Compensation is one of the biggest investments your organization makes in its people. The U.S. Bureau of Labor Statistics finds that employee compensation accounts for approximately 70% of what businesses spend to run their operations. This huge expense makes getting compensation right essential for both financial sustainability and business success.

The importance extends beyond company budgets to employee satisfaction and retention. Glassdoor research found that 67% of job seekers ranked pay and benefits among their top priorities when deciding whether to accept a position. The connection between pay and workplace happiness is even stronger, with studies showing that 96% of workers say their pay directly affects how satisfied they feel about their job.

These findings show why compensation planning is so important for businesses. Not implementing it properly affects everything from talent acquisition to employee retention to your company’s growth.

In this guide, you’ll get a full breakdown of compensation 101, along with its key components, different models, and steps to build an effective compensation strategy. Let’s get started!

Compensation 101 is the foundation of understanding how organizations structure, plan, and manage employee pay. It covers the basic principles that guide fair and competitive compensation practices.

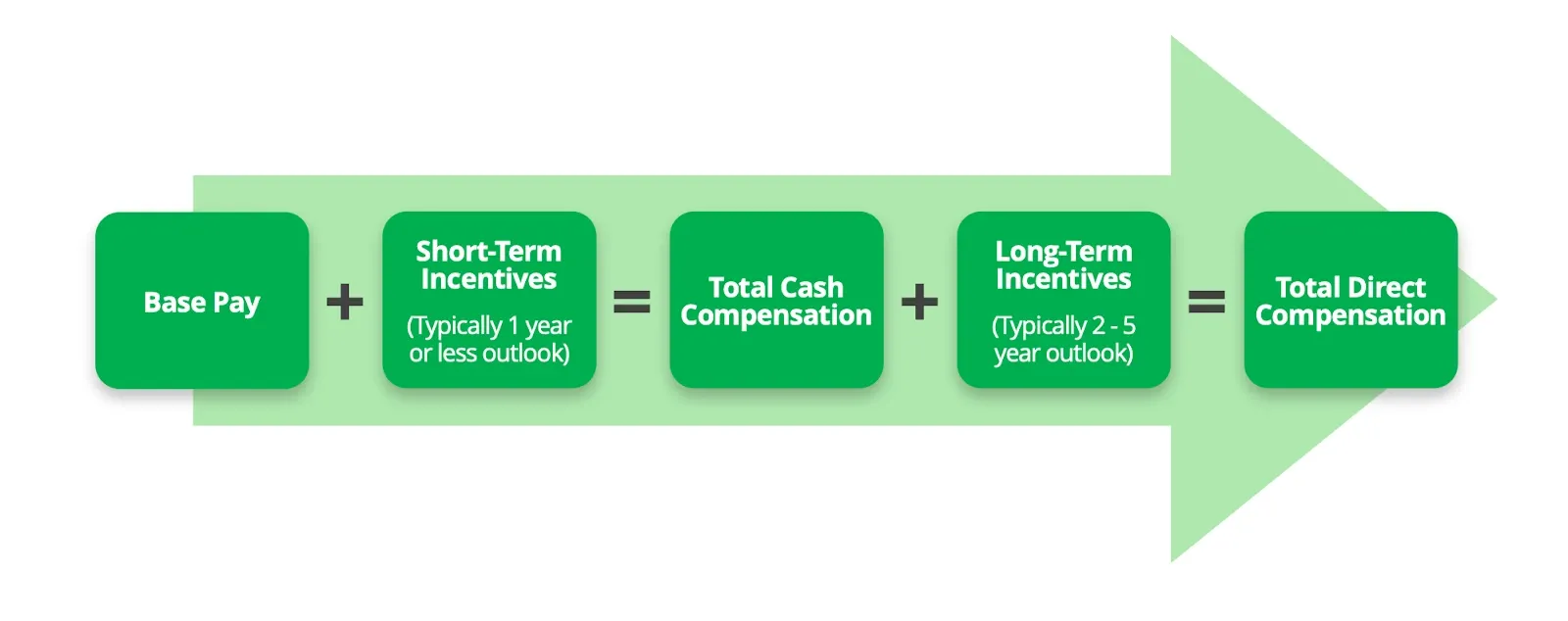

Essentially, it includes base salary, bonuses, benefits, equity, and other rewards that make up your total rewards proposition. For HR teams and compensation professionals, mastering these fundamentals helps you create pay systems that attract talent, retain top performers, and support business goals. Getting compensation right from the start prevents costly mistakes and builds trust with your workforce.

Now let's explore why compensation planning deserves your focused attention and resources.

Compensation planning directly impacts your ability to hire, motivate, and keep the people who drive business success. Without a clear compensation strategy, organizations struggle with pay inconsistencies, budget overruns, and employee retention challenges that hurt long-term growth.

Here's what effective compensation planning accomplishes for your organization:

These benefits work together to create a compensation system that supports both employee satisfaction and business objectives.

Understanding what makes up a compensation package helps you design more effective reward systems.

Every compensation package consists of several interconnected elements that work together to create your total rewards package. Understanding these components helps you design balanced compensation that meets diverse employee needs while staying within budget constraints.

Here are the main compensation components most organizations include:

The key is balancing these components based on your industry, company stage, and employee preferences. Tech companies might emphasize equity, while established corporations often focus on comprehensive benefits packages. Your compensation mix should reflect what matters most to your target talent pool.

Understanding the mathematical foundations behind compensation decisions can strengthen your planning process. You can check out this in-depth guide from the Economic Research Institute that covers industry-standard formulas for calculating pay ranges and adjustments.

Consider how each component serves different employee motivations. Some value immediate cash rewards, while others prioritize long-term financial security or work-life balance perks.

Now, choosing the right compensation structure depends on understanding the different approaches available to you.

Different organizations use different approaches to structure their compensation programs based on their industry, company culture, and business goals. Understanding these models helps you choose the right framework for your organization's needs and employee expectations.

The most common salary structuring types include these proven approaches:

Looking for in-depth insights on appraisal planning and merit cycles? CompUp's interactive sessions offer practical guidance on optimizing your compensation planning process. Explore our latest webinars for expert tips on salary bands and employee evaluation strategies.

Each structure has trade-offs between simplicity, flexibility, and administrative complexity that you'll need to weigh against your organizational priorities.

Beyond choosing the right structure, you also need to make sure your compensation practices follow all the rules and regulations.

Compensation decisions must align with federal, state, and local laws that protect employee rights and promote fair pay practices. Understanding these regulations help you avoid costly violations while building trust with your workforce through transparent and equitable compensation policies.

Most states now require employers to demonstrate that pay differences between employees are based on legitimate business factors like experience, education, and performance rather than protected characteristics. These laws require regular pay audits to identify and correct any unexplained wage gaps between similar roles.

The Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime requirements that form the foundation of U.S. compensation law. Federal and state minimum wage laws set the floor for employee compensation, with many jurisdictions requiring higher rates than the federal standard. Overtime rules determine when you must pay extra rates for non-exempt employees who work more than the standard work week.

Many states now require employers to include salary ranges in job postings and provide pay information to current employees upon request. These laws aim to reduce pay disparities by giving job seekers and employees better information about compensation expectations.

Employee benefits must comply with regulations like the Affordable Care Act for health insurance and ERISA for retirement plans. The Family and Medical Leave Act (FMLA) provides eligible employees with unpaid, job-protected leave for family and medical reasons. Paid leave requirements vary significantly by location, with some areas mandating sick leave, family leave, or general paid time off beyond FMLA protections.

Employment laws require maintaining detailed records of compensation decisions, including job descriptions, performance evaluations, and pay change justifications. These records become crucial during audits or legal disputes about pay practices.

Getting compliance right protects your organization while supporting fair treatment of all employees. Now let’s explore how you can effectively implement a compensation strategy.

Creating an effective compensation management strategy requires systematic planning that aligns pay practices with business goals and market realities. The process involves research, analysis, and careful decision-making about how you'll structure and manage employee compensation over time.

Follow these essential steps to develop your compensation framework:

Start by collecting salary data from multiple industry-specific compensation surveys, competitor job postings, and salary survey providers like Glassdoor to establish baseline pay ranges for each role in your organization. Focus on roles that are similar in scope and responsibility, not just job titles, since the same title can mean different things at different companies.

Write detailed job descriptions that outline specific responsibilities, required skills, and reporting relationships, then group similar positions to create logical pay relationships between roles. This step helps you understand which jobs should be paid similarly and which deserve higher compensation based on their impact and requirements.

Build salary ranges with minimum, midpoint, and maximum pay levels for each job grade, creating sufficient spread between levels to allow for experience and performance differences while maintaining internal equity. Your midpoint should align with market rates for fully competent performers in each role.

Calculate total compensation costs by multiplying headcount projections by average salaries, then include additional costs for benefits and payroll taxes to determine your complete people budget. Don't forget to add buffer room for merit increases, promotions, and new hires throughout the year.

Create written guidelines that specify how employees move through salary ranges, what triggers pay raises, and who has the authority to approve compensation decisions above defined thresholds. Clear policies help managers make consistent decisions and give employees visibility into how they can advance their compensation.

Plan a structured rollout schedule that includes manager training sessions, employee communication meetings, and system setup to ensure an easy transition to your new compensation structure.

Want to learn more about building effective compensation strategies? CompUp's expert-led discussions provide valuable insights into pay equity and compensation planning best practices. Check out our latest podcasts for real-world guidance from industry professionals.

Remember that the compensation strategy isn't a one-time project. Plan for regular reviews and updates as your business grows and market conditions change. However, it’s also worth looking into some of the common challenges in compensation management and how you can solve them.

Even well-planned compensation programs face ongoing challenges that require active management and continuous problem-solving. Common issues range from budget constraints to keeping pace with rapidly changing market conditions and evolving employee expectations.

Here are the most frequent compensation challenges and their effective solutions:

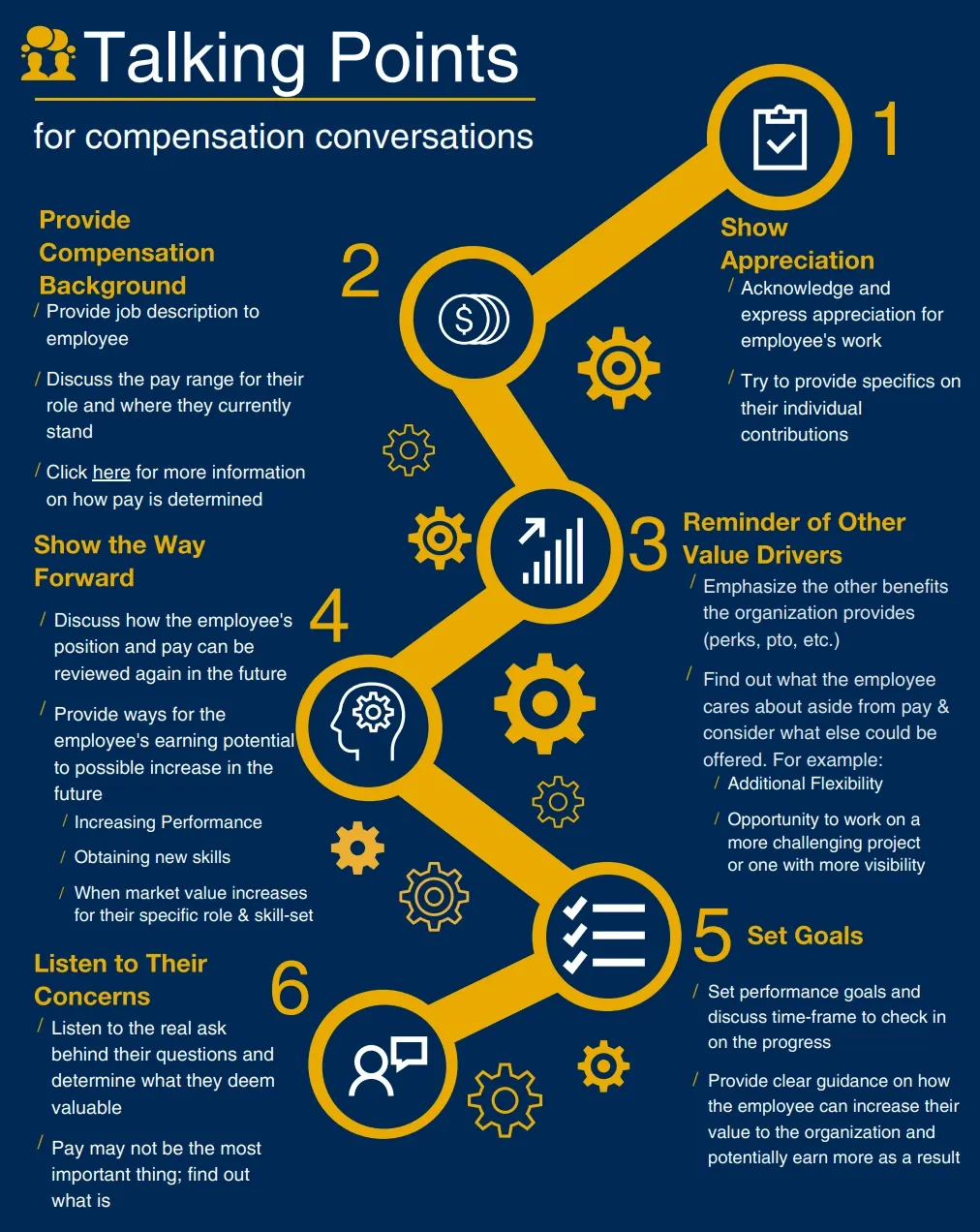

The most successful organizations treat these challenges as ongoing management priorities rather than one-time fixes. Effective communication about compensation topics requires special attention since many managers find these conversations difficult. You can explore these effective tips from West Virginia University for improving compensation conversations with employees.

Now, there are technology solutions that can help you overcome many of these challenges more efficiently.

CompUp is a complete compensation management platform designed specifically for mid to large enterprises looking to modernize their pay practices. The platform replaces manual, spreadsheet-driven processes with automated workflows that ensure fair, data-driven compensation decisions aligned with your company's philosophy and budget constraints.

Here's how its key features help you solve common compensation challenges:

CompUp's automation capabilities save your team hours of manual work while improving accuracy and consistency in compensation decisions. The platform scales with your organization and adapts to different compensation philosophies and structures across departments and locations.

Effective compensation management requires the right combination of strategy, data, and tools to execute fairly and efficiently. While the compensation 101 fundamentals remain consistent, the complexity of modern pay structures requires platforms that can handle the analytical and administrative workload.

CompUp offers the most complete solution for organizations ready to move beyond manual compensation processes. The platform's data-driven approach, automation capabilities, and integration flexibility make it the ideal choice for HR teams focused on building equitable, competitive compensation programs that scale with business growth.

Ready to see how CompUp can improve your compensation management? Schedule your demo today to see how our platform can help you build fair, competitive pay structures that retain top talent.

What is a compensation philosophy, and why is it important?

A compensation philosophy is a formal statement that outlines an organization’s approach to employee pay and rewards. It provides a framework for making consistent decisions about salaries, bonuses, benefits, and incentives. A well-defined philosophy aligns compensation with business objectives, fosters transparency, and helps attract and retain talent.

How often should compensation plans be reviewed?

Compensation plans should be reviewed annually or whenever there are significant changes in the market, company goals, or labor laws. Regular reviews ensure that pay structures remain competitive, fair, and compliant with regulations.

How does compensation management impact employee retention?

Fair and competitive compensation improves job satisfaction, reduces turnover, and strengthens employee loyalty. Transparent pay structures and meaningful rewards demonstrate that the organization values its workforce, which fosters long-term commitment.

What are the risks of not maintaining pay equity?

Failing to ensure pay equity can lead to legal liabilities, reputational damage, and low employee morale. Pay disparities may also result in disengagement, decreased productivity, and higher turnover.

Co-founder & CEO, CompUp

Anurag Dixit, founder of CompUp, is a seasoned expert in all things compensation and total rewards. With a deep understanding of the current compensation trends, his vision is to help companies create fair, transparent, and effective compensation strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking