Waiting for payday can be stressful, especially when unexpected bills come up. For many workers, the gap between earning their wages and actually using them leads to short-term borrowing, overdraft fees, or credit card debt. It’s a cycle that’s tough to break and even harder to manage when living paycheck to paycheck.

Earned Wage Access (EWA) offers a different path. It allows employees to access some of their earned wages before the usual payday, helping them cover day-to-day expenses without turning to high-interest options. 32% of EWA users report it helped them avoid a bank overdraft, and 75% access wages at least weekly.

However, with new possibilities come new questions for both employers and employees. What’s allowed? What’s not? And how are these services regulated?

This blog discusses EWA, how it works, and the current rules shaping its use across different regions.

Key Takeaways

Earned Wage Access gives employees the option to withdraw a portion of their already-earned wages before the usual payday. It’s not a loan, there’s no interest, no debt, and no borrowing involved. The amount made available is based on actual hours worked or tasks completed.

This approach helps workers manage short-term expenses using income they’ve already earned. It can also reduce the need for advances or high-cost lending options.

EWA helps smooth cash flow, reduce reliance on costly credit, and boost job satisfaction.

EWA works best when fees are transparent, withdrawals are reasonable, and usage is disciplined. With evolving legal frameworks and growing adoption, it's poised to remain a valuable option for many workers.

Now that the concept is clear, let’s examine why some employers and employees find this option appealing.

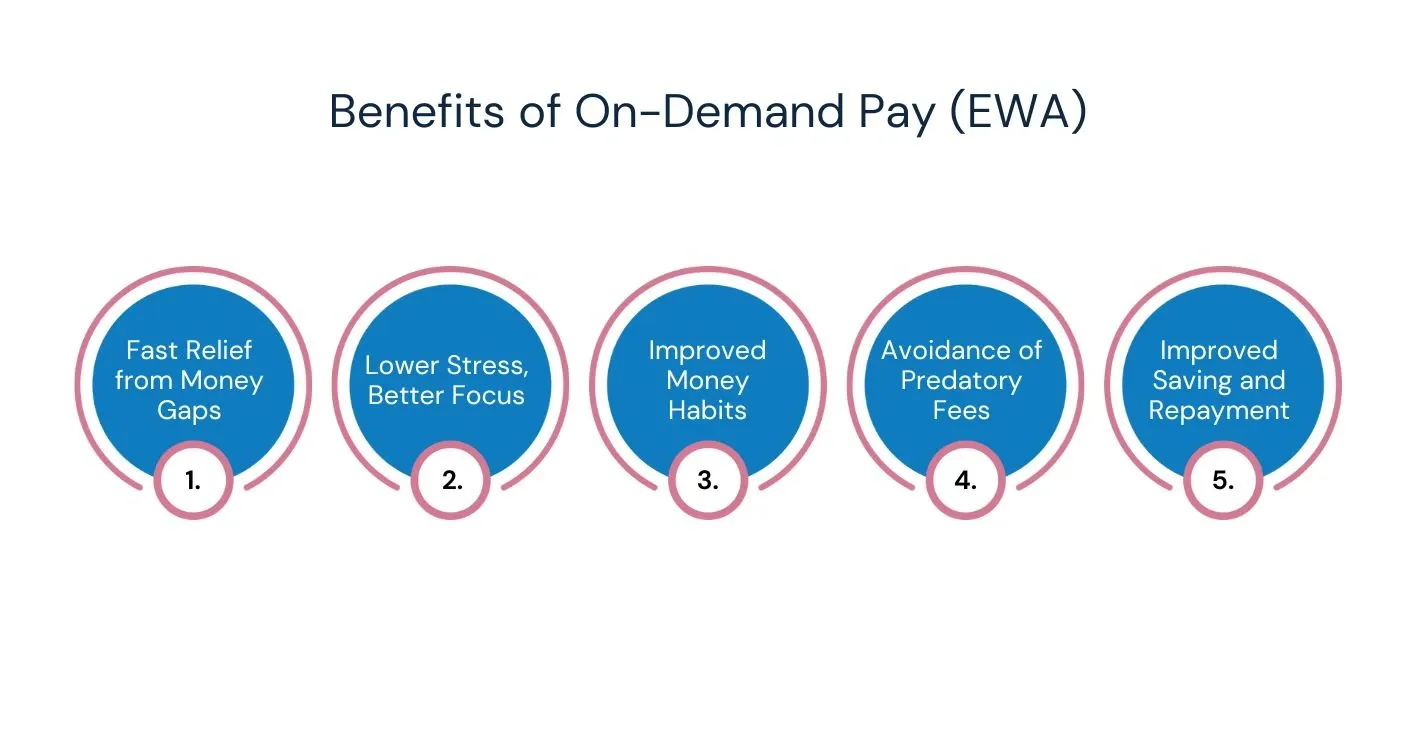

Earned Wage Access offers workers a practical financial cushion, improving their daily lives and money habits. At the same time, workplaces gain more engaged, stable teams and reduce HR strain, all while standing out during recruitment.

Earned Wage Access (EWA) gives employees instant access to their earned wages and reduces reliance on high-interest loans. It supports better budgeting and greater economic control for the employees.

Accessing pay as soon as it's earned helps cover urgent expenses, such as groceries and auto repairs, without resorting to credit cards or payday loans.

Financial peace of mind improves sleep and well-being. Stress reduces after EWA is introduced.

With the ability to withdraw pay gradually, users become more aware of their earning and spending patterns, leading to wiser financial choices.

A modest flat fee for this service often helps users sidestep expensive overdraft charges or high APR credit options.

Studies reveal that 67% reduce credit card debt, and 57% contribute to savings monthly.

Earned Wage Access boosts employee retention, satisfaction, and productivity by reducing financial stress. It also strengthens recruitment efforts and minimizes payroll-related administrative burdens.

Employers who offer EWA often see increased job satisfaction and improved employee perception of the workplace

Companies report an improvement of up to 63% in employee retention rate after introducing EWA.

EWA helps employees deal with emergencies without skipping work, with lower absentee rates and more focus on the job.

About 95% of businesses say offering EWA makes them more appealing to candidates.

Automating early-pay requests frees HR and payroll teams from manual advance checks.

When financial strain is lessened, employee well-being improves, which can reduce broader costs linked to health-related absenteeism.

EWA is a straightforward tool that helps employees manage finances better and remain present at work while giving employers happier, more committed teams. Its dual benefits make it a win-win addition for modern workplaces focused on wellbeing and retention.

So, how is early access to wages made possible? Here’s a breakdown of how the process usually works.

EWA involves tracking earned wages, providing access ahead of payday using provider funding, and deducting the amount on payday while managing usage through limits and protections.

EWA providers connect directly with employers’ payroll, HR, or time‑tracking systems via secure APIs. This lets them track real-time hours worked and wages earned while applying limits, often a fixed percentage of net pay, to protect against over-access.

Providers front the money using their own capital or credit facilities. Employees can access earned wages without waiting for payroll to post or incur a loan.

Employees view available earnings through an app or portal and request a payout. Funds can be deposited into their bank account, a prepaid/payroll card, or a provider’s settlement account, either instantly (with a small fee) or by the next business day.

On the next payday, employers deposit wages as usual but deduct the early access amount, plus any fee, and forward it to the provider. This clearing ensures employees receive precisely what they’ve already earned.

Caps may be set per paycheck (e.g., a percentage of net earnings), per day, or per period. Providers often impose limits on frequency, like one or two requests per pay cycle, to prevent excessive use.

Integrated platforms handle sensitive payroll and banking data under strict protocols. Providers typically offer encrypted data transfer and secure authentication and comply with financial privacy and labor regulations.

This model gives employees flexible access to their wages without creating debt or disrupting payroll. It’s built on automated tracking, secure integration, disciplined limits, and transparent reconciliation to serve users and employers well.

Now, the next step is putting the system into place. Here's how that might unfold.

A thoughtful rollout starts with understanding real staff needs. It progresses through a reliable tech setup, cautious initial testing, clear communication, ongoing measurement, and staff education, not a hasty, 'set and forget' adoption.

Use surveys or focus groups to identify financial pain points, banking access, payment schedules, and literacy gaps, and shape your design around real concerns.

Choose a provider that matches your payroll setup (small business vs enterprise), supports secure API connections, and offers transparent reporting and live support.

Confirm the provider follows applicable rules, such as FPCA guidelines in the U.S. or India’s Payment of Wages Act, and offers reports or registration details showing consent, fee disclosure, and wage advance limits.

Start with a subset of staff (e.g., 50 employees) to test technical flow, update policies, detect issues with hourly payroll entries or benefits deductions, and gather early feedback.

Map out current payroll and banking workflows. Your provider’s team should connect securely, support real-time wage tracking and set automatic payday deductions without manual intervention.

Hold targeted training so internal teams grasp compliance standards, usage limits, security measures, and how to troubleshoot typical issues like PTO handling.

Announce the benefit via emails, meetings, and app tutorials. Include FAQs on fees, caps (e.g., percentage per pay cycle), payday deductions, and non-loan nature; highlight financial wellness tools.

Offer budgeting modules, usage reminders, and resources within the app or during orientation to help employees avoid overuse or repeated withdrawals.

Use dashboard analytics to track usage rate, frequency, and caps reached. Collect staff feedback periodically. Adjust caps, update policies, and plan for wider rollout or deeper integration.

Provider support should be on call for technical needs. Occasionally, stakeholders should be re-trained, compliance measures should be audited, and communications should be updated whenever rules or payment systems change.

Launching early wage access demands solid groundwork: choosing the right partner, running a pilot, integrating carefully, training teams, educating employees, and tracking results. When done thoughtfully, it offers practical pay support without disrupting payroll or trapping users in a cycle of advance requests.

CompUp gives HR and finance teams clear, real-time insights into compensation costs, planning, and adoption across departments. Compensation planning and budgeting tools used by over 200 companies help finance and HR stay coordinated without slowing down payroll cycles. CompUp offers the precision needed to run pilots, spot risks, and refine policies at scale.

While the setup may seem straightforward, EWA has several types. Let’s examine EWA's four types.

Earned Wage Access (EWA) can be delivered through different models, depending on how the service is set up and how it interacts with payroll systems. While all models aim to give employees early access to wages they've already earned, the method of delivery, fees, and level of employer involvement may vary.

This approach connects directly with the employer’s payroll system. Employees request a portion of their earned wages, which is then disbursed through a bank transfer or payroll card. The amount is automatically adjusted in the next paycheck.

Some payroll software platforms now include EWA as part of their standard offering. Employees use the same system they already access for time-tracking or payslips, making wage access part of their existing workflow.

Employees receive a prepaid or payroll card linked to their earned wages. They can withdraw money or use the card for purchases. The card is usually issued by a financial partner or EWA provider.

Independent apps allow users to access earned income without any connection to an employer. These apps assess earnings using timesheet data or estimates and recover the disbursed amount directly from the user’s bank account after payday.

EWA models differ in how they handle access, disbursement, and repayment, but they all provide a way for workers to use their earned wages before payday. Employers may choose a model that fits their payroll process, while workers benefit from more flexible access to their income.

With these several types of EWA, it’s also important to be aware of legal and policy-related factors.

Choosing the right provider can shape how well EWA serves your team. Here are some points worth considering.

Top-tier providers pair trust and security with flexible disbursement and transparent pricing. They make setup easy and hard to misuse, safeguarding payroll integrity and employee finances.

Look for providers certified under official standards in the UK, the Earned Wage Access Code of Practice, in the U.S., compliant with CFPB/TILA guidance, ensuring fair practices, full disclosure of fees, and protection from hidden charges.

A robust provider will maintain SOC 2 Type II or ISO 27001 certifications, encrypt sensitive data, and follow secure integration practices, avoiding direct access to employee bank accounts.

Reliable providers connect seamlessly with payroll, timekeeping, and HR systems through APIs. These should allow automated and manual reconciliation without disrupting payroll, asking for escrow accounts, or pre-funding.

Ideal providers offer multiple payout methods, ACH to existing bank accounts, prepaid cards, and even gift or gas cards, often with a no-fee delay option and optional small transfer fees.

Fee structures should be flat and transparent, akin to ATM charges. Avoid providers that rely on opaque “tip” systems or hidden subscription fees, which may mask highly effective APRs.

Providers should include built-in caps per check, per day, and per cycle and encourage responsible use through in-app education, avoiding the risks of overdraft or dependency cycles.

Fast activation, typically under a day, intuitive interfaces for employees and HR, plus employer dashboards or analytics, reduce friction and support ongoing adoption.

Prioritize vendors offering real-time help, dedicated success managers, assistance with rollout, and promotion of the service to staff.

To reduce employer risk, opt for vendor-funded models, in which the provider advances payments and recoups through payroll deductions, avoiding escrow or employer-financed fronting.

Choosing the right EWA provider means selecting one with strong credentials, secure infrastructure, easy integration, fair pricing, and helpful tools. These features protect organizations from regulatory pitfalls while offering workers dependable access to their earnings.

If you’re considering EWA, here’s how CompUp can make that step more manageable.

CompUp makes it easier for employers to offer on-demand access to wages, without adding complexity to payroll or HR workflows. Here's how CompUp can assist:

CompUp brings pay access, analytics, and workforce data into one system, helping teams support employee needs while keeping operations simple.

Earned Wage Access (EWA) offers workers more control over when they get paid, which can help reduce stress during tight financial periods. It presents a way for employers to support their workforce without changing payroll schedules.

Still, offering EWA means knowing local rules and being careful with how the service is presented and used. It’s not a one-size-fits-all solution, but when approached thoughtfully, it can bring more flexibility to how people manage their money and how businesses support their teams.

CompUp helps companies offer timely, transparent pay experiences through tools like equity analysis, offer communication, and pay benchmarking. Over 200+ businesses, including Meesho and Navi, rely on CompUp to manage over 50% of their workforce-related costs. With a G2 rating of 4.9, the platform supports smarter decisions across hiring, budgeting, and rewards without adding admin overhead. Get CompUp today.

1. Can Earned Wage Access lead to employees taking home less in the long run?

Yes. If employees frequently tap into their wages early, they may have little or nothing left on payday. This can lead to budgeting issues and create a hard-to-break cycle of early withdrawals.

2. Are employers legally responsible if an EWA provider mishandles payroll data?

Even when using third-party EWA platforms, employers may still face questions from regulators or employees if something goes wrong, especially if there's confusion about how wages are tracked or released.

3. Does offering EWA affect how taxes are reported or withheld?

Not always directly, but it depends on how the provider is set up. If wages are considered “paid” when accessed, this can impact payroll cycles, tax timing, and accounting entries, which many employers initially overlook.

4. How does Earned Wage Access interact with garnishments or deductions?

Sometimes, wage garnishments or mandatory deductions may not be applied correctly if wages are accessed before the regular payday. This can lead to legal trouble or payment delays for obligations like child support.

5. Are there rules around how often employees can access their earned wages?

Some regions are starting to regulate how frequently early access is allowed to prevent misuse or overdependence. There may be limits on the number of withdrawals per pay period or restrictions on fees, even if the employer isn't directly charging.

Co-founder & CEO, CompUp

Anurag Dixit, founder of CompUp, is a seasoned expert in all things compensation and total rewards. With a deep understanding of the current compensation trends, his vision is to help companies create fair, transparent, and effective compensation strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking