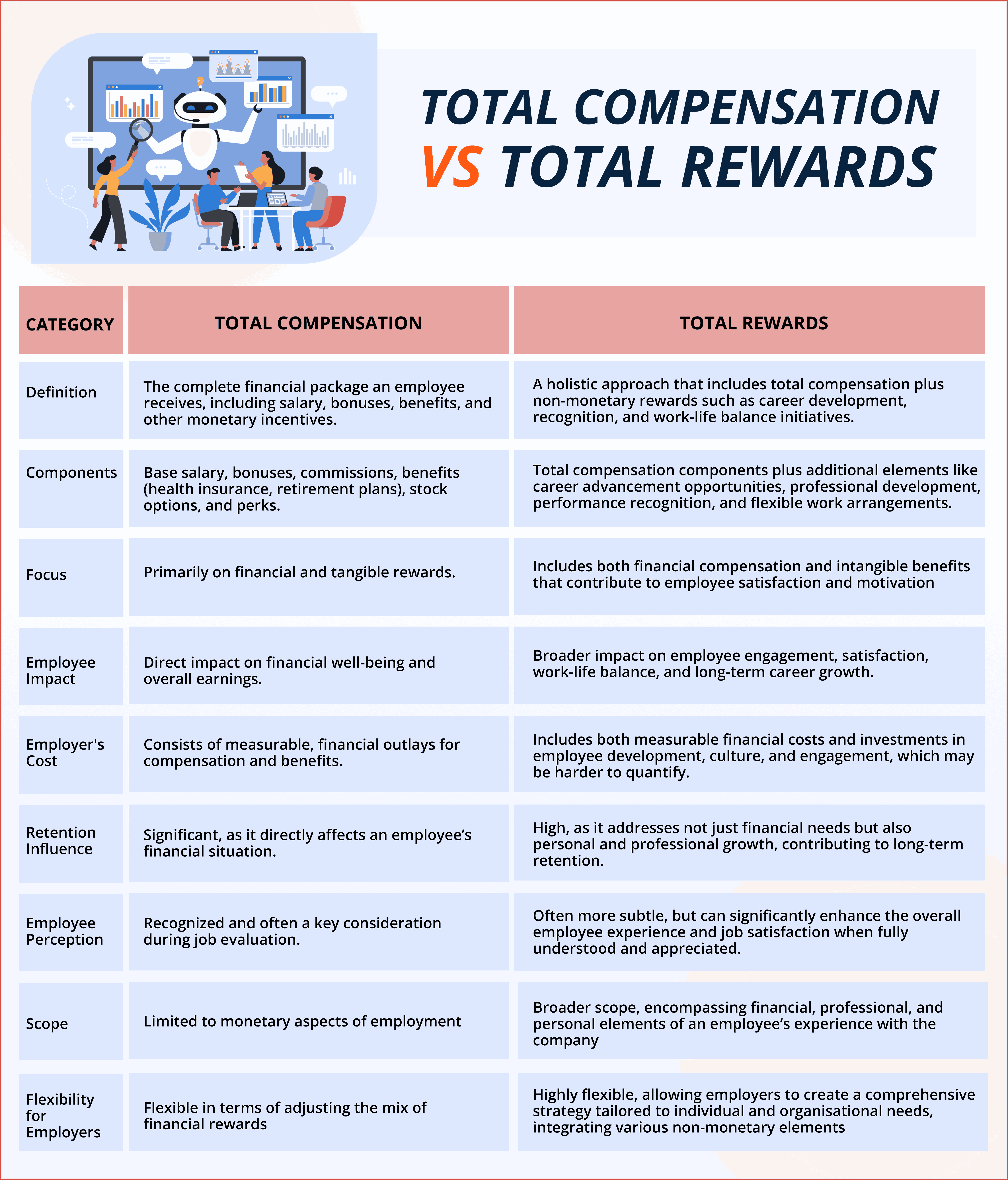

From the above table, we are now clear with the differences between total compensation and total rewards. It also emphasises how total rewards comprise components that enhance a more complete and satisfying work experience in addition to compensation.

Total compensation is crucial because it helps companies stand out in a competitive job market. When potential employees compare job offers, they often look at the total package, not just the salary. Offering a comprehensive and competitive total compensation package can be the difference between attracting top talent and losing them to a competitor.

Total compensation may be significant for businesses as well as employees:

Employees-

Businesses-

We start with the base wage and add the total compensation by the cost of all extra bonuses and perks to determine total compensation. They may include paid time off, commissions, bonuses, health insurance, and other incentives. The entire compensation sum will differ from person to person because every employee has a different package.

For example: the annual remuneration of a financial analyst making $75,000 basic pay plus $1,500 in student loan payback, $1,500 in health insurance, and $3,125 in paid time off equals $81,125.

Taking into account a variety of factors, including pay, incentives, benefits, and perks, can make managing total compensation challenging. This procedure is made simpler by compensation management software, which provides the following key benefits:

Compliance and Customisation- With automatic reporting features, an effective compensation management software may help you maintain legal compliance while giving you the freedom to create pay plans that are specifically tailored to each employee's needs.

CompUp is a full-stack software for managing compensation that is intended to assist organisations in efficiently managing their overall benefits packages.

By providing real-time data integration, it makes sure that your compensation plans reflect current market developments.

You can confidently keep top personnel by using CompUp to remove pay inequalities and future-proof your compensation strategies.

Experience first hand, how CompUp can elevate your compensation management. Book your free demo today and discover how easy it is to build a compensation strategy that works best for your organisation.

Community Manager (Marketing)

As a Community Manager, I’m passionate about fostering collaboration and knowledge sharing among professionals in compensation management and total rewards. I develop engaging content that simplifies complex topics, empowering others to excel and aim to drive collective growth through insight and connection.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking