A recent study shows that over 40% of HR directors feel unprepared for the future of work. This highlights an urgent need for better planning to meet the evolving workforce preferences and technological advancements.

Companies need compensation and benefits programs that align with the employee expectations and make more business sense.

Creating a well-rounded compensation strategy - blending salary with bonuses, equity and other rewards keeps your employees motivated to give their best performance.

But what exactly does it entail? Let us understand.

Compensation refers to the monetary paychecks employees receive for doing their jobs. It includes salaries, hourly wages, commissions, bonuses, incentives, and any perks tied to specific roles. Essentially, it covers all forms of payment employees earn.

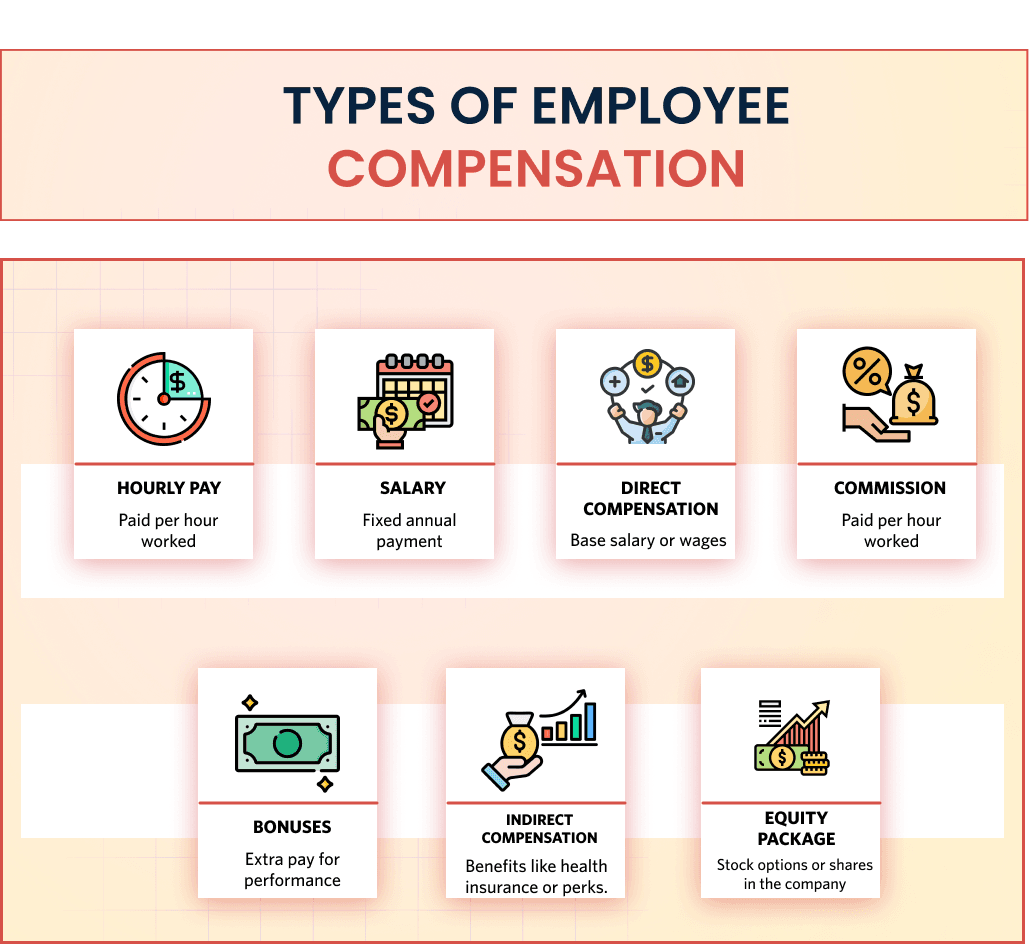

In order to create an effective compensation, it is important to know the main methods of compensation that you can offer:

Hourly compensation will be most common with non-exempt, part-time and contractors.

Using an hourly-rate pricing model gives businesses more control over labour costs. The caveat to this model is wage laws, particularly in terms of overtime and minimum wage laws.

Example: An employee is being paid $15 per hour, for each hour worked.

The simplest example of compensation is the direct form – base salary or wages an employee receives and therefore, it is the very foundation upon which most pay packages are built.

Example: A software developer receives a salary of $100k annually as their base compensation.

Salaries are a set amount of money an employer agrees to pay the employee on an interval basis, commonly monthly or bi-weekly and often for full-time, exempt roles. This process is critical to HR professionals because you want to pay fairly internally (maintain internal equity) while also being competitive in the market.

Example: A manager receives a salary of $60k regardless of the number of hours worked in a year.

Employees earn the right to a percentage of revenue and more rewards will be paid out if that performance exceeded the set targets.

Please note that commission-based-pay is heavily utilised in sales or performance based positions.

Employees receive commissions based on a percentage of the revenue and profit they generate, pushing them to surpass the targets. Setting up commission plans is not a straightforward exercise and requires being fair, motivating and especially allied with the organisation objectives.

Example: A sales representative in the industry, receives a 3 percent commission on every sale made; thus selling a $20k vehicle would result in a $600 profit for them.

Bonuses are another form of extra pay given to a worker which is over and above their normal wage. These may be paid for exceeding performance metrics or simply as an incentive, or in a discretionary manner. It is designed to reward exceptional performance and can be local or global, individual or team-based.

Example: At the end of the year if an employee surpasses their sales goals they receive a $5000 bonus.

Secondly, there is indirect compensation, which is benefits and perks supporting employee well-being but are not directly tied to their pay. They are vital to the total rewards strategies that drive employee satisfaction and engagement.

Example: Employees are provided with benefits such as health insurance coverage, paid time off for vacations and complimentary office meals as part of their compensation package.

Stock Options, RSUs or performance shares are powerful instruments to retain highest level employees and drive them to work for the interest of the company.

If you work with performance-related bonuses offering equity, a big advantage is that the potential downside of an employee owning a percentage of your company can be far outweighed by the positive side, which is the idea that when you sell (or IPO) then so will they.

Very attractive in companies growing rapidly and offering new stock instead of paying high salaries; at start-ups especially where ownership offers a piece of potential growth over time.

Example: An employee receives a share package comprising stock options that have the potential to increase in worth should the company thrive.

A complete compensation package goes beyond just being market competitive, but thoughtfully considers both external benchmarks and internal equity. So, this is how you can figure out accurate compensation:

The responsible balancing act of external competitiveness with internal equity is key when crafting a competitive compensation package that entices top talent to join your organisation and stay long enough to make an impact.

You professionals in HR and Comp are aware that Compensation is more than a figure.

The strategic weapon is envisioned to affect the commercial enterprise overall performance, and broaden worker engagement in preserving your commercial enterprise and improving company success.

With this combination of direct pay, bonuses, commissions and equity packages you will be able to create a total rewards strategy that benefits both the employee and the business.

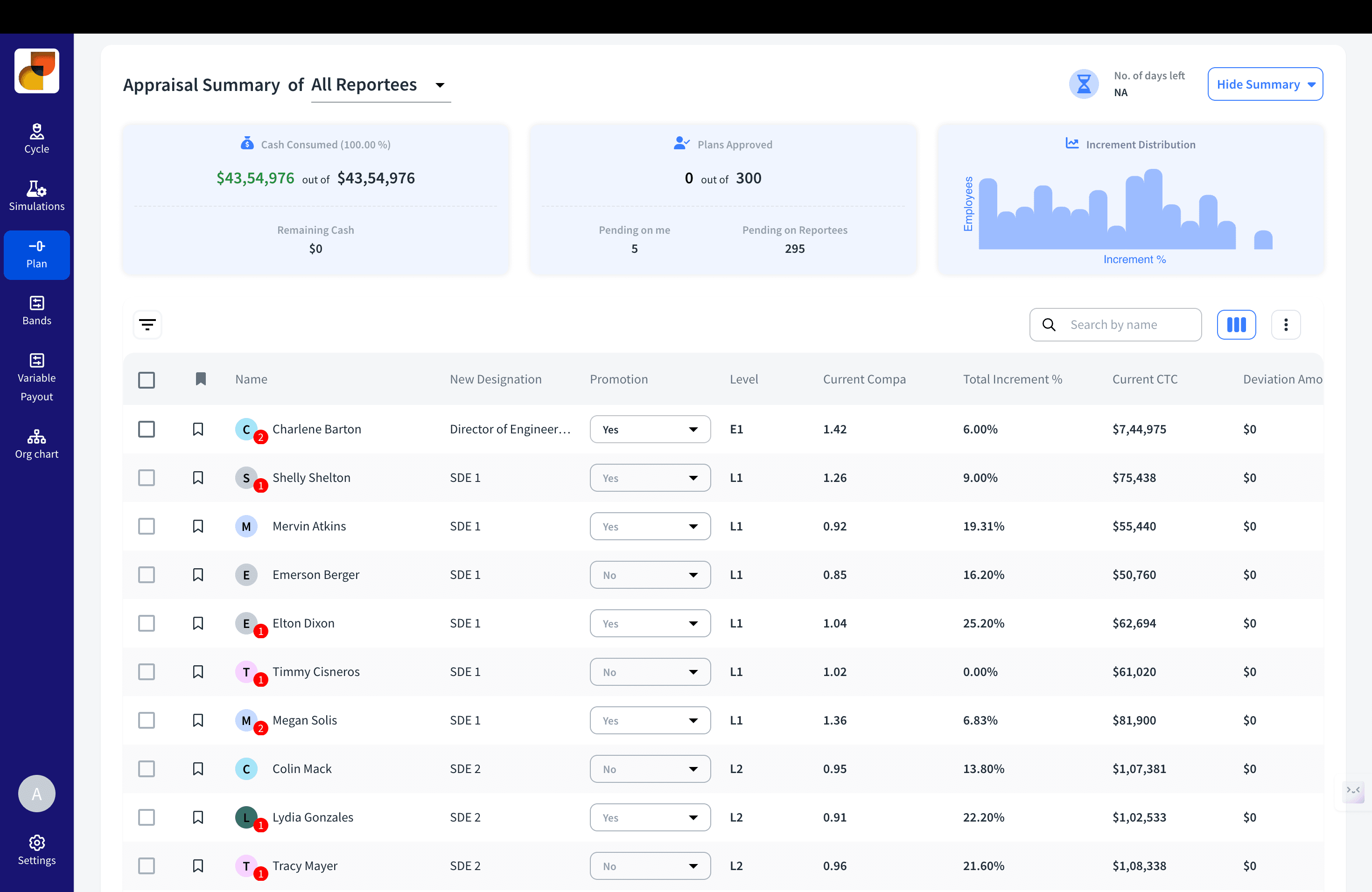

CompUp is a budget planning tool for your compensation and appraisal planning (running merit and increment cycles).

With CompUp, you can build, measure, and execute the best compensation plan at your organisations. Go one step ahead in Compensation management with CompUp today.

Community Manager (Marketing)

As a Community Manager, I’m passionate about fostering collaboration and knowledge sharing among professionals in compensation management and total rewards. I develop engaging content that simplifies complex topics, empowering others to excel and aim to drive collective growth through insight and connection.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking