As personal wealth surges globally, the role of wealth managers has never been more critical. Industry reports predict that the share of wealth and retail client segments will rise from 58% to 64% of total assets under management (AuM) within the next five years. This trend signals intensified competition for top advisory talent, making solid compensation strategies a business imperative.

We understand that in this fiercely competitive field, organizations may often feel the pressure and uncertainty in crafting compensation packages that truly attract and retain the best advisors.

In this blog, we break down the components of wealth management compensation structures and offer insights to help organizations build scalable, performance-linked frameworks that attract, retain, and motivate high-performing advisors.

Key Takeaways :

Wealth management is a comprehensive financial advisory service designed for high-net-worth individuals and families. It integrates investment management, financial planning, estate planning, tax services, and retirement planning under one strategic framework.

At its core, wealth management focuses on growing and preserving client assets while aligning financial strategies with long-term goals. Unlike traditional financial advising, it takes a holistic approach, factoring in every aspect of a client’s financial life.

This multifaceted discipline requires highly skilled professionals and firms equipped to deliver tailored solutions that meet the diverse needs of clients. This is also why compensation structures in this sector are more complex, reflecting the high value placed on advisory expertise and relationship management.

Let us now explore how pay structures vary for key positions in this sector.

Suggested Read: Top 5 Pave Alternatives and Competitors in 2025

Compensation frameworks in wealth management vary significantly across roles, reflecting the responsibilities, client portfolios, and revenue impact associated with each role. Competitive salary benchmarks are essential for firms looking to attract and retain top talent in a highly dynamic wealth management landscape.

Entry roles often come with a modest base salary and structured training bonuses. Variable components are minimal but may include incentives tied to team performance or client support metrics. The average hourly pay for a Wealth Associate in the United States is $19.87 an hour. This amounts to between $39,740 and $41,330 annually, with limited variable pay components.

Advisors typically receive a higher base salary supplemented by commissions on client acquisition, AUM growth, and retention. Performance-based bonuses drive alignment with the firm's revenue goals. Mid-career advisors earn total compensation ranging from $51,383 to $169,790, which combines base salaries with performance incentives tied to AUM growth and client retention.

Senior partners access long-term wealth through profit-sharing arrangements, equity participation, and deferred compensation plans. These align leadership rewards with the firm’s financial performance and strategic growth. Senior-level professionals may command salaries ranging from $135,000 to $252,000, driven largely by profit-sharing, equity stakes, and deferred bonuses that are aligned with the firm's profitability.

This tiered approach enables firms to strike a balance between guaranteed pay and performance incentives, thereby inculcating accountability and long-term commitment.

Understanding the pay structures across key roles gives valuable context, but it is equally important to see how these components function together within the broader compensation framework. Now, let us explore how compensation works in wealth management and why its structure is unique to the industry.

In our latest podcast, Senior DEI Consultants Susie Silver and Melanie Sanders share hard-earned insights on building authentic inclusion. They emphasize the importance of self-reflection in addressing unconscious bias and stress that DEIB is more than just training.

Wealth management compensation models are designed to align advisor performance with firm profitability. Unlike many industries, they rely heavily on variable components to incentivize client acquisition, retention, and asset growth. Here is a breakdown of how these models typically function:

Base salary offers wealth managers predictable income, ensuring financial stability while handling core advisory duties. It forms a smaller proportion of total compensation in firms emphasizing commissions and performance pay, particularly at mid-to-senior career levels.

This component rewards advisors with a percentage of revenues from managing client assets, acquiring new accounts, or selling specific financial products. It drives performance by aligning advisor earnings directly with their ability to grow and retain client portfolios.

Reserved for senior advisors or partners, these programs distribute firm profits or equity stakes. They align individual and organizational success, encouraging long-term commitment and ownership in the firm’s performance and strategic growth.

Targeted payouts incentivize top performers to stay, often tied to surpassing AUM thresholds or maintaining key client relationships. These rewards mitigate attrition risk in highly competitive markets and reinforce the retention of high-value advisors.

This mix creates a high-performance culture by carefully structuring pay components to ensure competitiveness while maintaining compliance with regulations and fairness across the team.

Key factors, including AUM, client acquisition, regional market conditions, experience, and firm size, determine the actual payouts and compensation structures within wealth management firms. Let us examine the factors that influence these compensation models in the next section.

Suggested Read: How Equity Compensation Works? A Guide for Employees

Designing effective pay structures in wealth management requires understanding the variables that shape advisor earnings. These factors impact both fixed and variable components, influencing how firms attract and retain top talent.

Understanding the factors that shape wealth management compensation is only the first step. To translate these insights into effective pay structures, firms require a clear and actionable framework. The next section explains how you can design a salary structure that aligns with your business goals.

Designing a solid salary structure requires striking a balance between competitiveness, compliance, and employee motivation. Follow these key steps to build compensation models tailored for wealth management roles:

While an effective framework provides a strong foundation, wealth management firms still face complex challenges in structuring compensation. These are explained in the following section.

Suggested Read: Understanding What the 75th Percentile Means in Salary Compensation

Designing compensation packages in wealth management is a complex process. Firms must strike a balance between competitive pay and compliance, equity, and long-term sustainability. Below are the key challenges compensation managers face in this highly dynamic industry.

Reliance on commissions and incentives can lead to unpredictable earnings, making it harder to maintain pay equity and financial stability across teams.

Solution: Introduce a higher base salary component or floor guarantees to ensure financial stability without discouraging performance incentives.

Bonuses and commission structures must align with changing financial regulations to avoid penalties and reputational risks.

Solution: Regularly audit compensation plans and use compliance-focused software to stay aligned with different laws.

Ensuring equitable pay for advisors in different markets, roles, and demographics is critical for retention and employer branding.

Solution: Utilize pay equity analytics tools to identify and close gaps, ensuring fair practices that support retention and employer branding.

Balancing short-term incentives with long-term firm performance can be challenging, especially in firms with aggressive growth targets.

Solution: Design deferred bonuses and equity programs to promote long-term client relationships and firm growth.

Competitors often poach high-performing advisors. Retaining top performers requires creative compensation strategies that go beyond standard bonuses or commissions.

Solution: Develop retention bonuses and career progression pathways tied to achieving specific AUM or client satisfaction milestones.

Overcoming these challenges is crucial as variable pay remains a defining feature of wealth management compensation. Its role in driving advisor performance, client acquisition, and firm growth is explained in detail in the next section.

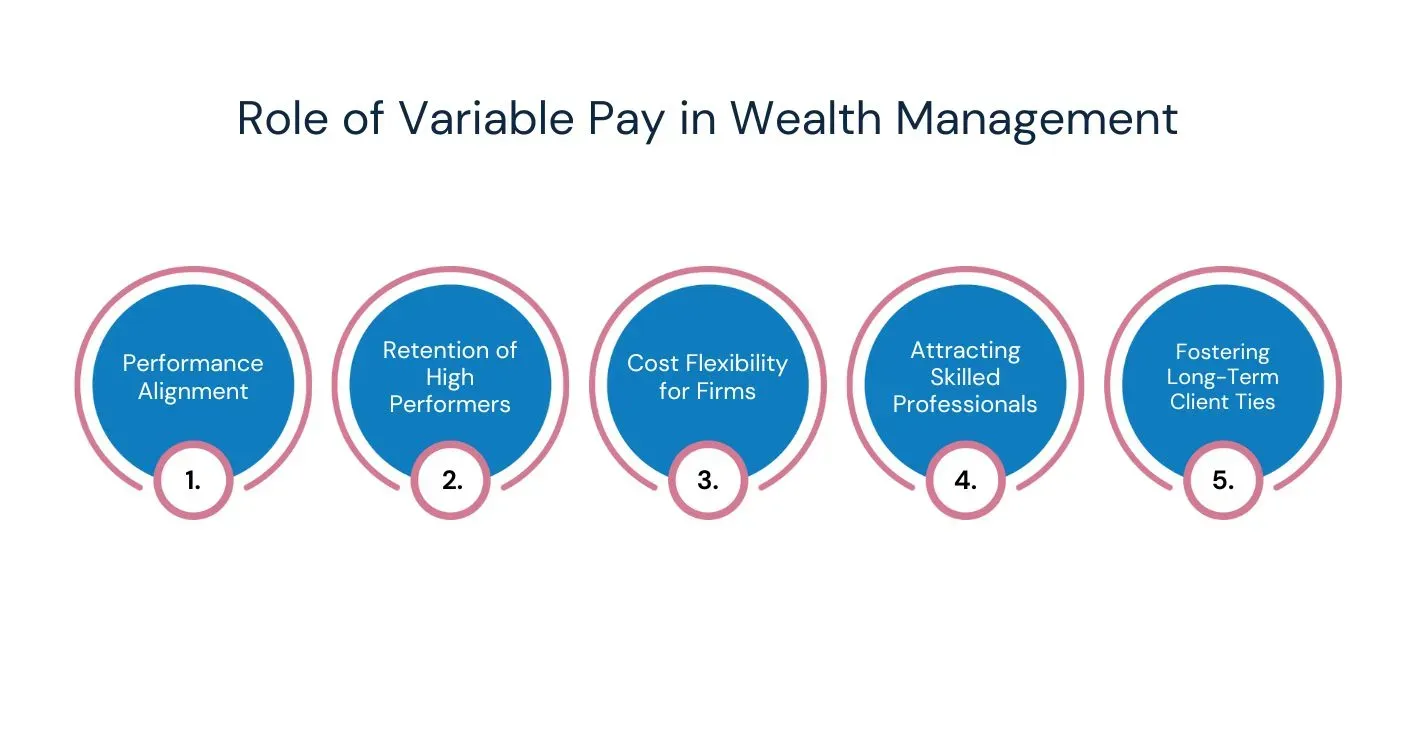

Variable pay accounts for a substantial portion of total compensation in wealth management. It aligns advisor goals with firm performance, drives client-centric outcomes, and supports retention in a highly competitive talent market.

These are a few reasons to incorporate variable pay in your compensation structure:

Managing variable pay is just one piece of the compensation puzzle. With multiple layers of pay structures, compliance needs, and performance-driven models, wealth management firms face increasing complexity in administering fair and competitive compensation.

Now, let us explore how technology simplifies these challenges and helps create scalable, transparent systems.

The complexity of wealth management compensation, ranging from layered variable pay to performance-based bonuses, demands more than manual spreadsheets and outdated tools. As firms scale and regulations become tighter, HR teams require systems that can automate workflows, provide visibility, and support informed strategic decision-making.

Incorporating the right technology enables firms to manage compensation efficiently while also creating performance-driven cultures that attract and retain top talent. However, finding the right platform to handle such complex and variable-heavy pay structures is critical.

This is where CompUp stands out as a trusted partner, offering purpose-built solutions tailored for the wealth management sector.

Managing compensation in wealth management demands precision and flexibility. With high-performing advisors, variable-heavy structures, and compliance risks, firms need a reliable solution. CompUp addresses these challenges with features designed to simplify and optimize compensation at scale.

Key features of CompUp:

CompUp enables firms to design and manage complex compensation plans that combine base salaries, commissions, profit-sharing, and equity. This helps wealth management organizations maintain competitive pay structures that drive performance and retention among top advisors and senior partners.

With tools to communicate compensation structures, firms can demonstrate how advisor earnings align with AUM growth, client acquisition, and firm-wide objectives. This transparency builds trust and helps attract talent in a highly competitive industry.

The platform identifies pay gaps across roles, geographies, and demographics, enabling fair and compliant compensation practices. Wealth management firms can utilize this feature to ensure equity among advisors who handle diverse client segments and portfolios.

Access real-time market data to benchmark advisor and partner compensation against industry standards. This helps firms offer competitive packages that align with market trends while minimizing overpayment risks in performance-driven roles.

Deliver a digital, engaging experience for new advisor hires. Hireshot enables firms to present offer details transparently, manage candidate engagement post-acceptance, and create a smooth onboarding process, thereby reducing early attrition among recruits.

Advisors and senior partners can access a consolidated view of their total compensation, including fixed pay, bonuses, commissions, equity, and benefits. This visibility supports retention by helping employees see the full value of their rewards over time.

CompUp helps wealth management firms tackle the complexity of advisor compensation with ease. Integrating all aspects of pay management into a single platform helps drive performance, retain top talent, and ensure compliance.

Wealth management compensation is no longer a simple mix of salaries and commissions. From aligning pay with performance to ensuring equity across roles, the right approach can have a direct impact on advisor engagement, client satisfaction, and organizational growth.

CompUp delivers measurable value in terms of creating a compensation structure. With Compensation Bands, firms can maintain equitable pay structures that align with both market benchmarks and internal hierarchies. Tools like Budget Simulation enable precise planning for high-value retention bonuses, while Pay Equity ensures compliance and fairness across all levels.

Take the next step to modernize your wealth management compensation strategy. Schedule a demo today and discover how your firm can optimize compensation processes, reward high performers effectively, and stay ahead in a competitive market.

1. What is the typical compensation structure for wealth managers?

Wealth managers typically receive a base salary, combined with variable components such as commissions, profit-sharing, equity, and bonuses. This mix aligns advisor incentives with client growth and organizational success.

2. How do firms decide on variable pay in wealth management?

Variable pay is tied to key metrics, including Assets Under Management (AUM), client acquisition, and firm profitability. Senior roles often see higher variable percentages linked to team or organizational performance.

3. What challenges do firms face in wealth management compensation?

Complex pay structures, regulatory compliance, and maintaining pay equity across roles are key challenges. Technology platforms like CompUp help simplify incentive calculations and align pay with performance.

4. How can technology improve compensation management in wealth firms?

Automation simplifies payroll, variable pay distribution, and equity tracking. Tools like CompUp’s Budget Simulation and Pay Equity ensure accurate, fair, and compliant compensation processes.

Co-founder & Head of Product

Anshul Mishra, Co-founder and Head of Product at CompUp, blends technology and total rewards to create smart, user-friendly solutions. He focuses on building data-driven tools that help companies design fair and effective compensation strategies, making complex processes simpler and more impactful.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking