Employee stock options (ESOs) are a form of equity compensation that grants you the right, but not the obligation, to purchase company shares within a specified timeframe. This arrangement allows you to benefit from the company's growth by acquiring shares at a lower price than the market value, provided the stock price appreciates above the exercise price.

Typically, ESOs are subject to a vesting schedule, meaning you must remain employed with the company for a specific period before you can exercise your options. The vesting period can vary, often spanning several years, and may include a "cliff" period, where no options vest until a specific date, after which a portion becomes exercisable. For instance, a common schedule might allow 25% of the options to vest after one year, with the remaining 75% vesting monthly over the next three years.

Upon exercising your options, you can choose to hold onto the shares in anticipation of further price increases or sell them to realize a profit. In this blog, we will explore the concept of Employee Stock Options (ESOs), explaining how they work, the different factors to consider, and how they can potentially benefit you.

Employee stock options (ESOs) are contractual agreements between you and your employer, granting you the right, but not the obligation, to purchase company shares at a predetermined price, known as the strike price, within a specified timeframe. This arrangement allows you to acquire company stock at a fixed price, potentially below its market value, depending on the company's performance.

These options come with an exercise window, which is the period during which you can exercise your right to purchase the shares. The duration of this window varies but is often several years. It's important to note that ESOs are not actual shares; they are rights to purchase shares in the future. If you choose not to exercise the options within the exercise window, they will expire, and you will lose the chance to purchase the shares at the strike price.

The value of your ESOs is tied to the company's stock performance. If the stock's market price exceeds the strike price during the exercise window, you can exercise your options to buy shares at the lower strike price, potentially realizing a profit. Conversely, if the market price is below the strike price, the options may be considered "underwater" and not exercised.

Knowing the specific terms of your ESO agreement, including the strike price, exercise window, and any vesting schedules, is crucial for making informed decisions about exercising your options.

ESOs are typically part of your compensation package, serving as an incentive to contribute to the company's success and remain with the organization over time.

Upon receiving stock options, you receive a contract detailing the number of shares you can purchase, the exercise price, and the vesting schedule. The exercise price is often set at the stock's fair market value on the grant date.

Vesting refers to the process by which you earn the right to exercise your options. Vesting occurs over some time, such as four years, with a one-year cliff. This means you must remain employed with the company for a certain period before you can exercise your options. If you leave the company before your options vest, you forfeit them.

Once your options have vested, you can exercise them by purchasing the shares at the exercise price. If the stock's current market price is higher than the exercise price, you can sell the shares for a profit. However, exercising the options may not be advantageous if the market price is lower.

Also Read: 5 Key Compensation and Benefits Trends for 2025

The mechanics of ESOs, including the granting process, vesting schedule, exercise options, expiration, and tax considerations, are vital for deciding your equity compensation.

ESOs offer a range of advantages for both employees and employers, serving as a strategic tool for mutual growth and success.

The benefits of ESOs for employees are as follows:

The benefits of ESOs for employers are as follows:

Employee stock options are mutually beneficial, offering employees the potential for financial growth and employers a means to attract, retain, and motivate talent.

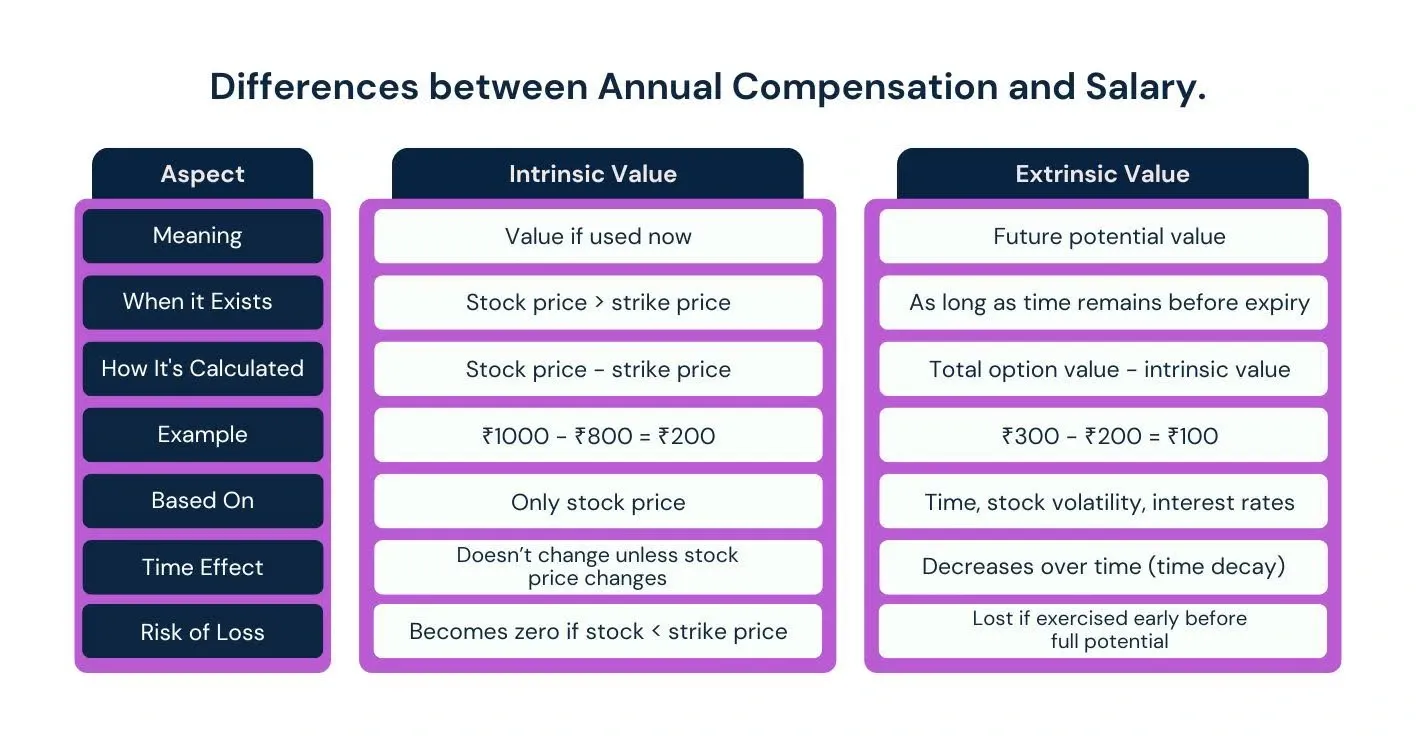

When evaluating ESOs, it's important to distinguish between intrinsic value and extrinsic value, as both contribute to the options' overall worth.

Exercising early may result in forfeiting potential extrinsic value, especially if the stock price is volatile or if abundant time remains before expiration. Conversely, waiting too long to exercise may lead to losing intrinsic and extrinsic value if the stock price declines.

Therefore, it's advisable to regularly assess the current stock price, the time remaining until expiration, and market conditions regarding your ESOs.

ESOs are contractual agreements that grant you the right to purchase a company. There are two primary types of ESOs:

ISOs are reserved for employees and offer favorable tax treatment. If you meet specific holding requirements, holding the shares for at least one year after exercise and two years after the grant date, the profit from the sale may be taxed at long-term capital gains rates. However, ISOs are subject to the Alternative Minimum Tax (AMT), which can complicate tax calculations. Additionally, there is a $100,000 limit on the value of ISOs that can become exercisable in a calendar year.

NSOs can be granted to employees, consultants, and directors. Unlike ISOs, NSOs do not qualify for special tax treatment. Upon exercise, the difference between the exercise price and the market value of the shares is considered ordinary income and is subject to income tax. Subsequent gains from selling the shares are taxed as capital gains.

ISOs and NSOs grant you the right to purchase company stock at a fixed price but differ in eligibility, tax treatment, and regulatory requirements.

Exercising your ESOs involves purchasing company shares at a predetermined price. When and how to exercise these options depends on several factors, including your financial situation, the company's stock performance, and the options granted.

Exercising is useful when the current market price exceeds your strike price, allowing you to purchase shares at a discount. However, exercising may not be advantageous if the market price is below the strike price.

There are several strategies to exercise your ESOs, each with distinct financial and tax implications:

This traditional method involves paying the strike price in cash to purchase the shares. It's straightforward but requires sufficient liquidity.

In this approach, you exercise your options and sell a portion of the acquired shares to cover the exercise cost and taxes. This method eliminates the need for upfront cash but may result in fewer shares owned.

Similar to a cashless exercise, this method involves selling just enough shares to cover the exercise price and associated taxes, allowing you to retain the remaining shares.

Some companies permit you to exchange previously owned company shares to cover the exercise cost of new options. This can be advantageous if you have appreciated shares but prefer not to use cash.

Exercising your ESOs is a significant financial decision. Carefully consider the timing and method that match with your financial goals and risk tolerance. Seeking advice from monetary and tax professionals can provide personalized guidance tailored to your situation.

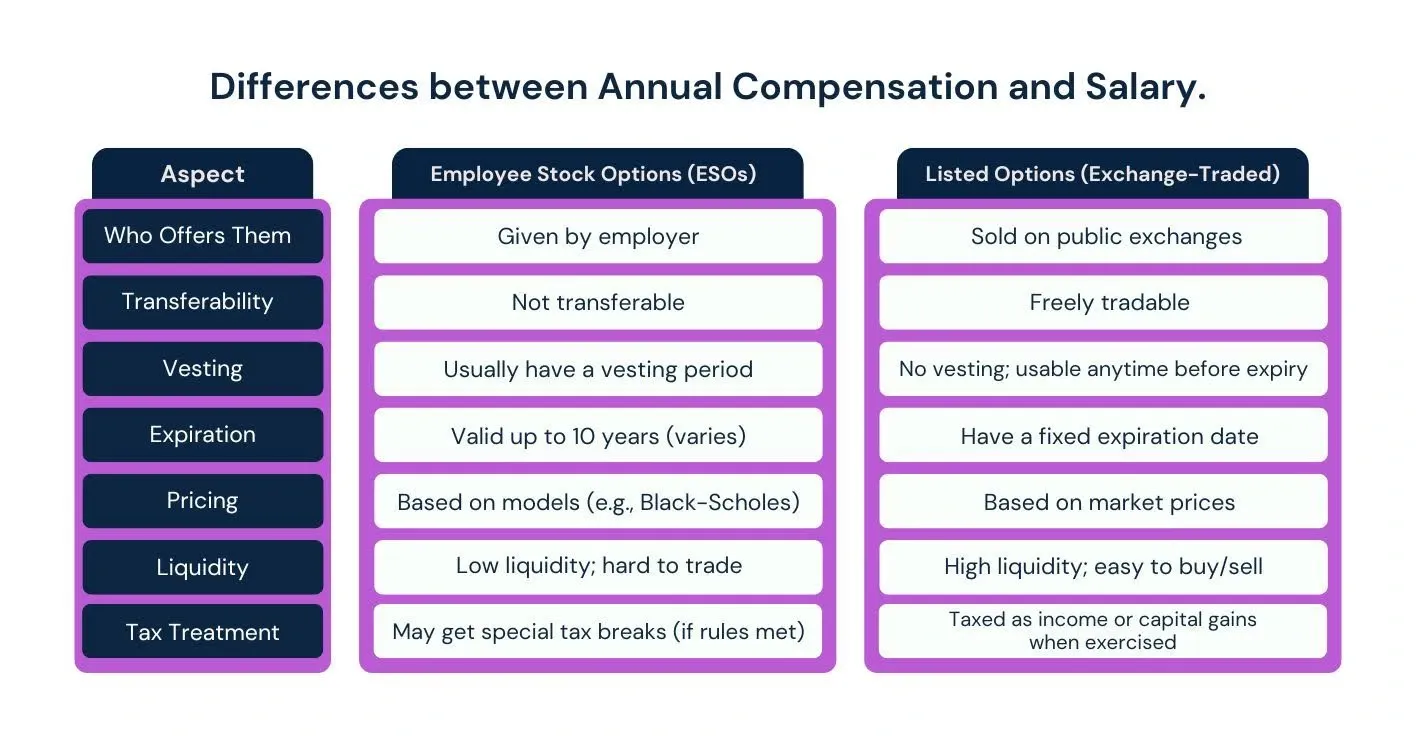

ESOs and listed options are both financial instruments that grant the right to buy or sell shares at a predetermined price. Still, they differ significantly in structure, liquidity, and valuation.

ESOs are harder to value because they don't have a market price. Companies use prediction models, but those depend on guesses about future changes.

ESOs can't be sold on the open market and usually must be held until exercised. In contrast, listed options can be sold or bought anytime, making them more flexible and liquid.

In contrast, listed options offer more flexibility and liquidity but require different skills and risk management strategies. Understanding the distinctions between ESOs and listed options is crucial for making informed decisions about your equity compensation.

ESOs offer potential financial benefits but come with specific tax considerations that vary based on the type of option granted. Understanding these tax implications is crucial for managing your equity compensation effectively.

ISOs are typically granted to employees and offer favorable tax treatment under certain conditions:

It's important to note that if the holding period requirements are unmet, the sale is considered a "disqualifying disposition," and the bargain element is taxed as ordinary income.

NSOs can be granted to employees, contractors, and others and have different tax implications:

Employers are required to withhold taxes at the time of exercise, and the income is reported on your W-2 form.

RSUs are another form of equity compensation:

Employers typically withhold taxes at the time of vesting, and the income is reported on your W-2 form.

To manage the tax implications of your ESOs:

To optimize tax outcomes, consider the timing of exercising your options and selling the shares. Meeting the holding period requirements for ISOs can result in favorable long-term capital gains treatment.

When exercising ISOs, be aware of the potential AMT liability. Consult with a tax advisor to determine if you may be subject to AMT and to plan accordingly.

Avoid concentrating too much of your wealth on company stock. Diversifying your investments can help manage risk.

Ensure appropriate taxes are withheld during exercise or vesting to avoid underpayment penalties.

Given the complexity of tax laws and their potential financial impact, it is advisable to consult with a tax professional to develop a strategy that matchs with your financial goals and minimizes tax liability.

ESOs are a common form of equity compensation, but several alternatives offer different structures and benefits. These alternatives can be more straightforward, provide immediate value, or match differently with company performance.

SARs allow you to benefit from the company's stock value increase without owning the shares. Upon exercise, you receive the appreciation in cash or stock without purchasing the underlying shares. SARs are typically taxed as ordinary income when exercised.

Phantom stock provides you with the benefits of stock ownership without actual share issuance. The value is tied to the company's stock price, and upon a triggering event (like a sale or IPO), you receive a cash payout equivalent to the value of the phantom shares. Phantom stock is taxed as ordinary income when paid out.

ESPPs allow you to purchase company stock through payroll deductions, often at a discount. Depending on the structure, these plans can be qualified (offering favorable tax treatment) or non-qualified. Qualified ESPPs may allow you to defer taxes until you sell the shares, potentially qualifying for long-term capital gains treatment.

These are awards of company stock or units that vest based on achieving specific performance goals, such as earnings per share targets or return on equity metrics. Performance shares are typically granted to executives and are taxed as ordinary income upon vesting.

In startups or small businesses, sweat equity refers to the ownership stake you earn by contributing time and effort instead of capital. This form of equity compensates for work performed and is often used when cash resources are limited. The value is typically realized upon a liquidity event, such as a company sale or IPO.

Each equity compensation form has unique features and tax implications. The choice between them depends on factors like company structure, stage, and financial goals. It's advisable to consult with a financial advisor to understand which option best suits your circumstances.

Valuing ESOs is a nuanced process that requires considering various factors, including the type of option, company-specific conditions, and market dynamics. Accurate valuation is essential for both financial reporting and strategic planning.

Several models are employed to estimate the fair value of ESOs:

Widely used for European-style options, this model calculates the option's value based on the current stock price, exercise price, time to expiration, risk-free interest rate, and stock volatility. It assumes constant volatility and no early exercise, making it less suitable for American-style options or those with complex features.

This model divides the option's life into discrete intervals, allowing for the modeling of various scenarios, including early exercise and changing volatility. It's particularly useful for American-style possibilities and can accommodate complex features like employee behavior and market conditions.

A computational technique that simulates a wide range of possible price paths for the underlying asset, providing a distribution of possible outcomes. It's beneficial for options with complex features or path-dependent characteristics.

Accurate valuation requires precise inputs:

These inputs are critical for determining the option's fair value and can significantly impact the valuation outcome.

Accurate valuation of ESOs is vital for financial reporting, tax compliance, and strategic decision-making. Employing appropriate valuation models and inputs ensures that the value of ESOs is estimated correctly and reflects the actual economic benefit to employees and the company.

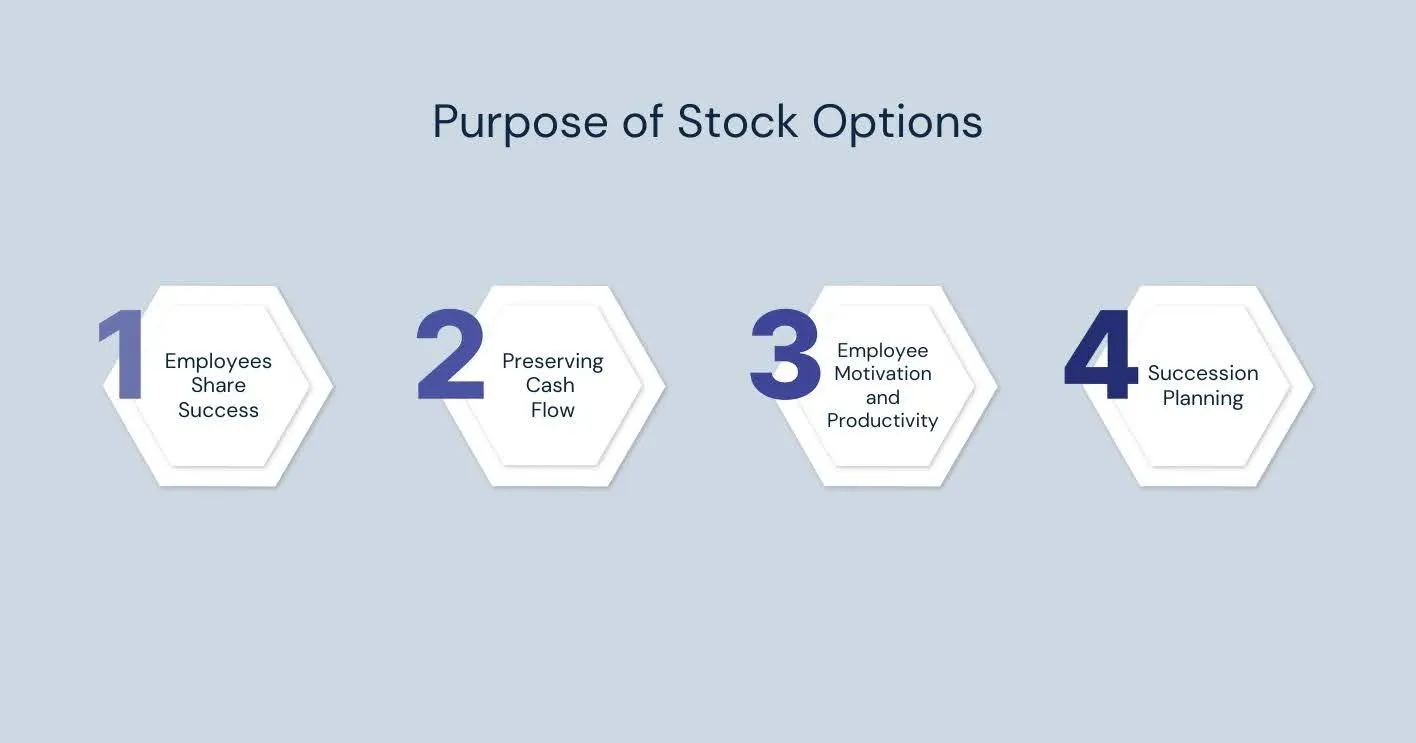

Companies provide ESOs for several strategic reasons, aiming to match employee interests with organizational goals, attract and retain talent, and manage compensation costs.

By granting stock options, companies encourage employees to work towards increasing the company's value. As the company's stock price rises, so does the potential financial benefit for employees.

For startups and companies with limited cash resources, ESOs allow them to offer competitive compensation without immediate cash expenditure. Employees receive the potential for future financial gain while the company conserves cash for operations and growth.

Employees with a financial stake in the company's success may be more motivated to contribute effectively. This sense of ownership can increase productivity and a more substantial commitment to achieving organizational objectives.

Companies sometimes use ESOs as succession planning strategies, especially in family-owned or closely-held businesses. They can be structured to transfer ownership to employees over time, ensuring continuity and stability within the organization.

Employee stock options serve multiple purposes, from matching interests and attracting talent to preserving cash flow and enhancing motivation. These reasons can help employers and employees appreciate the value and implications of ESOs in the broader context of compensation and organizational strategy.

ESOs have a finite lifespan. Most ESOs have a maximum term of 10 years from the grant date. If you approach this deadline without exercising, you risk forfeiting your options. For example, if you leave the company, you may have a limited window (often 90 days) to exercise your vested options before they expire.

If you leave the company, whether through resignation, retirement, or termination, the standard post-termination exercise period (PTEP) is usually 90 days. During this window, you can exercise any vested options. Failing to do so within the PTEP results in the forfeiture of those options. Some companies may offer extended PTEPs, but this is not guaranteed and varies by employer.

For ISOs, if you do not exercise them within 10 years of the grant date, they expire and become worthless. If you leave the company, you must exercise them within 90 days to retain their favorable tax treatment; otherwise, they are treated as non-qualified stock options (NSOs) for tax purposes.

Allowing your stock options to expire without exercising them means forfeiting any potential financial benefit. This is particularly impactful if the company's stock value has increased since the grant date. Once expired, options cannot be reinstated or exercised, and you lose the opportunity to acquire shares at the strike price.

Also Read: Equity Compensation vs. Variable Pay

You can maximize your employee stock options and avoid losing out on potential benefits.

While ESOs can be a valuable component of your compensation, they come with specific risks and considerations that require careful evaluation.

The value of your ESOs is directly tied to your company's stock performance. If the company underperforms or fails, your options may become worthless. Even if the company is acquired or goes public, the terms may not be favorable to employees, potentially leading to financial loss.

ESOs are often illiquid, especially in private companies. You may not sell the underlying shares until a liquidity event occurs, such as an acquisition or initial public offering (IPO). This lack of liquidity can make it challenging to realize the value of your options when needed.

ESOs typically come with vesting schedules that require you to remain employed with the company for a specific period before you can exercise your options. If you leave the company before your options vest, you may forfeit them, potentially losing a significant portion of your compensation.

Holding a substantial portion of your wealth in company stock exposes you to concentration risk. Your employment income and investment value may be adversely affected if the company's performance declines. Diversifying your investment portfolio can help mitigate this risk.

Exercising your options early can lead to premature tax liabilities without the benefit of potential appreciation in stock value. Additionally, you may incur financial losses if the stock price declines after early exercise. It's important to carefully consider the timing of exercising your options.

As more stock options are granted to employees, the ownership percentage of existing shareholders can be diluted. This dilution can affect the value of your holdings and influence within the company.

Before exercising your ESOs, it's advisable to consult with a financial advisor or tax professional to assess the potential risks and benefits based on your circumstances. They can help you develop a strategy that matches your financial goals and minimizes potential downsides.

CompUp provides tools that help companies manage Employee Stock Options (ESOPs) and other compensation plans. Here’s how CompUp can help with ESOs:

CompUp helps combine ESOs with other parts of your pay, like salary and bonuses, so everything works together. This makes it easier to see the total value of your compensation and helps companies make smarter decisions about offering ESOs.

It’s important to make sure everyone gets a fair share. CompUp’s pay equity analysis tools allow companies to check if their ESOs are distributed equally among employees. This helps avoid unfairness and keeps employees happy and trusting in their company.

It is important to plan how much to offer in ESOs. CompUp lets companies create budgets and allocate budgets for ESOs, simulate different compensation scenarios, and make decisions based on real data. This ensures the ESO program works well for the company and its employees.

Employees need to understand the value of their ESOs. CompUp makes it easy for companies to share information about ESOs and other benefits and aids in the creation of comprehensive total rewards statements so employees know how much they are getting and why it matters.

By using these tools, CompUp helps companies manage their ESOs in a fair, clear, and well-planned manner.

ESOs are subject to a vesting schedule, requiring you to remain employed with the company for a certain period before exercising your options. Upon exercising, you can choose to hold onto the shares or sell them, depending on various factors, including market conditions and personal financial goals.

It's important to note that ESOs are not the same as direct stock ownership. They represent a potential future opportunity to purchase shares at a favorable price, contingent upon the company's performance and your continued employment. However, they also come with risks, particularly if the company's stock price does not perform as expected. Careful consideration and planning are necessary to maximize the benefits of employee stock options.

CompUp is designed to manage compensation and help organizations create and implement data-driven, fair compensation strategies. With a 4.9/5 rating on G2, it is relied upon by over 200 global companies to handle intricate compensation structures. The platform provides tools for analyzing pay equity, planning compensation, communicating total rewards, and managing surveys.

Our customizable compensation bands, budget simulations, performance appraisal management, and compensation analytics are all focused on promoting fairness and transparency. CompUp integrates with over 100 HR software systems, aiding smooth data transfer and easy access. Schedule a free demo today.

1. Can employee stock options (ESOs) be transferred or sold to someone else?

Generally, ESOs cannot be transferred or sold to someone else unless specified by the company. Most stock option plans require that the employee exercise their options personally. However, some plans allow options to transfer under certain conditions, like to a family member, after meeting specific vesting criteria or upon the employee's death.

2. What happens to my stock options if I leave the company before they are fully vested?

If you leave the company before your stock options are fully vested, you typically forfeit any unvested options. However, vested options may be exercisable within a specific period after your departure, often 90 days, depending on the terms of your stock option agreement.

3. How does the alternative minimum tax (AMT) apply to incentive stock options (ISOs)?

ISOs are subject to the AMT if exercised and held beyond the calendar year of exercise. Although you don't have to pay regular income tax immediately on ISOs, their spread (the difference between the exercise and market prices) is added to your AMT calculation. This can result in paying taxes on the options even if you don't sell the shares.

4. Can stock options affect my social security or retirement contributions?

In most cases, exercising stock options does not directly impact your Social Security contributions or retirement plans. However, suppose stock options are exercised as part of your overall compensation. In that case, the income from those options may increase your total earnings and potentially affect the amount you contribute to Social Security or a retirement fund, especially if the options are part of a bonus or salary package.

5. What should I consider when deciding whether to exercise my options or wait?

When deciding to exercise stock options, consider the current stock price, the option's expiration date, and your financial situation. You should also consider potential tax implications, whether you expect the stock price to rise or fall, and whether you want to hold onto the shares for long-term gains or sell immediately for a short-term profit.

Customer Success Manager - Team Lead

Led by a vision to transform the landscape of total rewards with an innovative mindset and technological advancements.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking