Fringe benefits are an integral part of modern employee compensation packages, offering added value and security beyond just base salary. According to the U.S. Bureau of Labor Statistics (BLS), as of March 2024, approximately 43% of private industry workers had access to dental benefits, while 60% of state and local government workers were provided with similar perks.

For employers, offering the right fringe benefits package is key to attracting top talent, increasing employee engagement, and promoting a productive work environment. Understanding the importance of these benefits is essential for both employers and employees in today’s developing job market.

In this comprehensive guide, we will explore what fringe benefits are, their types, and how they work, along with their importance for both employees and employers.

Fringe benefits are non-wage perks provided by employers, such as health insurance, bonuses, paid leave, and retirement plans. These benefits add value beyond base salary and influence employee satisfaction and business performance.

With that in mind, let’s look at the different types of fringe benefits organizations typically offer.

Employee fringe benefits can be categorized into mandatory and voluntary benefits. In addition, they can also be classified as taxable or non-taxable based on tax laws. Below, we’ll explore each of these categories in more detail.

Mandatory fringe benefits are those that employers are legally obligated to provide. These benefits provide security to employees against specific risks and support their long-term financial security. Here’s a closer look at these benefits:

Social Security and Medicare contributions are part of the federal programs that provide employees with financial protection in their retirement years or in the event of disability.

These programs are designed to guarantee that employees have some level of financial protection as they age, become ill, or retire.

Workers' compensation insurance is mandatory in most states and provides financial support to employees who are injured while on the job. This benefit includes

Unemployment insurance provides temporary financial assistance to employees who lose their jobs through no fault of their own.

This is an essential safety net that helps protect both employees and employers from financial hardship caused by workplace injuries.

Employers contribute to the unemployment insurance fund, which ensures that employees are not left financially stranded if they lose their job unexpectedly.

The Family and Medical Leave Act (FMLA) mandates that employers with 50 or more employees provide eligible workers with up to 12 weeks of unpaid leave per year for family or medical reasons, including the birth of a child or the care of a seriously ill family member.

This law helps employees manage their personal and family health needs without the fear of losing their jobs. It supports work-life balance and employee retention by giving workers the time they need to handle family emergencies or personal health concerns.

Suggested Read: What Is Payroll Automation & Its Benefits

Unlike mandatory benefits, voluntary fringe benefits are offered at the employer's discretion. While these benefits are not required by law, they provide a competitive advantage for businesses seeking to attract and retain top talent. Here are some common voluntary fringe benefits:

Health insurance is one of the most valued voluntary fringe benefits. Companies may offer:

It’s also important to note that employers often shoulder a significant portion of the insurance premiums. For family coverage, companies in the private sector typically pay about 68% of the premiums, whereas state and local government employers contribute 71%.

Retirement savings plans, such as 401(k) plans, provide employees with a way to save for retirement with tax benefits. Employers may offer matching contributions, which add extra value to the employee's retirement savings.

Paid time off allows employees to take leave for vacation, sickness, or personal reasons while still receiving their regular paycheck. Policies may vary between companies, but they typically include:

PTO is essential for maintaining employee well-being and reducing burnout.

Life insurance and disability insurance are critical voluntary benefits that offer financial security in the event of unexpected circumstances.

These benefits offer peace of mind, knowing that employees and their families are financially protected in the event of unforeseen circumstances.

Fringe benefits are categorized as either taxable or non-taxable for tax purposes.

Employees should be aware of which benefits are taxable, as this will impact their overall taxable income. Employers need to track taxable benefits to comply with IRS regulations.

Also Read: Employee Retention Bonus: Benefits and How They Work

In addition to the basic types of fringe benefits, many organizations offer additional perks to further improve employee satisfaction. To optimize your financial planning and reward allocations, CompUp’s Budget Simulation tool allows for precise forecasting, assuring your benefits program aligns with your company’s financial strategy.

Some companies offer employee discounts on their products or services. These discounts can help employees save money and feel more connected to the company’s offerings.

Other perks might include:

These small perks go a long way in increasing employee morale and improving job satisfaction.

Education assistance is a highly sought-after benefit. Employers that offer tuition reimbursement or financial support for further education are investing in their employees' personal and professional growth.

By helping employees pursue higher education or certifications, companies can encourage a more knowledgeable and skilled workforce.

Many employers now offer wellness programs as part of their benefits package. These programs may include:

Moreover, these programs improve employee health, reduce absenteeism, increase productivity, and create a positive work environment.

Flexibility is one of the most desired benefits in today’s workplace. Many companies now offer flexible working arrangements, such as:

These benefits help employees maintain a better work-life balance and can significantly reduce stress.

As we look further, it’s essential to understand the economic impact of fringe benefits on both employers and employees.

Gain a clearer perspective on EPM to improve outcomes. CompUp’s webinars offer practical tips on aligning your compensation practices with performance management strategies.

Fringe benefits have significant economic implications for both employers and the broader economy, besides employees. Employers need to balance the cost of these benefits with their business goals, while employees need to consider the overall value they receive.

Let’s now explore the legal framework that governs how these benefits are regulated.

Suggested Read: What are Earned Wage Access Benefits and Regulations?

In the USA, the provision of fringe benefits is governed by various laws and regulations at the federal, state, and local levels. Employers need to confirm compliance with these laws to avoid potential fines or legal disputes.

Several federal laws govern how fringe benefits are provided to employees. Some of the most important include:

Employers must adhere to these laws to maintain a fair and legally compliant benefits program that meets the needs of their employees.

Let’s examine the growing trends and future directions of fringe benefits in the workplace.

As employee expectations develop and companies strive to stay competitive, the landscape of fringe benefits is continually changing. What was once considered a luxury is now a key component of a comprehensive compensation package.

The future will see companies adopting more innovative, flexible, and personalized benefits packages to cater to the diverse needs of their workforce.

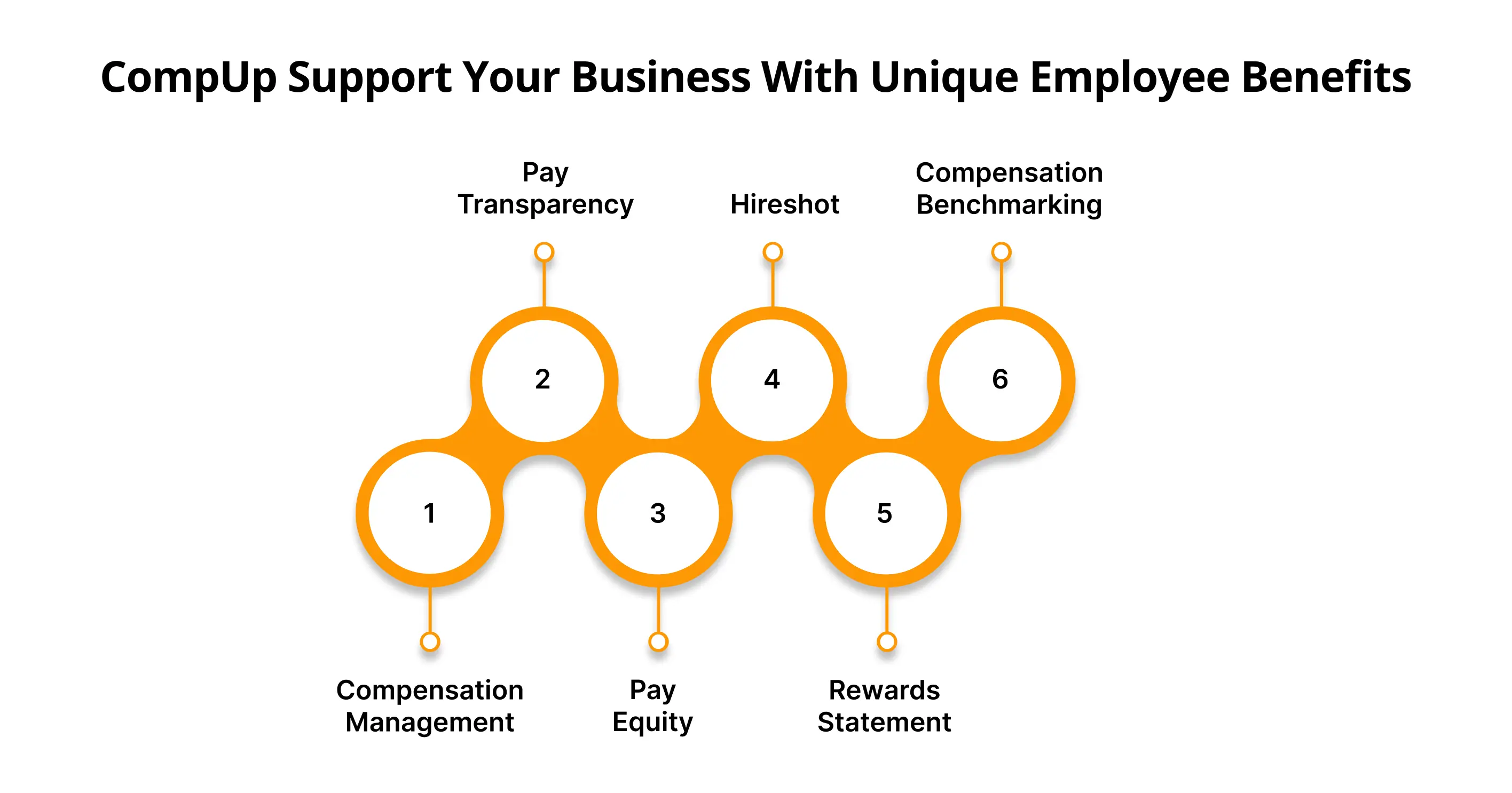

CompUp offers a comprehensive solution for managing fringe benefits, helping businesses streamline processes, ensure compliance, and enhance employee satisfaction. By consolidating various compensation components into one unified platform, you can create a more efficient, equitable, and transparent benefits structure that aligns with your organization’s values.

Key services include:

By utilizing these features, CompUp helps organizations efficiently manage and communicate fringe benefits, ensuring that compensation packages are fair, transparent, and aligned with business goals.

Fringe benefits are more than just a perk; they are an essential part of the compensation package that can have a positive impact on employee satisfaction, retention, and productivity. By offering a mix of mandatory and voluntary benefits, companies can create an environment where employees feel valued, supported, and engaged.

To effectively manage your compensation strategy, CompUp offers tools that simplify compensation planning, confirm pay transparency, and help businesses create equitable reward systems.

Explore how CompUp can assist in building a better benefits package that supports your company’s value proposition and guarantees your employees’ long-term well-being.

1. What are the fringe benefits in the US?

Fringe benefits in the US are additional perks beyond your base salary. These include health insurance, retirement plans, paid time off (PTO), and bonuses. These benefits not only boost your compensation but also provide financial security and can improve job satisfaction and retention.

2. What are type 1 and type 2 fringe benefits?

Type 1 fringe benefits are taxable to you, such as bonuses or employer-provided housing. Type 2 benefits, like health insurance and retirement contributions, are non-taxable, offering you valuable financial protection without extra tax obligations. Both types enhance your overall compensation package.

3. How to calculate fringe benefits?

Ans: To calculate fringe benefits, add up the total value of all non-salary perks you receive, like health insurance, paid leave, and retirement contributions. Ensure you consider the taxability of each benefit, as some may be taxable while others are not, according to IRS guidelines.

Co-founder & CEO, CompUp

Anurag Dixit, founder of CompUp, is a seasoned expert in all things compensation and total rewards. With a deep understanding of the current compensation trends, his vision is to help companies create fair, transparent, and effective compensation strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking