Employee Stock Ownership Plans (ESOPs) have emerged as a powerful tool for creating sustainable business growth while rewarding workforce commitment. According to a recent data report, approximately 10.8 million employees currently participate in ESOP programs across the United States, making up nearly 8% of the private-sector workforce.

The momentum behind employee ownership continues to build, with over 6,358 companies currently operating ESOPs and an average of 264 new programs being implemented each year. This steady growth shows the success of ESOPs in improving employee morale, increasing productivity, and driving sustained company growth.

In this guide, we will break down what an employee ESOP is, how it works, its benefits for employees and employers, and what you need to know if you are considering implementing an ESOP in your organization.

An Employee Stock Ownership Plan (ESOP) is a retirement plan that allows employees to become partial owners of the company they work for. Unlike traditional retirement plans that rely solely on contributions, ESOPs grant employees stock in the company. This stock builds up over time and can be cashed out upon retirement or other qualifying events.

Companies set up ESOPs to offer employees a direct financial stake in the business's success. It builds a culture of commitment, as employees directly benefit from the company’s performance.

Instead of providing cash bonuses, employees accumulate stock in the company, which has the potential to appreciate in value over time, offering them a stake in the company's long-term growth.

Now that you know what Employee ESOP is, let’s take a closer look at how it exactly works.

An Employee Stock Ownership Plan (ESOP) gives your employees a stake in your company's future. Instead of just offering traditional retirement benefits, you hand them a piece of the company itself. Here's a breakdown of how it works:

Now that you know how ESOPs work, let's look at what makes them valuable for both companies and workers.

ESOPs offer a range of benefits for both employees and employers, making them a great option for businesses looking to improve engagement, performance, and create long-term value.

Employee stock ownership creates powerful advantages for business leaders looking to build stronger companies. When workers have a direct stake in company success, they naturally become more committed to achieving better results.

These employer benefits work hand in hand with equally important advantages for workers.

Employee ownership provides workers with unique opportunities to build wealth and secure their financial future while feeling more connected to their workplace.

To get an in-depth understanding of best practices for compensation planning and employee ownership strategies, CompUp offers interactive learning sessions with industry experts. Check out our webinars to discover proven approaches for optimizing salary bands, merit cycles, and total rewards strategies that complement ESOP programs.

Overall, ESOPs serve as a win-win for both employees and employers. Employees enjoy the opportunity to build wealth and secure a more comfortable retirement while also feeling more connected to the company’s growth and success.

However, there are also a few limitations to this compensation strategy that are worth considering.

While Employee Stock Ownership Plans (ESOPs) offer a range of benefits for both employees and employers, it’s important to recognize that they are not without their challenges.

Here are some common challenges that should be considered before implementing one:

Ultimately, ESOPs can be a powerful tool for creating an engaged and committed workforce. However, it’s crucial to carefully assess the potential risks. This will help you determine if an ESOP aligns with your company’s needs and long-term vision.

For in-depth insights on compensation strategies that complement employee ownership programs, CompUp's expert-led discussions provide valuable perspectives on building effective reward systems. Explore our compensation podcasts to learn from industry leaders about pay equity, total rewards, and more.

Beyond the pros and cons of employee ESOP, you'll also want to understand the specific financial commitments involved in the ESOP process.

Setting up an ESOP requires significant upfront investment and ongoing financial commitments. Companies must hire certified professionals to determine the fair market value for company shares. This valuation process happens every year, creating ongoing expenses that continue throughout the ESOP's life.

Managing the plan involves tracking vesting schedules, handling paperwork, and staying compliant with federal regulations. Most companies need dedicated staff or external help to handle these responsibilities properly.

Employee distributions work differently from regular paychecks. Shares typically vest over several years, and actual payouts usually happen during major events like company sales, public offerings, or retirement. While these payments can be substantial, they're taxed as regular income, which reduces the final amount employees receive.

Tax rules significantly impact both company and employee experiences with ESOPs.

ESOP tax treatment offers advantages for companies while creating specific obligations for employees. Understanding these implications helps both employees and employers plan effectively.

Companies receive substantial tax breaks through ESOP contributions and dividend payments. Both ESOP contributions and dividends paid to employees are tax-deductible business expenses. For example, in leveraged ESOPs, companies can deduct both loan principal and interest payments, creating powerful tax savings.

Employees don't pay taxes on ESOP shares while they remain in the plan. Taxation occurs when workers receive distributions, typically during retirement or job changes. These distributions are taxed as ordinary income rather than capital gains, potentially creating higher tax bills.

Employees can choose lump sum payments or installment distributions over several years. Installment payments may reduce tax burdens by spreading income across multiple tax years. Workers can also roll ESOP distributions into traditional IRAs to defer taxes further.

ESOP shares become part of employee's estate and may trigger inheritance taxes. So, proper estate planning becomes important for workers with substantial ESOP values.

Now let's explore the different structural approaches companies can take when designing their ESOPs.

Understanding the different types of ESOP structures helps you choose the right approach for your company's goals and employee engagement strategy. Each type offers distinct advantages depending on your business size, ownership objectives, and employee retention strategy.

Here are the main ESOP plan types that you can implement:

In a non-leveraged ESOP, your company contributes cash or stock directly to the ESOP trust without borrowing money. The trust then purchases your company stock or holds the contributed shares, functioning like a defined contribution retirement plan.

This type often works within existing 401(k) plans, where your company stock becomes an investment option or gets contributed directly to employee accounts. It's perfect for companies that want to share ownership gradually while maintaining predictable cash flows and avoiding debt complications.

A leveraged ESOP borrows money to purchase your company shares immediately, creating instant employee ownership while your company pays back the loan over time. You can guarantee a third-party loan, lend directly to the ESOP, or fund the debt payments through regular contributions and dividends.

This structure works best when you need immediate capital or want to sell a significant ownership stake quickly. The ESOP releases shares to employees as loan payments are made, and you get substantial tax benefits since both principal and interest payments are tax-deductible.

This ESOP structure uses special preferred stock that employees can convert to common stock or sell back to your company at fair market value. The put option gives employees flexibility to cash out their ownership when they leave or retire, while you maintain control over who owns company shares.

You must be prepared to repurchase these shares or provide equivalent marketable securities when employees exercise their put options. This type works well for companies that want employee ownership but need to control share transfers and maintain liquidity for departing employees.

In this structure, your company issues preferred stock that converts to common shares or gets redeemed at a fixed value in cash, stock, or a combination of both. Unlike the put option version, this guarantees redemption at predetermined terms rather than the current market value.

This approach gives you more predictability in planning for share redemptions while still providing employees with valuable ownership benefits. It's particularly useful when you want to offer ownership without the uncertainty of market-based valuations affecting your cash flow planning.

Now, once you've selected your ESOP structure, you'll need to determine how ownership gets distributed among your employees.

Setting up an ESOP requires careful planning and professional guidance, but understanding the basic steps helps you prepare for the process and make informed decisions. Most companies complete ESOP implementation usually within 6-12 months when they follow a structured approach.

Start by assembling your professional team and following these key implementation steps:

Once you've planned your setup, the next important decision is how those shares get distributed to your team.

Share allocation determines how your ESOP benefits reach individual employees, making this process crucial for ensuring fairness and maximizing the plan's motivational impact. Most companies use straightforward formulas that employees can easily understand and predict.

The allocation method you choose should align with your company culture and compensation philosophy:

Now, each of the allocation methods works well, but real company examples will show you what a successful implementation of employee ESOP actually looks like.

Real-world ESOP success stories demonstrate how different industries and company sizes can benefit from employee ownership structures. Learning from established ESOP companies will help you understand implementation strategies and long-term outcomes:

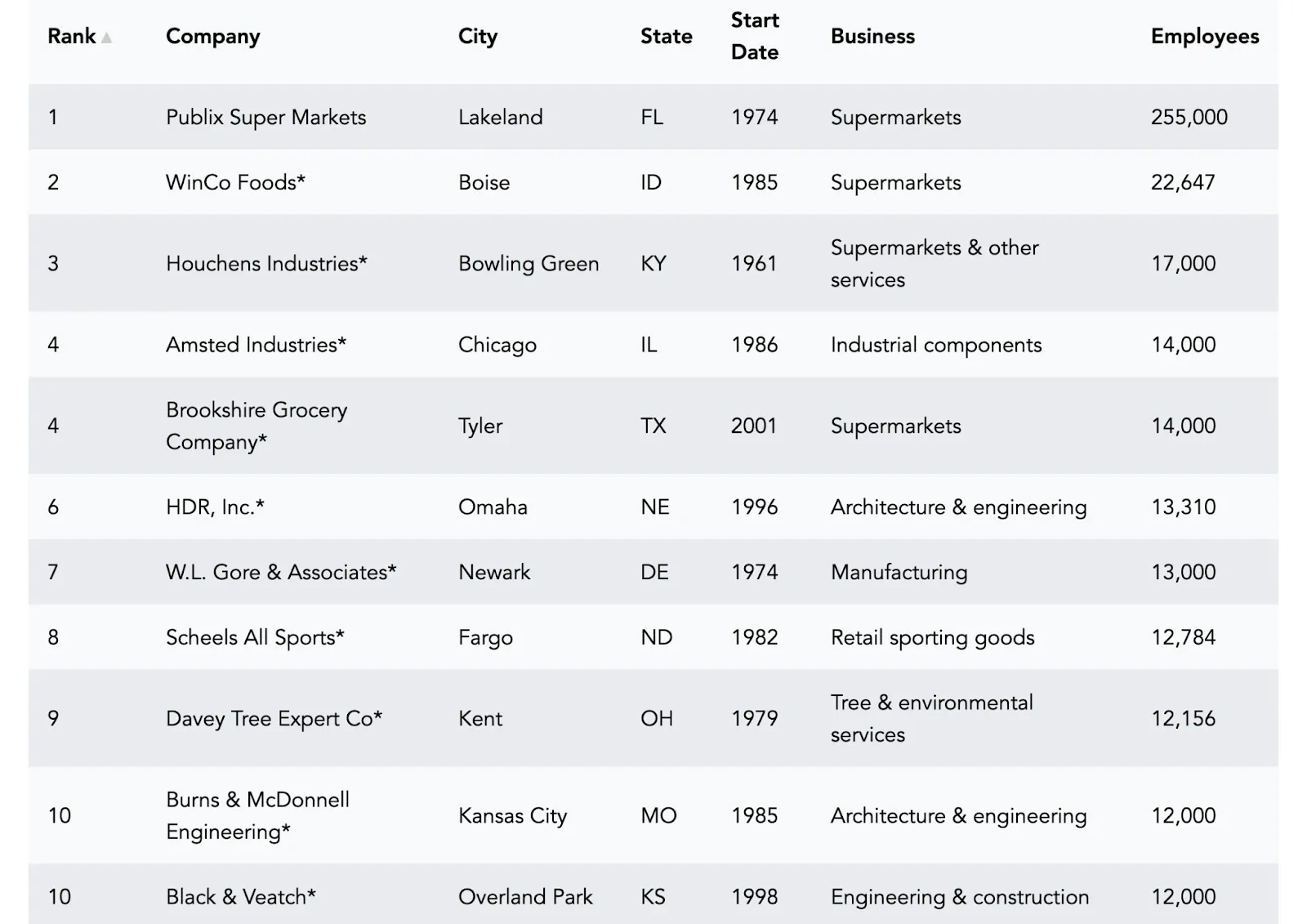

Publix stands as the largest employee-owned company in America, with 255,000 employees across 1,404 stores generating $59.7 billion in annual sales. Since starting their ESOP in 1974, they've built a culture where every employee, from cashiers to executives, receives company stock as part of their retirement benefits.

Their success comes from treating ESOP participation as a core part of their employee value proposition rather than just an additional benefit. Publix employees consistently rank the company among the best places to work, directly correlating their ownership stake with exceptional customer service and operational excellence.

WinCo Foods has delivered an impressive 18% average annual return since launching its ESOP in 1985, turning a $5,000 investment into approximately $863,000 today. With over 22,000 employees across 140+ grocery stores, they've proven that employee ownership drives both financial performance and employee satisfaction.

Their model requires employees to work 500 hours in their first six months to become eligible, then maintain 1,000 hours annually to continue participation. This structure ensures committed employees benefit while maintaining operational standards, creating a workforce that genuinely cares about company success.

Recology's waste management business covers 2.5 million residential and 112,000 commercial customers across three states, with 3,600 employees participating in their ESOP since 1986. They supplement their employee ownership with traditional 401(k) plans, creating multiple retirement benefit layers.

Their approach demonstrates how ESOPs work effectively in service industries where employee engagement directly impacts customer satisfaction. Recology employees take ownership of their routes and customer relationships, leading to higher retention rates and superior service quality.

These examples showcase just a fraction of successful employee-owned businesses operating today. To explore more examples and see how America's largest employee-owned companies have built their success stories, you can review the top 100 employee-owned organizations across various industries.

These success stories highlight the positive outcomes of employee ESOP. But employee ESOPs aren't the only way to give employees an ownership stake in your company's success.

ESOPs aren’t the only way companies offer ownership. Depending on the stage and structure of the business, other models might work better. Here are a few common ones:

Each of these comes with its own terms, tax implications, and risks. The best choice depends on how a company wants to structure incentives and long-term value sharing.

Successfully implementing an ESOP can be complex. However, using the right tools can make the process more efficient and manageable.

CompUp transforms complex compensation planning from spreadsheet chaos into data-driven decision-making, especially valuable when managing employee ownership programs like ESOPs alongside traditional compensation structures.

Here's how CompUp's features support your compensation and ownership program goals:

CompUp simplifies complex compensation decisions through data-driven tools. Our platform helps you manage ESOP programs alongside traditional pay structures. This integration makes employee ownership more transparent and effective for your organization.

Implementing an employee ESOP can be an effective growth strategy for your company. It offers benefits for both employees and employers. By giving employees a stake in the company’s success, you can build better engagement, loyalty, and long-term financial growth.

However, it’s crucial to consider the financial, legal, and cultural implications. If you are interested in exploring the advantages of an ESOP for your company, you must carefully consider how it aligns with your goals. Whether you are looking to enhance employee engagement or improve long-term financial growth, an ESOP can be a powerful tool.

If you need help managing the process, CompUp is here to assist you. We provide the necessary support and solutions to simplify and improve the implementation, ensuring a smoother transition and ongoing success.

Don’t let complexity slow you down. Find out how CompUp can simplify your ESOP management. Schedule a free demo today.

1. How does an ESOP differ from a 401(k)?

While both are retirement plans, an ESOP allows employees to own company stock, whereas a 401(k) plan typically includes a variety of investment options, such as mutual funds. Additionally, an ESOP ties employees’ financial outcomes to the company's performance, whereas a 401(k) is more diversified.

2. How to Cash Out of an ESOP

Employees can usually cash out their ESOP shares after leaving the company, during a buyback window, or at a liquidity event like an IPO or acquisition. The process and timing depends on your specific ESOP rules and vesting status.

3. What happens to an employee's ESOP if they leave the company?

When employees leave the company, they may sell their shares back to the company or, in some cases, to another employee. The exact process varies depending on the company’s ESOP plan and its stock value at the time of departure.

4. Are there any tax benefits for companies offering an ESOP?

Yes, companies offering an ESOP can receive tax advantages, such as tax deductions for contributions made to the ESOP, including the cost of purchasing shares. These tax benefits make ESOPs an attractive option for business owners, especially when considering long-term succession planning.

5. How is the value of ESOP shares determined?

The value of ESOP shares is determined through an annual independent valuation for privately held companies. For publicly traded companies, the market price of the stock is used to determine the value of the shares. This process ensures that employees’ shares are priced fairly and accurately.

6. What happens if the company goes bankrupt or underperforms?

If the company’s value decreases or it goes bankrupt, the value of employee shares in the ESOP will also decline. Employees may lose some or all of the value tied to their ESOP stock. This is one of the risks associated with ESOPs that employees should be aware of when considering participation.

Co-founder & CEO, CompUp

Anurag Dixit, founder of CompUp, is a seasoned expert in all things compensation and total rewards. With a deep understanding of the current compensation trends, his vision is to help companies create fair, transparent, and effective compensation strategies.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking