A pay equity audit is a structured review of your organization's compensation practices aimed at identifying and addressing unjustified pay disparities. This process ensures that employees performing similar work receive fair compensation regardless of gender, race, or other protected characteristics.

A 2024 survey by the Society for Human Resource Management (SHRM) revealed that 75% of organizations regularly audit for pay equity. The audits most commonly assess gender (80%), race or ethnicity (68%), and age (62%) disparities. Conducting a pay equity audit serves multiple purposes. It helps you comply with equal pay regulations, thereby reducing the risk of legal challenges. It also enhances your organization's reputation, making it more attractive to current and prospective employees.

In this blog, we’ll be talking about a pay equity audit, and you’ll be able to take a proactive step toward ensuring equitable compensation practices within your organization.

Pay equity means making sure people who do the same or similar jobs get paid fairly, no matter their gender, race, or background. It’s about equal pay for equal work. If there are differences in pay, they should be based on real job-related reasons like how much experience someone has, their education, or how well they perform.

Pay equity isn’t just about salary. It also includes things like bonuses, health benefits, and chances to get promoted. When a company follows pay equity, it helps create a fair and respectful workplace.

A pay equity audit is when a company looks closely at how it pays its employees to make sure everyone is being paid fairly. This review checks salaries, bonuses, and other benefits to find and fix any unfair differences. The goal is to make sure people doing the same kind of work are getting similar pay.

The audit begins by reviewing your organization's compensation framework, which includes base salaries, bonuses, and benefits. This process helps identify any unjustified pay disparities among employees performing similar roles. By examining these components, you can ensure that your compensation practices are fair and equitable.

A detailed analysis of salary structures, bonus distributions, and benefits packages is conducted to uncover any inconsistencies or biases. This step is crucial in understanding how compensation is allocated and identifying areas where adjustments may be necessary to promote fairness.

It's advisable to conduct a pay equity audit at least annually. However, if there are significant changes within your organization, such as mergers, acquisitions, or restructuring, it may be beneficial to perform audits more frequently. Regular audits help maintain equitable compensation practices and address any emerging disparities promptly.

By regularly conducting pay equity audits, you can ensure that your organization's compensation practices remain fair and just, fostering a more inclusive and equitable workplace.

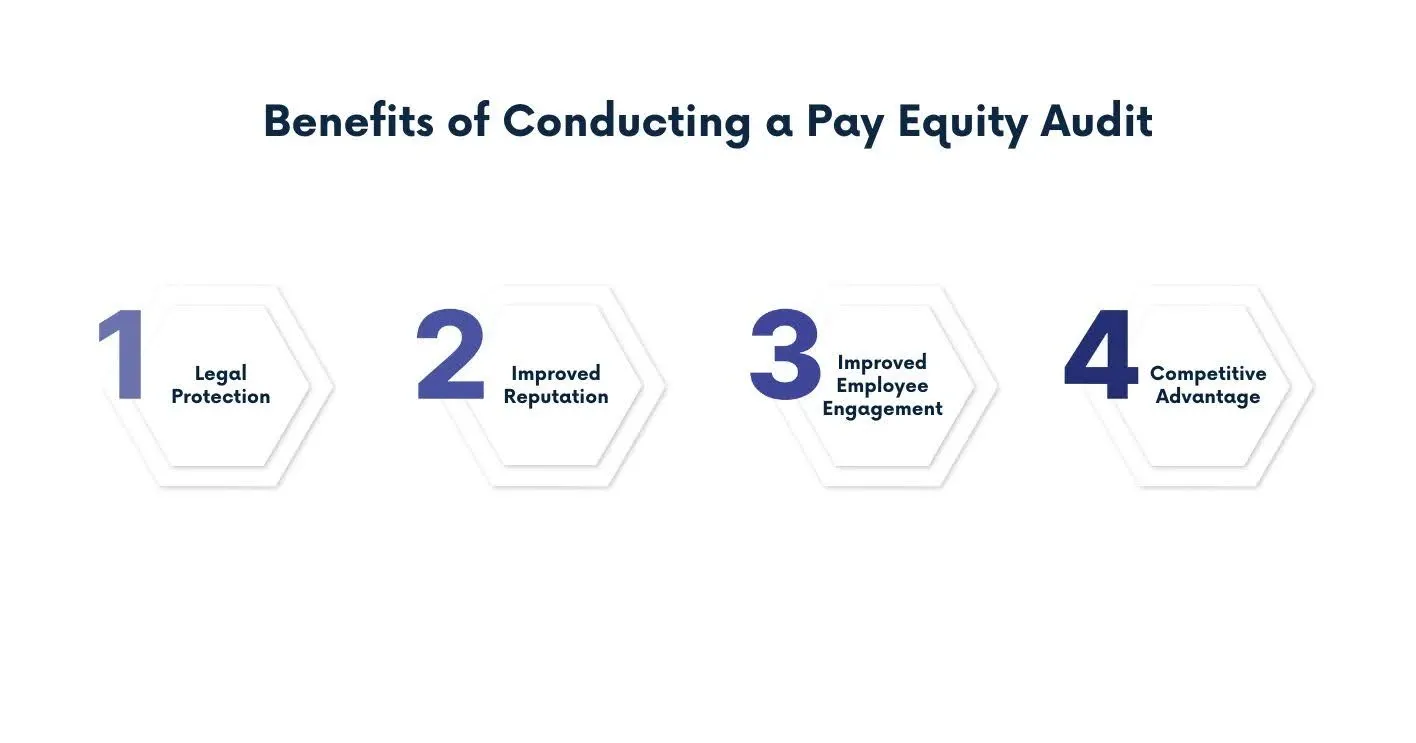

Conducting a pay equity audit is crucial for several reasons:

Employees who perceive their compensation as fair are more likely to be engaged and remain with the organization. Addressing pay disparities can lead to increased job satisfaction and reduced turnover.

Organizations known for equitable pay practices are more attractive to top talent. A commitment to pay equity can be a differentiator in competitive job markets.

Regular audits help identify and address unjustified pay disparities, promoting fairness and equity within the organization.

Also Read: Understanding Pay Equity Analysis: Steps and Importance

By conducting a pay equity audit, you take proactive steps to ensure fair compensation practices, comply with legal requirements, and create a more equitable and attractive workplace.

Conducting a pay equity audit offers several advantages for your organization, such as:

In some regions, performing a pay equity audit can provide legal safeguards. For instance, states like Massachusetts and Oregon offer a "safe harbor" to employers who conduct a good faith, reasonable pay audit and make progress in addressing any identified disparities. This proactive approach can help mitigate the risk of legal challenges related to pay discrimination.

Demonstrating a commitment to fair compensation practices can improve your organization's public image. By addressing pay disparities, you signal to employees, potential hires, and the public that your organization values fairness and transparency.

Employees who perceive their compensation as fair are more likely to be engaged and satisfied in their roles. Addressing pay disparities can lead to increased morale and productivity, fostering a more positive work environment.

Organizations known for equitable pay practices are more attractive to top talent. A commitment to pay equity can be a differentiator in competitive job markets, helping you attract and retain skilled professionals.

By conducting a pay equity audit, you can ensure that your organization's compensation practices are fair, compliant with legal standards, and conducive to a positive workplace culture.

Conducting a pay equity audit involves several key components to ensure its effectiveness and accuracy. Here's a breakdown of the essential steps:

Begin by establishing the audit's purpose and the specific areas to be examined. Decide whether the audit will focus on compliance with legal standards, internal equity, or both. Also, in terms of whether to adopt an intersectional approach, examining how multiple characteristics (e.g., gender and race) intersect to impact pay disparities. This clarity will guide the entire process and ensure that the audit addresses the most pertinent issues.

Form a team comprising members from various departments, including Human Resources, Legal, Finance, and Operations. This diverse group will bring different perspectives and expertise, promoting a comprehensive analysis.

Create a standardized system to categorize positions based on comparable skills, responsibilities, and working conditions. This classification will serve as the foundation for comparing compensation across similar roles.

Gather comprehensive compensation data, including base salaries, bonuses, benefits, and any other forms of compensation. Ensure the data is accurate and up-to-date. Address any data gaps by implementing strategies like annual employee surveys or integrating data collection into onboarding processes.

Analyze the collected data to identify any pay disparities. Utilize appropriate statistical methods to assess whether observed disparities are justified by legitimate factors such as experience, education, or performance. Consult with legal counsel to ensure compliance with applicable laws and to interpret findings accurately.

If disparities are identified, develop a remediation plan to address them. This may involve adjusting compensation, revising policies, or implementing new practices to ensure equitable pay. Create a communication plan to transparently share findings and actions with stakeholders while considering legal guidelines on information disclosure.

Establish a system for ongoing monitoring to ensure that pay equity is maintained over time. Regular audits and updates to compensation practices can help prevent future disparities.

By following these steps, you can conduct a thorough and effective pay equity audit that promotes fairness and compliance within your organization.

Conducting a pay equity audit is a strategic approach to identifying and addressing wage disparities within your organization. A critical component of this process involves calculating the gender pay gap to uncover differences in compensation between male and female employees.

The gender pay gap represents the difference in average earnings between men and women. It's typically expressed as a percentage of men's earnings. There are two primary methods to calculate this gap:

The gender pay gap is typically calculated by comparing the average earnings of men and women across an organization.

Gender Pay Gap = Average Salary of Men - Average Salary of Women/Average Salary of Men × 100

This percentage reflects the difference in earnings between male and female employees. A smaller gap indicates greater pay equity, while a larger gap suggests the need for closer attention and corrective actions.

Example:

(60,000−54,000/60,000) × 100 = 10%

This result indicates that, on average, women earn 10% less than men in the organization.

The median pay gap provides insight into the middle point of the salary distribution, which can be less affected by outliers.

1. Determine Median Salaries

List all male salaries in ascending order and identify the middle value to find the median male salary.

2. Apply the Formula:

(58,000−52,200/58,000) × 100 ≈ 10%

This calculation also reveals a 10% median pay gap, highlighting a consistent disparity at the midpoint of earnings.

For an analysis, consider using specialized tools and calculators designed to assess pay disparities. These tools can help you:

With these resources, you can gain deeper insights into your organization's compensation structure and take informed steps toward achieving pay equity.

These calculations in your pay equity audit enable you to pinpoint areas where wage disparities exist and develop targeted strategies to address them. This proactive approach not only ensures compliance with equal pay laws but also promotes a fair and inclusive workplace culture.

Data security is a critical component in conducting pay equity audits, as these audits involve the collection and analysis of sensitive employee information, including compensation details, personal demographics, and employment history. Ensuring the confidentiality and integrity of this data is paramount to maintain trust and comply with legal requirements.

Using strong encryption protocols for data at rest and in transit is necessary to protect sensitive information from unauthorized access. This includes encrypting databases, file systems, and communications channels.

Establishing strict access controls ensures that only authorized personnel can access sensitive data. Using role-based access control (RBAC) and requiring multi-factor authentication (MFA) can improve security measures.

Where possible, anonymizing or pseudonymizing data can reduce the risk of exposure. This approach allows for meaningful analysis without compromising individual privacy.

Adhering to data protection laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is crucial. These regulations mandate specific data handling and reporting practices to safeguard personal information.

By integrating these data security measures into the pay equity audit process, organizations can protect sensitive information, comply with legal obligations with trust and transparency.

Understanding the legal framework is necessary when conducting a pay equity audit. Here's an overview of the key legal considerations:

The EPA mandates that men and women receive equal pay for equal work. Employers must ensure that pay disparities are based on factors other than sex, such as seniority or merit. Violations can lead to legal actions and penalties. Title VII of the Civil Rights Act of 1964 prohibits employment discrimination based on race, color, religion, sex, or national origin.

Many states and municipalities have enacted laws that go beyond federal requirements. For instance, Massachusetts' Equal Pay Act prohibits gender-based pay discrimination, while New York's law extends coverage to additional protected characteristics. These laws may also impose specific audit obligations.

This proposed legislation aims to strengthen the EPA by requiring employers to prove that wage discrepancies are tied to legitimate business qualifications and not gender. It also seeks to prohibit companies from retaliating against employees who raise concerns about gender-based wage discrimination.

Employers with 100 or more employees must submit annual EEO-1 reports, which include W-2 pay and hours worked data. The Equal Employment Opportunity Commission (EEOC) uses this data to investigate pay practices and identify potential disparities.

Federal contractors are subject to additional regulations, including directives from the Office of Federal Contract Compliance Programs (OFCCP). These directives promote the use of pay equity audits to identify and address barriers to equal pay.

When conducting a pay equity audit, it's important to ensure that the process is legally privileged to protect against potential legal challenges. Additionally, safeguarding employee data is important to comply with privacy regulations and maintain trust.

Also Read: What is a Pay Equity Software? Why Do You Need One?

By matching your audit process with these legal frameworks, you can mitigate risks and promote fair compensation practices within your organization.

CompUp offers a suite of tools designed to support your organization's pay equity audit and equity compensation initiatives. Here's how it can assist you:

Establish clear compensation ranges across functions and levels, providing a transparent framework for equitable pay decisions.

Model various compensation scenarios to understand the financial implications of different pay structures, aiding in informed decision-making.

Analyze compensation data to identify disparities and develop strategies to address them, promoting fairness across your organization.

Access real-time market data to ensure your compensation packages remain competitive and aligned with industry standards.

Use customizable dashboards to gain insights into compensation trends, aiding in data-driven decision-making.

By integrating these features, CompUp supports your efforts in conducting thorough pay equity audits and managing equity compensation effectively.

Conducting a pay equity audit is a proactive step toward ensuring fairness in your organization's compensation practices. By identifying and addressing wage disparities, you not only comply with equal pay laws but also enhance employee trust and morale. Regular audits can reveal hidden financial risks, such as potential litigation costs and employee turnover, which can impact your organization's bottom line.

Moreover, a well-executed audit provides insights into your compensation structure, allowing for informed decisions that align with your organization's values and goals. Taking action based on audit findings demonstrates a commitment to equity and can improve your organization's reputation, making it more attractive to current and prospective employees.

CompUp is a compensation management trusted by over 200 global brands, including Cipla, Meesho, and Porter. It offers advanced tools for pay equity analysis, compensation planning, and real-time benchmarking, helping organizations identify and address wage disparities.

With a top rating of 4.9 out of 5 on G2, CompUp stands out among 90+ global solutions for its customizable features and user-friendly interface. By integrating CompUp into your compensation strategy, you can make informed decisions that align with your organization's values and goals. Schedule a free demo today.

1. Can a pay equity audit backfire or increase legal risk?

Yes, if not handled properly. While audits help identify pay gaps, they also help identify mishandling of the findings. Failing to act on them or disclosing them carelessly can lead to legal or reputational trouble. To minimize this, involve legal counsel early and consider conducting the audit under attorney-client privilege.

2. How do you account for performance-based pay without masking inequities?

You need clear, documented criteria for performance evaluations. Without objective standards, performance-based pay can unintentionally reflect bias. During the audit, compare compensation alongside performance ratings to see if disparities persist even when performance is similar.

3. Should part-time and contract workers be included in the audit?

Often overlooked, but yes, especially if they perform similar work to full-time employees. Excluding them can hide gaps and paint an incomplete picture. Include them with clear job matching and compensation data to assess equity across all worker types.

4. What if your data is incomplete or inconsistent?

Missing or messy data can stall your audit. Start by prioritizing data hygiene, standardizing job titles, pay components, and demographic info. Use this as an opportunity to improve your HRIS systems and build stronger data practices before running the analysis.

5. Can internal transparency about the audit backfire with employees?

Transparency builds trust, but oversharing can lead to misunderstandings or dissatisfaction if not carefully managed. Share high-level goals, progress, and actions, and avoid disclosing sensitive individual or group-level data unless necessary.

Customer Success Manager - Team Lead

Led by a vision to transform the landscape of total rewards with an innovative mindset and technological advancements.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking