Designing compensation strategies that drive performance and align with organizational goals requires more than fixed pay structures. Variable components, such as bonuses, commissions, and profit-sharing, have become essential tools for rewarding achievement and encouraging high performance.

Studies show that well-structured incentive programs can increase employee performance by 25 to 44 percent, underscoring their strategic value in total rewards planning.

This blog explores the concept of variable allowance in salary, its various types, and how HR leaders can employ it to create performance-driven compensation frameworks.

Key Takeaways

Variable pay refers to the portion of an employee’s compensation that is contingent on performance, results, or organizational success rather than being a fixed salary component. It includes incentives, bonuses, commissions, and profit-sharing, designed to reward employees for meeting specific targets or contributing to company goals.

Unlike fixed pay, which guarantees a set amount regardless of performance, variable pay introduces a dynamic element into compensation planning. For HR leaders, it serves as a strategic tool to align employee motivation with business priorities by offering flexibility to reward high performers while managing payroll costs efficiently.

You now understand what variable pay is and how it differs from fixed salary structures. Now, let us explore the key reasons variable pay matters in modern compensation.

Variable pay serves as a strategic tool to link employee contributions with business success. It enables responsive, performance-driven compensation planning that goes beyond static salary models.

Key reasons why variable pay is essential:

While understanding the importance of variable pay highlights its strategic value, it is equally essential to see how it fits alongside fixed pay. A clear distinction between fixed and variable pay will help you design a balanced and effective compensation structure.

Suggested Read: Building Pay Bands Using Market Reference Points and Benchmark Data

Fixed pay and variable pay serve distinct purposes in your compensation strategy. Fixed pay is the guaranteed salary component, offering employees income stability through regular payments like base salary and fixed allowances. It is predictable and not tied to performance outcomes.

In contrast, variable pay includes components such as bonuses, commissions, and profit-sharing. These are directly linked to individual, team, or organizational achievements and fluctuate based on performance. This makes variable pay a critical lever for driving motivation, aligning employee efforts with business goals, and maintaining cost flexibility for organizations.

By striking the right balance between fixed and variable pay, you can design a compensation structure that ensures financial security for employees while encouraging high performance. As organizations design variable pay structures, understanding who qualifies for these rewards is critical. Eligibility is not universal—it depends on role, contribution, and seniority.

Let us explore how variable pay eligibility typically works across different levels and functions.

Most employees working under registered organizations can be eligible for variable pay. However, eligibility and payout amounts vary significantly based on the employee’s role, department, and seniority level.

At junior levels, variable pay often focuses on individual performance. In contrast, senior executives typically have variable components tied to team or organizational performance, reflecting their broader influence on business outcomes.

Typical Variable Pay Ranges by Level:

This structure ensures high performers are rewarded while aligning compensation with business objectives.

Now that you know who qualifies for variable pay, it helps to see how these incentives work in real-world scenarios. The following examples illustrate how variable pay can motivate employees and align their efforts with organizational goals.

Variable pay structures are highly adaptable and can take many forms depending on business needs and employee roles. Here are three common examples that demonstrate how organizations implement these programs effectively.

This is a widely used variable pay component across industries, designed to reward employees for meeting or exceeding performance goals.

Example: An employee earning $80,000 annually receives a 15% bonus for achieving individual KPIs and contributing to company-wide success, resulting in a $12,000 year-end payout.

Sales roles often feature commissions to tie earnings directly to revenue generation, encouraging high performance.

Example: A sales associate earning a $50,000 base salary secures $200,000 in sales during a quarter and earns a 7% commission, bringing in an additional $14,000.

This approach distributes a portion of company profits to employees, promoting collective ownership and long-term commitment.

Example: If a company allocates 5% of its $10 million profit pool, a mid-level employee could receive $5,000 based on their role and tenure.

Seeing real-world examples highlights the diversity of variable pay structures. However, to implement these effectively, it is crucial to understand how to calculate payouts accurately. Now, let us break down the steps to calculate variable pay.

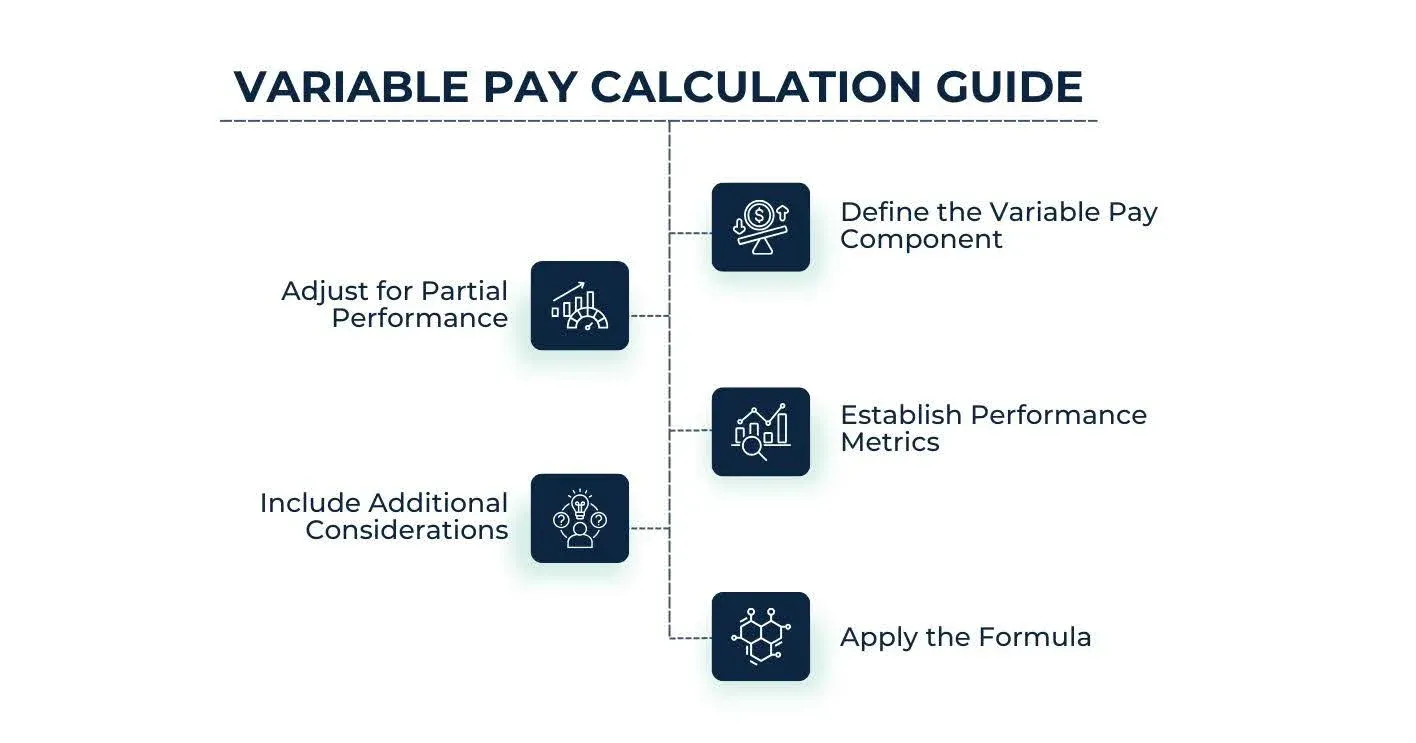

Calculating variable pay requires a clear understanding of the compensation structure, performance metrics, and payout formulas. Organizations often use different methods based on the type of variable pay (bonuses, commissions, or profit-sharing). Here are key steps and examples to guide the process:

Identify whether the variable pay is a fixed percentage of base salary, a commission rate, or a profit-sharing allocation.

Tie variable pay to measurable outcomes such as sales targets, project milestones, or organizational KPIs.

Use the agreed-upon percentage or commission rate to calculate the payout.

Example: If an employee has a base salary of $70,000 and is eligible for a 10% annual bonus, then:

Variable Pay = $70,000 × 10% = $7,000

If targets are only partially achieved, scale down the payout proportionately.

Example: Achieving 80% of a $10,000 bonus results in $10,000 × 80% = $8,000

Factor in elements like team performance, organizational profit margins, or individual contribution weightages for a more comprehensive calculation.

With its clear strategic advantages, variable pay has become a core component of modern compensation frameworks. But not all variable pay is created equal. Understanding the different types can help you design plans that fit your workforce and organizational goals.

Variable pay comes in many forms, each designed to address different organizational objectives and employee motivations. Bonuses, commissions, and profit-sharing are common examples of a variable allowance in salary.

Understanding these types can help you structure effective and equitable compensation plans.

These incentives reward employees for meeting or exceeding predefined individual or team goals. They include annual bonuses, goal-based payouts, and merit-based increases. By tying rewards directly to results, organizations can drive accountability and motivate consistent high performance across functions.

Profit-sharing distributes a portion of company profits to employees, aligning their interests with the organization’s financial success. This creates a sense of ownership and engagement, particularly in startups or growth-stage companies aiming to build a performance-driven culture.

Common in sales-heavy roles, commissions are paid as a percentage of revenue or profit generated. They can follow tiered structures, offering higher percentages as targets are exceeded, to encourage overperformance and reward top performers effectively.

These are discretionary, on-the-spot rewards for exceptional contributions outside of regular performance cycles. They help reinforce desired behaviors, improve morale, and create a culture of continuous recognition across teams.

Equity components such as Stock Options (ESOPs) and Restricted Stock Units (RSUs) provide long-term incentives, aligning employees’ interests with shareholder value. These are particularly effective for retention and for engaging senior leaders or high-potential employees in long-term business outcomes.

You have seen the different types of variable pay that organizations use to reward specific contributions. But to implement these effectively, you need structured programs that define how and when these pay elements are distributed.

Let us now explore the different variable pay programs and how they support broader compensation strategies.

Variable pay programs are structured compensation plans that define how performance-based rewards are distributed. Each program serves a specific organizational goal and workforce need.

Designed for immediate impact, STIPs reward employees for achieving annual or quarterly targets. Examples include annual bonuses, performance-linked incentives, and sales commissions. These programs drive focus on short-term business priorities while recognizing individual and team contributions.

LTIPs encourage sustained high performance by rewarding employees over multiple years. Equity-based compensation, such as stock options, RSUs, and performance shares, falls into this category. They are often used to retain key talent and align them with long-term organizational goals.

These programs reward collective performance rather than individual achievement. Profit-sharing and gain-sharing are common examples that encourage collaboration and shared accountability among teams or departments.

Recognition programs provide discretionary rewards for exceptional efforts outside regular appraisal cycles. Spot bonuses are often used to reinforce desired behaviors, promote innovation, or reward significant contributions in real-time.

Part of the payout is held back and paid after a certain period, often linked to continued performance or retention. This helps manage risk and encourages long-term employee commitment.

To implement variable pay programs successfully, you must weigh their potential advantages against inherent challenges. This perspective helps you create balanced plans that drive performance without unintended consequences.

In the next section, we will explain the advantages and limitations of variable pay.

Suggested Webinar: High candidate dropout rates can derail even the strongest hiring strategies. In CompUp’s webinar, “Solutions to Candidate Dropout,” industry leaders from Recro, Scaler Academy, and ThoughtWorks share practical insights to tackle this challenge.

Variable pay can be a powerful tool in modern compensation strategies, but it is not without its challenges. Understanding both the benefits and potential pitfalls allows you to design balanced programs that motivate employees while supporting organizational goals.

Variable pay offers a range of strategic advantages that can support agile workforce management. These are:

Despite its benefits, variable pay also presents challenges that require careful planning and oversight to avoid negative impacts on morale, equity, and administration.

While the advantages and challenges of variable pay are clear, turning theory into practice requires a structured approach. To help you design a program that balances motivation with operational efficiency, let us break down the key steps to implement variable pay effectively.

Suggested Read: How Equity Compensation Works? A Guide for Employees

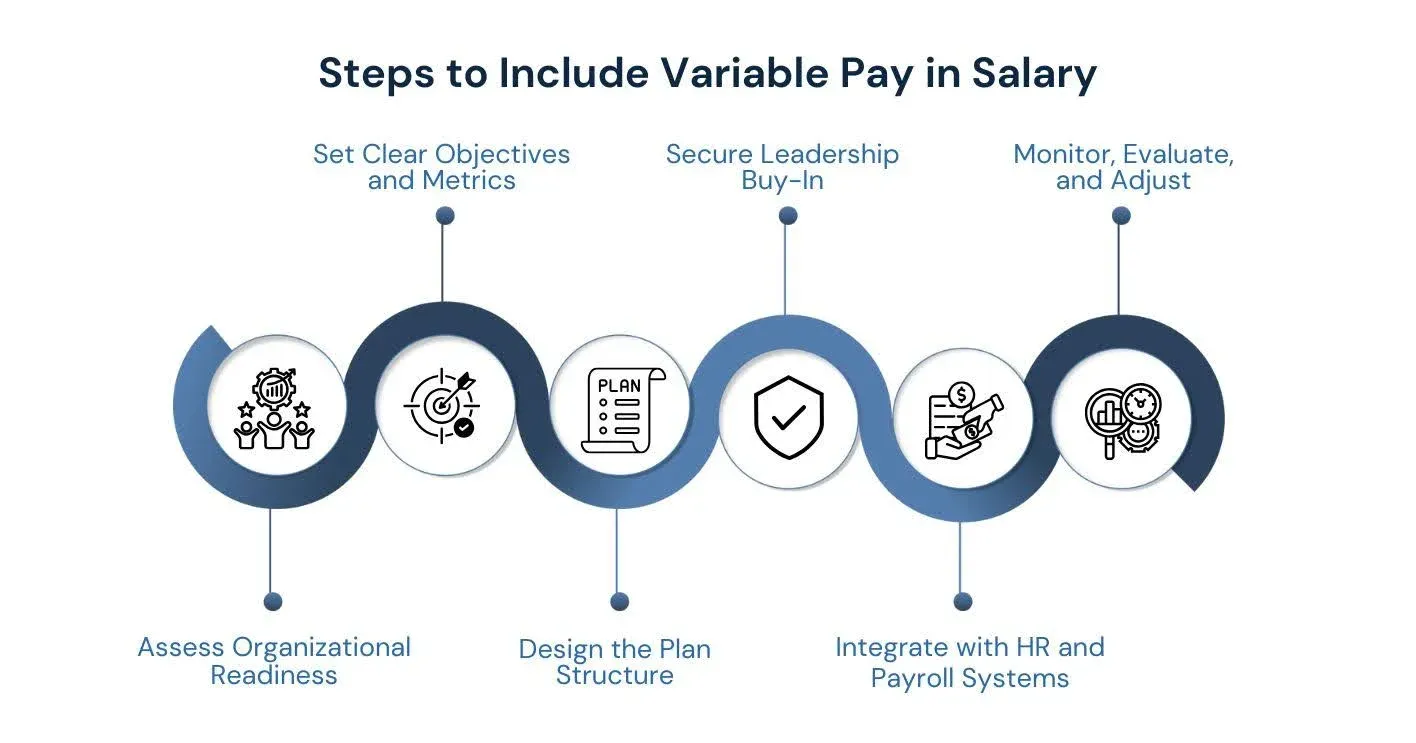

Variable pay demands a strategic process that aligns rewards with organizational goals, ensures fairness, and integrates effortlessly with existing HR systems. Follow these key steps to design and deploy an effective variable pay program:

Start by analyzing your current compensation framework, business priorities, and workforce demographics. Evaluate whether variable pay aligns with your organizational culture and whether your HR and payroll systems can support this complexity.

Define what you want to achieve with variable pay, such as improved productivity, retention, or cost management. Establish measurable KPIs and performance thresholds to ensure payouts are tied to meaningful outcomes.

Choose which types of variable pay (bonuses, profit-sharing, equity) suit your workforce and business model. Clearly outline eligibility, payout cycles, and communication strategies to build trust and transparency.

Present your plan to senior stakeholders with data-driven forecasts of ROI and cultural impact. Address concerns about budgeting, compliance, and potential risks to gain alignment across leadership teams.

Smooth integration with existing systems is crucial to manage payouts, track performance, and ensure compliance. Automating workflows reduces administrative overhead and minimizes errors.

After implementation, continuously monitor plan performance against objectives. Use analytics and employee feedback to refine targets, adjust reward structures, and keep the plan relevant as business needs grow.

Designing and rolling out a variable pay program is only the beginning. To ensure long-term success, you need to fine-tune your approach with proven best practices that drive engagement, maintain fairness, and support business goals at scale.

Suggested Read: Steps to Create a Fair and Equitable Compensation System

To create variable pay structures that drive results and avoid common pitfalls, consider these proven best practices:

Even with a solid strategy and adherence to best practices, managing variable pay manually can still create inefficiencies and compliance risks. This is where technology becomes indispensable.

With a solution like CompUp, you can automate and scale your variable pay programs for maximum impact.

CompUp provides a unified platform to manage all aspects of compensation, including variable pay. You can focus on driving employee engagement and business results while CompUp takes care of automating workflows and centralizing data.

Key services include:

CompUp’s accessible APIs enable easy integration with HR systems like BambooHR, Lattice, and Culture Amp. This ensures your variable pay programs draw on real-time performance data, making compensation decisions faster, more accurate, and aligned with your existing workflows.

Variable pay is a critical tool for aligning workforce performance with organizational goals. When implemented thoughtfully, it drives motivation, rewards excellence, and creates a culture of accountability. However, designing and managing variable allowance in salary requires adaptability to changing business needs.

This is where CompUp transforms compensation management. It combines tools like Budget Simulation, Manager Execution, and Personalized Rewards into one platform. These features help HR teams automate workflows, ensure compliance, and manage variable pay programs that are fair, efficient, and scalable.

Ready to take your variable pay strategy to the next level? Schedule a demo to learn how CompUp can simplify your compensation planning and help you reward talent with confidence.

1. What are the different types of variable pay?

Variable pay includes bonuses, commissions, profit sharing, stock options, and incentives tied to individual, team, or organizational performance. These rewards supplement fixed salaries and align employee efforts with business objectives.

2. What are the different types of salary payments?

Salary payments include fixed pay (base salary), variable pay (performance-linked bonuses, incentives), and benefits (healthcare, retirement contributions). Together, they create a total compensation package that motivates employees and ensures competitiveness in talent markets.

3. What is the variable salary structure?

A variable salary structure combines a fixed base salary with performance-based components such as bonuses, commissions, or profit-sharing. This design motivates employees to achieve targets while giving organizations flexibility in managing compensation costs.

4. What are the three variable payments?

The three common variable payments are bonuses (annual, spot), sales commissions, and profit-sharing plans. These incentives directly link employee or team performance to organizational success, improving engagement and aligning goals.

Community Manager (Marketing)

As a Community Manager, I’m passionate about fostering collaboration and knowledge sharing among professionals in compensation management and total rewards. I develop engaging content that simplifies complex topics, empowering others to excel and aim to drive collective growth through insight and connection.

Revolutionizing Pay Strategies: Don't Miss Our Latest Blogs on Compensation Benchmarking