Equity compensation offers you a stake in your company's future, matching your interests with its performance. Instead of solely receiving a salary, you might be granted stock options, restricted stock units (RSUs), or participate in an employee stock purchase plan (ESPP). These forms of compensation can provide financial benefits if the company's value increases, but they also come with complications that require careful consideration.

72% of organizations reported that having an equity compensation plan provides them with a competitive edge during the hiring process. Additionally, 84% of companies introduced equity plans to align employee objectives with those of the company and its stakeholders. Each equity compensation type, be it stock options, RSUs, or ESPPs, has its own set of rules, tax implications, and potential rewards.

This blog aims to provide clarity on the various aspects of equity compensation, helping you navigate the opportunities and responsibilities that come with it.

Equity compensation is a non-cash benefit that grants you ownership of the company you work for. This form of compensation includes instruments like stock options, restricted stock units (RSUs), and employee stock purchase plans (ESPPs), providing you with a share in the company's potential growth and success. By receiving equity, your financial interests become aligned with the company's performance, offering the possibility of financial gains if the company's value increases.

Understanding the structure of equity compensation plans is crucial. These plans typically involve:

Companies offer equity compensation to align your financial interests with the company's performance. This approach encourages you to contribute to the company's growth, as your potential financial gain is directly tied to its success. By granting equity, companies aim to motivate you to work towards shared goals.

Equity compensation also serves as a strategic tool for attracting and retaining talent. Startups and companies with limited cash flow often use equity to offer competitive compensation packages without immediate cash expenditures. This method enables them to conserve cash for operational needs while still providing valuable incentives to employees.

Additionally, equity compensation can enhance employee engagement by providing a tangible stake in the company's future. This sense of participation can lead to increased productivity and a stronger connection to the company's mission and objectives.

Equity compensation is offered to align employee and company interests, attract and retain talent, manage cash flow, and boost employee engagement.

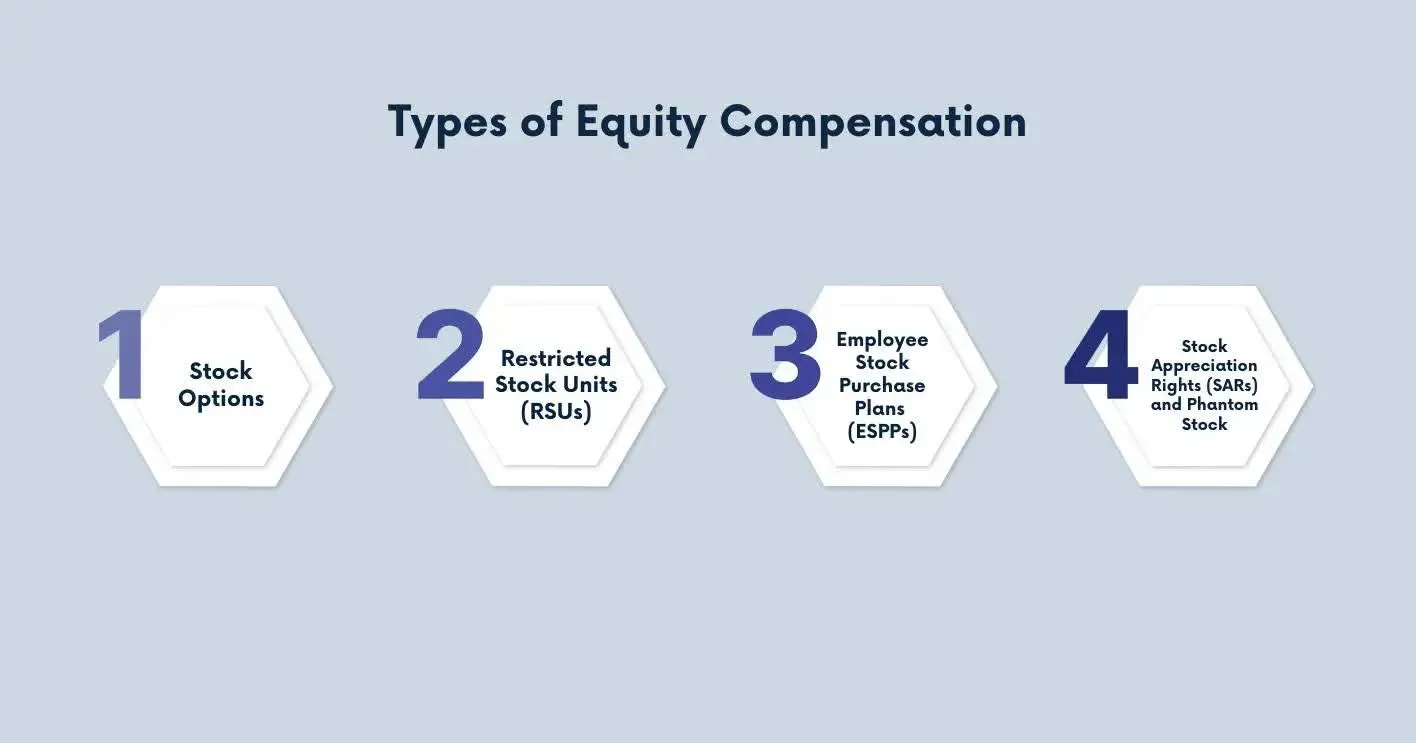

Equity compensation offers various forms of ownership or value tied to your company's stock. Understanding the different types can help you make informed decisions about your compensation package.

Stock options grant you the right to purchase company shares at a predetermined price, known as the strike price, after a specific vesting period. There are two primary types:

RSUs are company shares promised to you, which you receive after meeting certain vesting criteria, such as continued employment or performance goals. Unlike stock options, RSUs do not require you to purchase the shares; they are delivered to you once vested.

ESPPs allow you to purchase company stock at a discount, often up to 15%, through payroll deductions over a set offering period. Some plans offer a "look-back" feature, applying the discount to the stock's price at the beginning or end of the offering period, whichever is lower.

Each type of equity compensation has its features, tax implications, and potential benefits. These differences can help you make choices that align with your financial goals and risk tolerance.

Equity compensation grants you a stake in your company's future, offering potential financial rewards tied to its performance. The mechanics can help you make informed decisions about your compensation package.

When you're offered equity compensation, you're granted rights to a specific number of shares or units. However, you don't own them outright immediately. Instead, they become yours over time through a process called vesting.

For example, a four-year graded vesting schedule might grant you 25% of your shares each year. If you leave the company before full vesting, you forfeit the unvested portion.

Once your equity has vested, the next steps depend on the type:

Deciding when to exercise options or sell shares involves considering market conditions, personal financial goals, and tax implications.

Equity compensation has specific tax treatments:

These tax implications can help you plan effectively and avoid unexpected liabilities.

By grasping how equity compensation works, from grant to vesting, exercising, and taxation, you can better control your benefits and align them with your financial objectives.

Equity compensation can offer you several advantages that extend beyond a traditional salary.

If your company's value increases, the equity you've been granted—such as stock options or restricted stock units, may appreciate, potentially leading to financial gains. This can be particularly impactful if you're part of a growing company or a startup.

Holding equity means your financial outcomes are tied to the company's performance. This alignment can motivate you to contribute to the company's growth and success, knowing that your efforts may directly influence your financial rewards.

Being an equity holder can instill a sense of ownership, encouraging you to think and act in the company's best interest. This perspective can enhance collaboration and commitment within the organization.

Equity compensation often comes with vesting schedules, meaning you earn your equity over time. This structure can incentivize you to stay with the company longer to fully realize the benefits of your equity grants.

Certain equity compensation plans may offer tax advantages. For example, specific types of stock options or employee stock purchase plans might provide favorable tax treatment, depending on how and when you exercise or sell your shares.

Also Read: What is a Pay Equity Software? Why Do You Need One?

These benefits can help you make informed decisions about your compensation and how it fits into your overall financial planning.

Equity compensation can significantly impact your tax obligations. The tax treatment varies based on the type of equity you receive and the actions you take.

Knowing the tax implications of your equity compensation is crucial for effective financial planning. Consulting with a tax advisor can help you handle these complexities and make informed decisions.

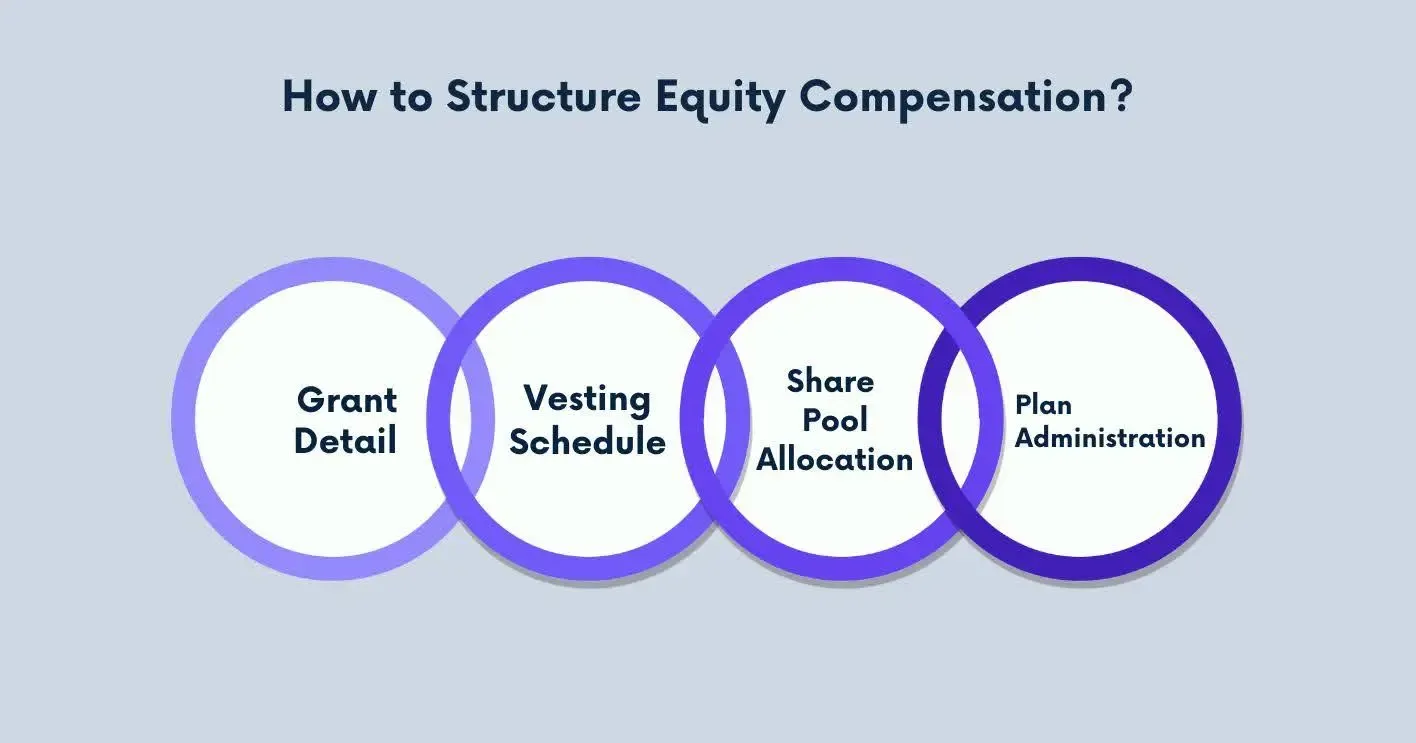

Structuring equity compensation involves several key elements that define how you receive, earn, and benefit from equity awards.

Your equity compensation begins with a grant, which specifies:

These details are outlined in your equity grant agreement.

Vesting determines when you gain ownership of your equity awards. Common vesting schedules include:

Understanding your vesting schedule is crucial, as unvested equity is typically forfeited if you leave the company before it vests.

Companies allocate a portion of their total shares to an equity compensation pool. This pool is used to grant equity to employees and is typically sized to cover several years of anticipated grants. The size of the pool can impact the value of your equity, as it affects the dilution of existing shares.

An equity compensation plan outlines the rules and procedures for granting and managing equity awards. This includes:

Reviewing the plan documents can provide clarity on how your equity compensation is structured.

By these components, you can better assess and manage your equity compensation, matching it with your financial goals and career plans.

Accepting equity as part of your compensation package doesn't automatically mean you'll earn a lower salary. Instead, it often reflects a trade-off between immediate cash and potential future gains.

Startups and growth-stage companies frequently use equity compensation to attract talent when cash flow is limited. By offering stock options or restricted stock units (RSUs), they provide you with a stake in the company's future success, aligning your interests with the organization's long-term goals. This approach can be particularly appealing if you believe in the company's mission and growth potential.

Equity compensation can be lucrative, but its value is tied to the company's performance and future valuation. If the company thrives, your equity could be worth more than the salary you might have received elsewhere. However, there's also the risk that the company's value doesn't increase as expected, which could impact the worth of your equity.

When considering an equity offer, evaluate:

By carefully weighing these factors, you can determine whether accepting equity as part of your compensation aligns with your financial goals and risk tolerance.

When considering equity compensation, it's important to understand the potential challenges and factors that may impact its value and effectiveness:

Equity compensation's value is tied to the company's performance and market conditions. In private companies, shares are not easily sold, making it difficult to convert equity into cash when needed. Public companies also face market fluctuations that can affect stock value. For instance, the sudden dismissal and rehiring of OpenAI's CEO led to significant changes in the company's valuation, highlighting the volatility in private markets.

Issuing new shares to employees can dilute existing shareholders' ownership percentages, potentially affecting decision-making control and earnings per share. Companies must balance offering competitive equity incentives with maintaining shareholder value.

Different types of equity compensation, such as Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs), have varying tax treatments. NSOs are taxed as ordinary income upon exercise, while ISOs may qualify for capital gains tax if certain conditions are met. Understanding these implications is crucial to avoid unexpected tax liabilities.

Equity compensation often includes vesting schedules, requiring employees to stay with the company for a certain period before gaining full ownership. Leaving the company before full vesting can result in forfeiting unvested shares. Companies may implement graded or cliff vesting to align employee retention with company goals.

Managing equity compensation plans involves navigating regulatory compliance, maintaining accurate records, and ensuring transparent communication with employees. Failure to do so can lead to legal challenges and employee dissatisfaction.

These challenges helps in making informed decisions about accepting equity as part of your compensation package.

To maximize the benefits of your equity compensation, consider the following strategies:

For Incentive Stock Options (ISOs), holding shares for at least one year after exercise and two years after the grant date can qualify you for long-term capital gains tax rates. Non-Qualified Stock Options (NSOs) are taxed as ordinary income upon exercise, with any subsequent gains taxed as capital gains upon sale.

Exercise Methods:

Early Exercise: Exercising options early can start the holding period sooner, potentially qualifying for favorable tax treatment.

Different equity compensation types have varying tax treatments. For example, ISOs may be subject to the Alternative Minimum Tax (AMT) if certain conditions aren't met.

Strategic Planning:

Determine how your equity compensation fits into your broader financial plan, whether it's saving for retirement, purchasing a home, or funding education.

Also Read: Steps to Conduct a Pay Equity Analysis and Gender Pay Gap …

By thoughtfully managing your equity compensation, you can improve its value and better match it with your financial aspirations.

CompUp offers a comprehensive platform designed to assist you in managing equity compensation effectively. Here's how it can support your journey:

Gain insights into industry standards with CompUp's real-time salary and benefits benchmarking tools. This feature enables you to compare your equity compensation against market trends, helping you make decisions about your compensation package.

Understand the full value of your compensation through personalized Total Rewards Letters. These documents provide a clear breakdown of your salary, benefits, and equity components, offering a comprehensive view of your total compensation.

CompUp's pay equity management tools help ensure fairness in compensation across the organization. By analyzing compensation data, you can identify and address any disparities, promoting a more equitable workplace.

Use CompUp's compensation planning features to model various compensation scenarios. This allows you to assess the potential impact of different equity compensation structures and make strategic decisions aligned with your financial goals.

By using these features, you can handle equity compensation with greater confidence and clarity.

Equity compensation can be a valuable component of your overall remuneration, offering the potential for significant financial rewards if your company performs well. However, it's important to understand the complexities and potential risks involved.

Familiarize yourself with different forms of equity compensation, such as stock options, restricted stock units (RSUs), and employee stock purchase plans (ESPPs). Each has its vesting schedules, tax implications, and potential benefits. Consider how equity compensation fits into your broader financial objectives and risk tolerance. The potential for high returns comes with the risk of stock price volatility and company performance.

CompUp is a compensation management platform trusted by over 200 global brands, offering tools to navigate the complexities of equity compensation. With a 4.9 rating on G2, it provides real-time salary benchmarking, pay equity analysis, and automated workflows to help you make informed decisions about your compensation package.

Features like Total Rewards Communication and Compensation Planning enable a comprehensive view of your remuneration, aligning it with your financial goals and ensuring transparency in equity offerings. By utilizing CompUp's analytics and planning tools, you can better understand the value of your equity compensation and how it fits into your overall financial strategy. Schedule a free demo today.

1. What happens to my equity compensation if the company is acquired?

If your company is acquired, your unvested shares may be accelerated (vest sooner), canceled, or converted into new shares of the acquiring company. The outcome depends on your grant agreement and the terms negotiated in the acquisition. Always review your plan documents for specific clauses around the change of control.

2. Can I negotiate the type of equity I receive?

Yes, in some cases. While companies often offer standard equity packages, especially at early-stage startups, there's sometimes flexibility. You might ask to trade some options for RSUs or request additional equity if the cash salary is lower than expected. How much room there is depends on the company’s stage, policy, and your role.

3. What happens to vested options if I leave the company?

Once you leave, you typically have a limited window, often 90 days, to exercise your vested options. If you don’t act within that period, you could lose them. However, some companies are starting to extend this window, especially for long-term employees. Check your stock option agreement for the specific expiration terms.

4. Can I sell private company shares before an IPO?

It’s possible but not always easy. Some private companies allow secondary sales during specific windows or approve transfers to outside investors. Others restrict sales altogether. If your company uses a platform like Carta or has held a tender offer, you might have limited liquidity options. You’ll need company approval in most cases.

5. Does accepting equity affect my unemployment benefits if I’m laid off?

Equity itself doesn’t count as income unless you sell or exercise it. However, severance packages that include equity or cash-out clauses might impact eligibility, depending on state law. If you’re laid off, speak with an employment attorney or your state’s unemployment office to see how your specific situation could be affected.

Co-founder & CEO, CompUp

Anurag Dixit, founder of CompUp, is a seasoned expert in all things compensation and total rewards. With a deep understanding of the current compensation trends, his vision is to help companies create fair, transparent, and effective compensation strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking