A Report on Global Impact by Deloitte elaborates on how Deloitte has achieved an 81% reduction in Scope 1 and 2 emissions and a 53% reduction in Scope 3 business travel emissions per full-time equivalent, progressing toward their 2030 goals.

ESG—environmental, societal, and governance initiatives—have high significance with today’s businesses. Though adding ESG to the corporate strategy isn't only about making it a policy, rather it is about engaging the employees within an organization.

A well-made compensation plan is just the means through which employees can stay more aligned to the ESG goals of the organization. So, it is simply very significant to explore the connection between the ESG goals of a company and how it drives employee engagement.

The full form of ESG is environmental, social, and governance. These are three key elements that are used in order to evaluate a company’s overall commitment towards sustainability and goals towards a more sustainable world, including other ethical practices as well.

Environmental: This focuses on primary goals to conserve and protect our environment through practices and goals like managing waste, conserving natural resources, and attempting to reduce carbon emissions.

Social: Social goals include goals that are streamlined towards public welfare, employee welfare, community engagement, consumer rights, and so on.

Governance: Governance primarily deals with transparency and accountability and making sure to be compliant with regulatory frameworks and other means of ethical decision-making as well. Like corporate social responsibility, inclusion and diversity, financial transparency, and so on.

Like the US Securities and Exchange Commission, it is enacting very significant ESG disclosure requirements, and the same goes with the European Union passing such similar regulations.

Addressing global challenges to create a long-term value for all the stakeholders involved is more a need than a want, considering the environmental hazards there are in the world, and so companies incorporate such ESG principles as a means of their uncompromising commitment towards sustainable development and goals.

The very concept of ESG started with some movements that induced a socially responsible means of investing seen in the late 20th century. This particular term ‘ESG’ gained more attraction when a report named "Who cares wins” released by the United Nations Global Compact highlighted the need to integrate ESG factors into financial markets as well.

From then to now, ESG has clearly evolved into a very keenly pivotal metric to evaluate a company’s commitment towards its sustainability goals and other ethical practices. This is driven by the understanding and awareness of major issues like climate change, corporate accountability, and social justice.

Considering the growing demands from companies, consumers, and the government for more responsible practices, adopting ESG into the core strategies of the company helps them do the same.

It is a global crisis, from climate change to economic inequality, whether that be an environmental crisis or one that is more social. ESG is no longer looked at as an optional bit; it is rather very essential. So, here is why ESG matters more than ever today

Climate change is a true and immediate crisis, which makes adopting ESG to a company’s corporate strategies very significant. From sea level rising to depletion of resources and other unpredictable weather events, businesses are now being held accountable for their impact on the environment.

The advantages for the company in doing this are definitely reducing the harm they cause to the environment. Moreover, other regulatory advantages and an elevated brand image. Like BlackRock prioritizing ESG-conscious investments is one of such investment examples.

Employee expectations have changed over time and so have the expectations from consumers. They expect not just the best consumer experience and quality products or competitive salary packages for employees but also an organization that has ethical standards and sustainable practices.

Consumers: Studies show that customers prefer particular brands that go on to make sure that sustainability is a priority and ethical sourcing too.

Employees: Companies must align with the employee’s values as well, particularly in how they accept diversity and how they contribute to help with the climate crisis or more.

Risks that can lead to financial losses and other operational risks simply cannot be ignored, and so there is a need to mitigate them rather effectively. Companies can be caught off-guard with the unpredictability of environmental risks adding to financial risks, and so having these programs ensures the long-term benefits they will avail.

Incorporating ESG in companies often helps these companies outperform their own peers in the long term because it helps having a more proactive means of addressing risks and helping with the unforeseen costs that the company might incur.

Moreover, it also provides an elevated sense of brand image to the company and attracts more investors, leading to higher stock valuations and access to capital.

Governments and other regulatory bodies are attempting to enforce more stringent means to identify ESG and other compliance measures. This helps mitigate when there is non-compliance, as it will result in damage to a company’s reputation, fines, and so on. From the EU Green Deal, making sure that companies align with the ambitious goals the EU has set as well as global reporting standards such as SASB, GRI, and so on helps ensure that such regulatory requirements about ESG are met.

There are significant advancements when it comes to technology, including AI, blockchain, and big data, all of which enable companies to be able to track and improve their ESG strategies. Including carbon tracking, streamlining ESG disclosures, and supply chain transparency.

When ESG goals align with the company’s core mission and their other personal values. Also, clearly being able to share the company’s ESG strategies, vision, and progress means in a relatable and inspiring way. Such ESG efforts are also ones that contribute to a broader purpose.

Creating a collaborative environment includes employees feeling more involved in the planning and execution of ESG initiatives. This also helps garner regular input from employees regarding it, brainstorming innovative ideas for it, and having task forces to address more inclusion, embrace diversity, and so on.

Making sure to conduct and train employees to engage in community outreach and other green initiatives as well. Transparent and regular communication about everything regarding the ESG goals and how effective they can be are very pivotal.

Recognizing top performers who are aligned to such goals and values and being able to meet with them can be reinforced and also motivate other employees to participate in such ESG initiatives. Such recognition can also help inspire more people to try and align with the ESG strategies of the company.

Communicating success stories is a powerful way to keep employees motivated and engaged with ESG initiatives. Celebrating milestones and sharing the impact of these efforts highlights the tangible difference employees make. Making sure to publish case studies showcases their accomplishments, fostering a sense of purpose and pride.

Creating a well-made compensation plan is the means through which employees can attempt to stay more aligned with their ESG goals. It is clear why aligning with ESG goals is such a priority now more than ever.

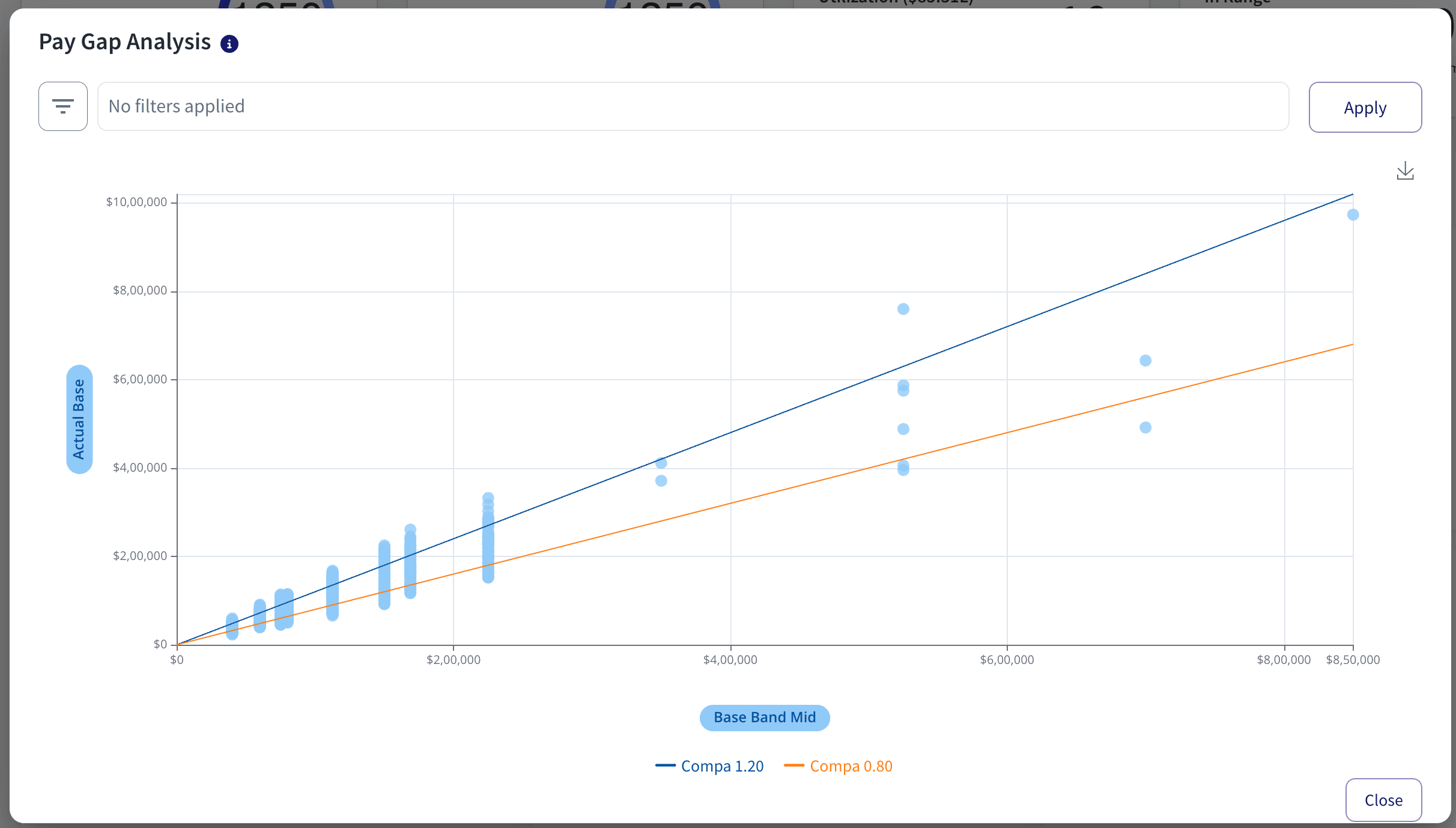

CompUp is software that has advanced features for compensation planning and has solutions that simplify the entire process of developing comprehensive compensation plans; this helps build high-performing teams as well.

As ESG takes center stage in corporate strategy, the role of employee engagement becomes increasingly crucial. A well-designed compensation plan that integrates ESG values not only motivates employees, but it also ensures that they are active contributors to the company’s sustainability efforts.

So, try the platform now to understand how CompUp can streamline your compensation planning with fair pay practices.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking